First Quarter Summary

We end the first quarter of 2018 with all client portfolios lower than their recent peaks. All portfolios ended the 2017/2018 Tax Year up modestly, but certainly without the gains we have recently become accustomed to. Centre stage was a much expected pause for breath, brought about by the looming potential of a global trade war. During a trade war there are no winners, with tit-for-tat actions increasing costs and certainly slowing global growth and many companies profits. Domestically this worry has completely overshadowed the recent encouraging progress that has been made with the UK’s Brexit negotiations.

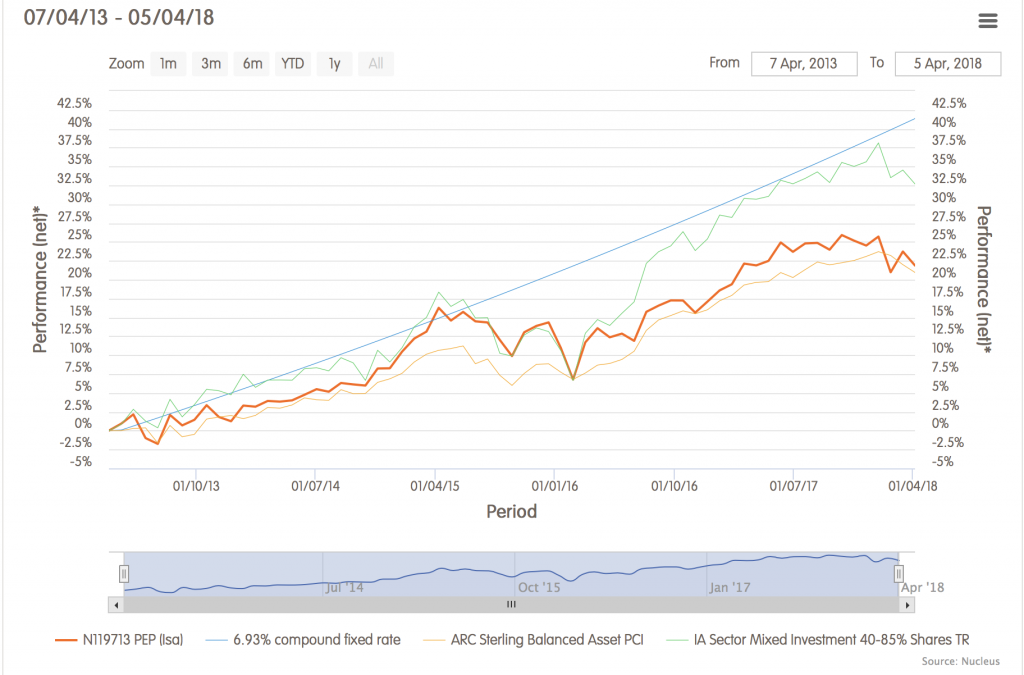

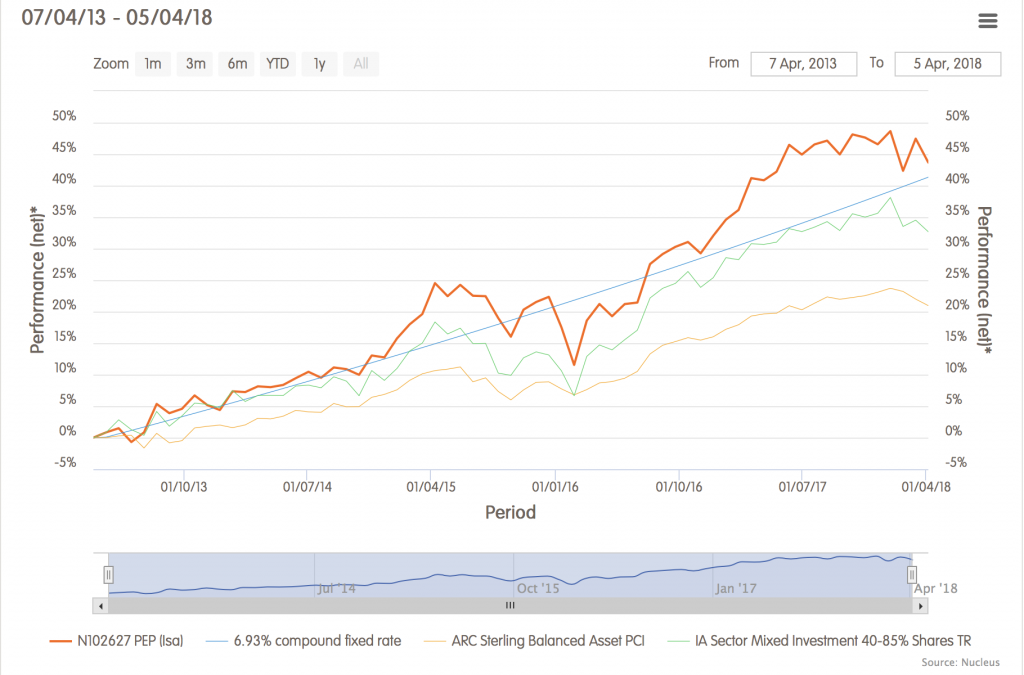

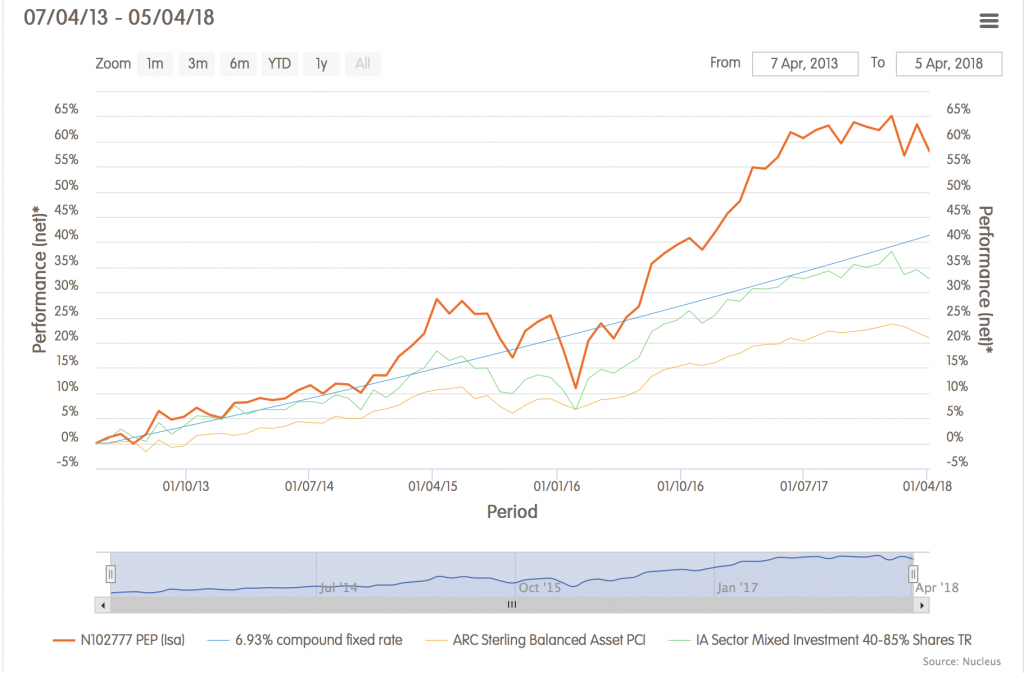

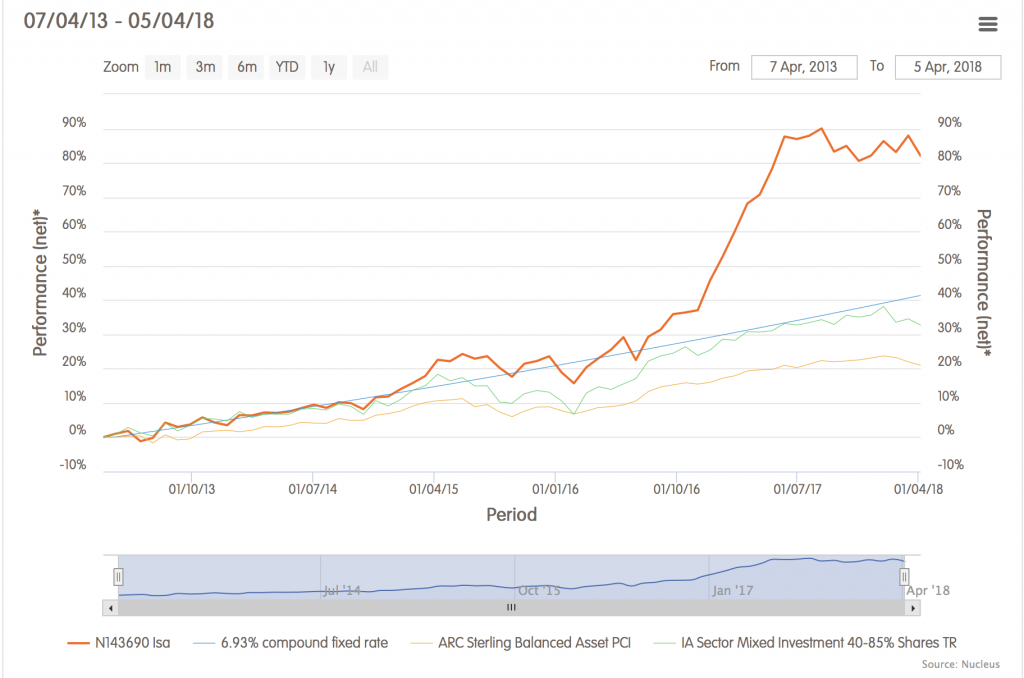

As the amount we manage within our collective accounts continues to grow ever larger, just a 2-3% dip wipes in excess of £2 million off our joint life-savings. At a time like this we all need to be reminded of how far we have come recently, and that a short term dip should not have any effect on our planned withdrawals and expenditures. Indeed short term dips are healthy and help markets to avoid long-term bubbles. Therefore below are our Model Portfolio charts, showing the steady progress that has been made over the last 5 years, which puts the latest dip in perspective.

