We could have done nothing

The FTSE 100 stood at 6,833.46 points 12 months ago and closed on 6th April this year at only 6,091.23 points. Which is 10.86% down over 12 months. Generally all global markets followed suit, ending lower to some extent. Being an entirely passive investor would dictate we simply rebalanced between our existing funds and left as is. Keep to strategy. By taking the rough with the smooth we eventually achieve the same return as the market generally, which is enough to beat 97% of active fund managers over most 5 year periods. However we overlay our strategy with tactics. So how much have we lost this year?

Has 12 months brain power, crystal ball gazing, general worry and gnashing of teeth had any effect? Well obviously it did otherwise we wouldn’t be drawing your attention to it today!

The portfolio changes we made over the last 12 months

We lost no time making changes to our Cautious, Moderate & Aggressive portfolios when many of the markets of the world hit their highs around a year ago.

April 2015

First to go was our Chinese fund described here. Our Europe & our UK Dividend Shares fund followed soon after described here. The final sale was 25% of our Global Health & Pharmaceutical Fund. All done by the end of April. If only we had left the proceeds from these sales untouched for a little longer, then our position now would be somewhat better.

However with some of the proceeds we threw our investment net wider. The majority of our realised cash went towards a global technology fund and a UK small shares fund. Smaller amounts went into a Japanese fund, an Indian fund and a fund that held all UK shares, both large and small. My expectation was that of safety through wider diversification.

August 2015

Then when the markets hit rock bottom in August we reduced our commercial property holdings and sold all of our Gold fund described here. We felt it was time to load up with cheap shares. We bought a German tracker fund and a FTSE 250 fund.

January 2016

As soon as markets opened after the New Year, and fortunately just before the “worst start to the year for a century”, We dumped the fund that held all UK shares both large and small at a loss. Then the markets hit the deck. Described here.

March 2016

I did nothing until just recently when I sold our German fund after a short term gain of over 5% and since then the German markets are back down once again, which would have all but wiped out our little result.

Successes v Failures

As you would guess we didn’t get everything right. We should have hung on to our Gold longer, but getting rid of China, Europe, Large UK shares and reducing our Global Health & Pharmaceuticals all turned out to be very good decisions. We should have waited a while before we bought Japan and India. But buying a Technology fund was a good thing, as was buying and subsequently selling a German fund. Our small positions in Japan and India are forever, not just for Christmas.

Using our Moderate Portfolio as an example, all in all, counting both our successes and of course our failures, the beneficial decisions saved 4.3% across the portfolio whilst the loses caused by the detrimental decisions cost us only -1.0%. Therefore on balance the portfolio was to the better by 3.3% directly because of our management.

So where is the growth then?

Over the last tax year, here are the results. All our efforts simply reduced our losses.

