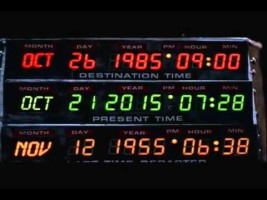

“Back to the future” was released in 1985. I wouldn’t describe it as one of my favourite films but I did like the DeLorean DMC-12, so I had to watch it. In “Back to the future II”, released in 1989, Marty & The Doc travel to October 21st 2015

If you need reminding of the complex plot, you can find it here.

Travelling 30 years in to the future brings me nicely to retirement & long term investment. Retire at age 60, and 30 years looks like the duration of the rest of your life if you are lucky. You still have that period of investment ahead of you.

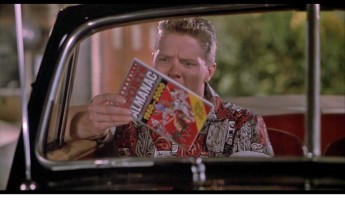

In “Back to the future II”, the bad guy Biff Tannen, becomes wealthy by gambling on football games. He is armed with a year 2000 Sports Almanac, which he received in 1955, that gives him the result of 45 years of future football games. Imagine what you could do if you knew all the future Grand National winners?

You couldn’t lose.

Now since the films were American, allow me to use US data to demonstrate Biff’s easier alternative to time travel. (OK, I have to use US data as there isn’t a FTSE100 total return index in existence over the whole term). In 1985 the S&P 500 stood at 186 versus 2032 today. Every $100,000 invested in the index on October 21st 1985 would be worth a cool $2,550,000 just 30 years later. Just getting the index return is enough for anyone.

Staying invested for 30 years wouldn’t have been as easy as pie though. Going the distance defeats most investors. Just two years after investing, the Crash of 1987 would have wiped out 23% of any investors capital in a single day. Our job as Financial Planners is to guide you. The financial markets of the world will reward us if we go the distance. We don’t need insider knowledge, we need faith and patience.

Please don’t choose us as your long term planning partners if you want us to show you the next hot investment. Unfortunately my Mercedes doesn’t list time travel amongst its extras.

Compound interest is the eigth wonder of the world. He who understands it, earns it…he who doesn’t, pays it. – Albert Einstein.