Our longer term clients both understand and expect that regular dips will continue to occur along the way. For our newer clients who have had only a few years experience of how we do things around here, I can understand dips must be concerning.

Cautious Model Portfolio – £3.8 million

Moderate Model Portfolio – £50.5 million

Aggressive Model Portfolio – £14.3 million

AIM Portfolio* – £5.4 million

- All the above charts are actual client accounts and take into account an on-going Nucleus Platform fee deduction of 0.35% p.a. and an ongoing H.J.Scott & Co. fee deduction of 1% p.a.

- I have used universal benchmarks so an accurate cross portfolio assessment is possible, however the benchmarks used are only appropriate to our Moderate Model Portfolio

- * Our AIM Portfolio commenced from the 14th October 2014 therefore data is not available for the full 5 years. The chart shows the performance of our Moderate Portfolio, prior to the switch into our AIM Portfolio to give 5 year performance.

Takeaways

- Interestingly it can be seen that the riskier portfolios have not been hit considerably harder than our safer portfolios.

- Falls have been across the board, from 5% down in the Cautious Portfolio to only 10% down in our much more Aggressive AIM Portfolio.

- Since trade wars tend to play out more at the global level, our domestically concentrated smaller shares have been less effected.

Over these volatile times I expect that it will become harder to generate much more than 4% p.a. for our Cautious clients. For that reason I took the decision a couple of years back not to add any more Cautious clients to the group. As interest rates start to rise in the future, it may become prudent to return some capital back to our existing Cautious clients.

Happy New Tax Year

We will shortly commence to move client funds from their General Accounts into their ISA Accounts managed by ourselves. This is a free service, but will result in some share sales and repurchases over the next few weeks. Please contact us if you require any more capital back in the short term or would prefer to use your ISA allowance by way of a new contribution from your bank account instead.

The usual

- Past performance isn’t necessarily a guide to the future.

- The value of investments and the income derived thereof can fall as well as rise.

- Nothing on this website constitutes regulated financial or investment advice.