Cautious Portfolios -1.04%

Moderate Portfolios -1.11%

Aggressive Portfolios -1.45%

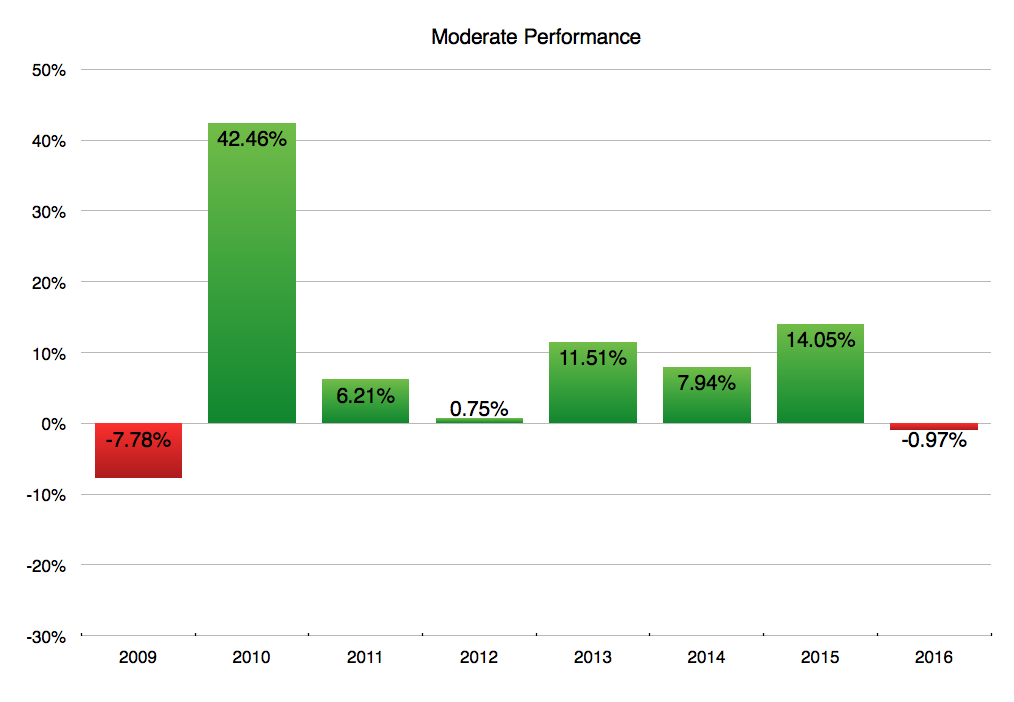

As I mentioned earlier the FTSE ended the year -10.86% so our returns are certainly not the end of the world. A good rule of thumb is that investment markets make money 3 years out of every 4. If this becomes our one bad year in 4, we will consider ourselves lucky. The chart below shows the pattern of returns over the last 8 years.

Hello

That 8 year graph was interesting, with large swings, so I did the maths and with the large 42% growth year it gives a compounded growth of 8.5%, and with the 42% replaced with 25% it still gives a compound of 6.6% which is realy a very good solid return.

This last year has been odd, with Bloomberg channel openly saying that they had no idea why the markets were dropping at the start of the year, Just seemed to be some major players giving out sell commands.

With the reduced property holdings, what are you using as the hedge to the stock markets? Gold seems to have been rediscovered but could easily be forgotten again.

I would have thought that the medical sector would have been a good one. Philips of Holland seemed to have chosen that sector as their main business, with scanning equipment, and trying to sell off the lighting division. They have a very good record of entering and pulling out of markets at the right time.

Phil

Hi Phil

Thanks for your considered reply and for sharing your knowledge of Philips. I agree with pretty much all you say. 2008 & 2009 were quite extraordinary, we did well to avoid the majority of the falls as the crisis grew. The following 42% return was not difficult to achieve, missing the previous years 32% fall made the difference. So increasing the 2008/9 loss from 8.69% to 32.2% would take 23.51% out of the overall return. I believe I was fortunate to avoid the large losses of 2008/9, let’s hope I stay that way.

The Gold sale story was compounded by the fact the fund became unsuitable for one of our platforms who didn’t like the use of derivatives within the chosen fund. Even though it was marketed as a physical gold fund (holding bars not just paper), as soon as opinion suggested it held complex derivatives, I became uncomfortable and decided to take no further risks. I have to fully understand where I am investing. Like you I believe Gold will drop out of favour as quickly as it rose.

Bloomberg are referring to large oil-producing nations when they talk about the sell side commands. I agreed and mentioned it in a previous blog https://hjscott.co.uk/zero-sum-game/. Commercial property must slow down, which isn’t a bad thing, and certainly there must be some large sellers around amongst the desperate oil-producing nations.

So no Gold, reduced Commercial Property and a reluctance to buy over-priced Government Gilts at 40+ year highs with higher inflation and interest rate rises on the way which will savage capital values of bonds and gilts. What do I use as a hedge?

We continue to hold cash and try to play the volatility of shares, trying to buy on setbacks and selling at short term peaks. Smaller shares have been our saviour, they continue to operate within a domestic market which is still thriving. I believe normal service will be resumed later this year for international shares, when the oil price stabilises as world wide reserves start to fall.

The medical sector has become challenging due to the US Presidential Election. If Hilary is elected she has said she is coming out gunning for the profits of the large drug companies in the US.

Howard