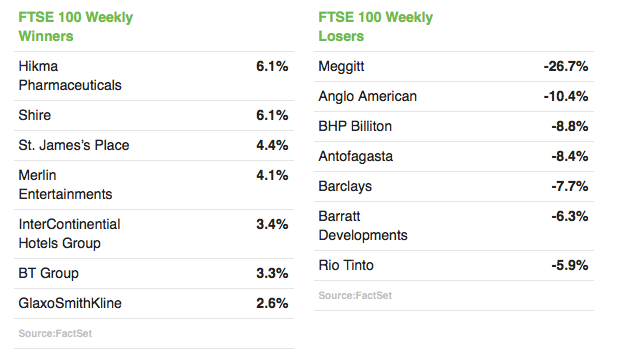

Last week the FTSE 100 fell by 1.29%. It was kind of business as usual and not surprising when the week before it rose by 1.04%. Swings and roundabouts you might say. But when you lift the hood of the index and take a look inside there are some horrors!

Just take a look at the table above. The index overall lost 1.29% but the biggest faller amongst the FTSE 100 shares lost an eye watering 26.7% of it’s value. Meanwhile a couple of winners put in a sterling effort and climbed by 6.1% each. So between the highest climber and the lowest faller there was a variation of 32.8%.

Expert fund manager A thinks that the only way for the banks, miners, house builders and engineering firms is up. His clients took a beating this week.

Expert fund manager B dislikes the banks, miners, house builders and engineering firms and so avoids them. Instead he invests in Pharmaceuticals, Hotels, Leisure and Telecoms. Winner winner chicken dinner!

The trouble is that it’s just a lottery. No-one knows who will be the winners and losers each week. When things go right for an active manager he milks it, when things go wrong he has “deep conviction in his long term strategy”.

It’s the reason why we usually invest in just the whole index. We shouldn’t get any nasty surprises.

Which index should we invest in?

I have said many times that the FTSE 100 isn’t my first choice of index even though it is the most common and easiest to see the price of. In fact you just can’t avoid it’s daily progress on the TV, Radio and Newspapers. You could believe the FTSE 100 index is the only show in town.

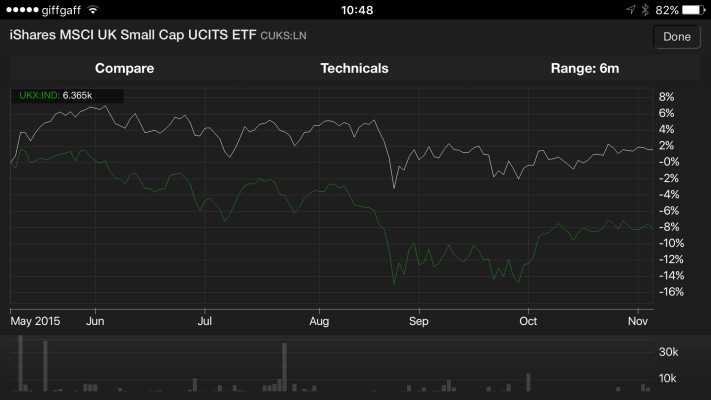

We are always invested in around 6 or 7 indices at a time. We will return to the FTSE 100 in the future I’m sure, when the price of steel, oil and copper all start to pick up and the banks stop being fined for scandal after scandal. Since April of this year my main UK index weapon of choice has been the UK Small Capital Index, shown below in the chart as the white line. It’s progress has been plotted against the FTSE 100 index, shown as the green line. The difference between the two is 10% over the last six months.

Investing in an index is known as passive investing by the experts who advocate active investing. There is substantial evidence that shows that over the long term, simply investing in an index usually beats in excess of 90% of active managers. Ask Warren Buffet. We are invested for the long term aren’t we?

Keeping us on an even keel as ever Howard. I am very comfortable with your strategy and even more pleased with the results.