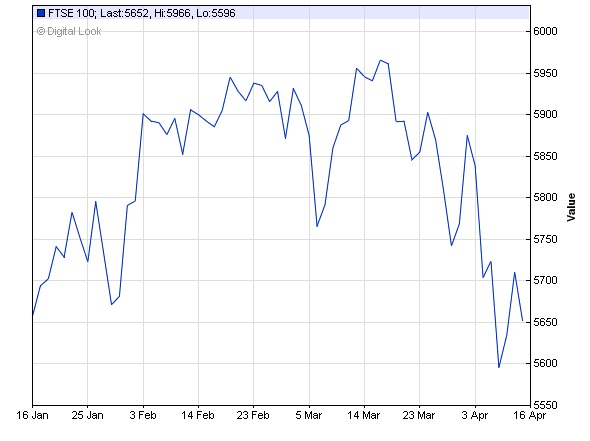

Since my last Investment Review in January, the FTSE 100 has gained almost 300 points, but then has recently lost the same 300 points. The FTSE 100 ended the tax year within a point or two of where it started in January. We did manage to sell our more aggressive clients’ holdings in the iShares FTSE 100 at 5800 points, having bought them at between 5000 and 5200 points last September. The strategy was discussed in the October 2011 Investment Review.

We also recommended a sale of index-linked gilts at the end of January, as inflation continued to fall and future returns started to look poorer.

So many client portfolios are now cash rich at the moment, waiting to be invested. However the old adage of “Sell in May and go away, come back St. Leger’s Day” held true both last year and the year before. The question is “What about this year?”

When the market corrected in 2011, the trigger was a combination of US politicians dragging their heels on raising the country’s debt ceiling and increasingly bad news on the state of Greece. Betting against similar factors denting confidence again this year would be brave, lending weight to the idea that we shouldn’t be too hasty to commit the cash to the markets. Let’s be honest Spain is looking worse all the time.

Recent market swings have been like trying to get Ketchup out of a bottle. Everyone knew about the global debt problems for ages but nothing changed, the markets just carried on regardless. By mid 2011, bad news had delivered one heavy knock after another. Then one final knock and a huge drop occurred.

As usual we are watching for value all the time and will contact clients individually when we are ready to recommend that you commit the funds to the markets.