Off Target

Each and every month, economists and financial observers try to predict the rate of inflation, the level of unemployment and the exchange rate of the pound versus the euro. Every month the vast majority are no where near correct. Many of their predictions are exceedingly poor, given that only a month has passed. And yet, judging by many of the economic arguments currently being put forward by both sides, you could believe that crystal balls are being sold off in the Grand BHS closing down sale. They can now predict the long term with great accuracy.

Both sides profess to possess accurate knowledge of where the UK economy will be in 2yrs….. 5yrs………. 10yrs………….. 30yrs…………………………. Seriously?

Anyway I said I wouldn’t pay too much attention to all the rhetoric but I will continue to assess the situation in an attempt to try to benefit my clients financially. How I react to investment opportunities is what most clients value.

Here is what I said last time.

Betting is where people put their money where their mouth is. Financial Journalists and Economists shout loudest but don’t have their hard-earned cash on the line. Here’s the odds currently.

For those of you who don’t understand betting odds this is what you can take from William Hill if you predict the outcome of June 23rd correctly.

- If you bet £5 that we will remain and you are right you will get back £6.11

- If you bet £5 that we will leave and you are right you will get back £21.00

I can’t see too many queuing up to risk a fiver to win it back along with only £1.11. Personally I’d rather bet the other way and experience the short-lived thrill of perhaps winning a full £16.00 on top of my stake. We will continue to check the odds to see if they change.

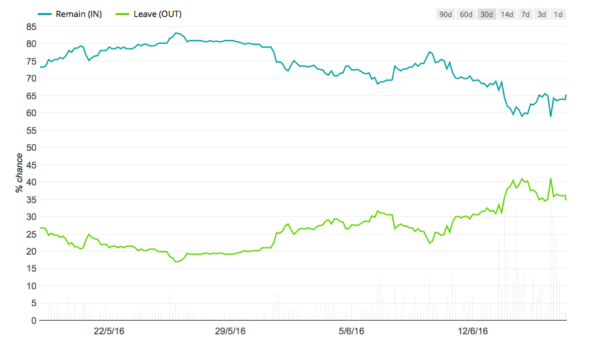

And here is where we are now.

Once again, just to make the betting odds clearer.

- If you bet £5 that we will remain and you are right you will get back £7.50

- If you bet £5 that we will leave and you are right you will get back £13.12

Now that is a huge swing. A brexit could happen. The odds of it happening have almost doubled. The recent pick up in momentum of support for Leave seems to be causing markets to fall. Certainly the German fund we invested in until we sold it in March, we could now buy back 7% lower. Now that’s the kind of Euro result I like. I’m likely to buy the fund again as things settle down and if the opportunity continues. As I guessed, if it even looks like the UK is an outie, then it leaves little confidence in the EU adventure holding together and the German stock market in particular will suffer.

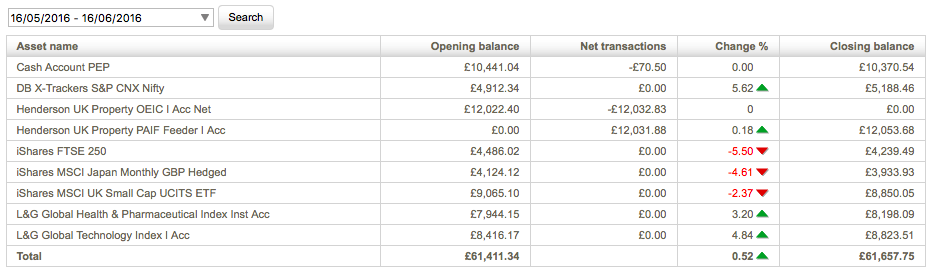

Our currency has sunk too. This enhances the value of our global holdings for now. Over the last 30 days of turmoil our Moderate Portfolio has grown in value by 0.52%. Of course our cash holdings are sitting and waiting for opportunity.

But it’s world events that cause markets to move really. This week oil prices fell back again and US markets seem to be in lock-step with the oil price currently. Janet Yellen at The US Federal Reserve is pondering whether to increase US interest rates and the stockmarket rises and falls with her moods. Finally a much watched announcement from a provider of investment benchmarks, once again went against China’s wishes. They won’t be happy. The last time they were rejected was last August and they promptly de-valued their currency to “punish the West”. Expect more market moving action from them. So as you can see, we are a tiny island 22 miles off a band of 27 Nations that can’t make a decision to save their life in a hurry. We think the EU referendum is moving markets, but in fact much of what happens is decided in far flung areas of the Earth.

Once the Referendum is over the world can get on with a much more important matter. The next US President

Finally

So I know everybody is tired with all this and hopefully we have all made our own decision for personal reasons. However I have finally found an article from someone with first hand knowledge of UK manufacturing and exporting. Someone who holds the UK in high regard and isn’t just looking for his next political job to be within the European gravy train. I think this one article is the best I have seen.

- Please read on if you haven’t made your mind up yet.

- Do not read on if you are sure you will vote to remain. This might challenge your views.

- If you are going to vote out anyway, this article will strengthen your resolve

The Telegraph

Sir James Dyson: ‘So if we leave the EU no one will trade with us? Cobblers…’

He invented the iconic Dual Cyclone Bagless Vacuum Cleaner because he got fed up with the family Hoover losing suction when it filled up with dust. Things that don’t work properly really bug him, which is why we are here to talk about the European Union. After much thought, Dyson is coming out passionately for Brexit. In fact, he has worked out that, should we vote to leave in 12 days’ time, we could be much better off, both in spirit and in wallet.

“When the Remain campaign tells us no one will trade with us if we leave the EU, sorry, it’s absolute cobblers. Our trade imbalance with Europe is running at nine billion a month and rising. If this trend continues, that is £100bn a year.”

He jabs at a graph. “If, as David Cameron suggested, they imposed a tariff of 10 per cent on us, we will do the same in return. We buy more from Europe than they buy from us, so we would be the net beneficiary and based on these numbers it would bring £10bn into the UK annually. Added to our net EU contribution, it would make us around £18.5bn better off each year if we left the EU,” he concludes with quiet triumph.

“Anyway, the EU would be committing commercial suicide to impose a tariff because we import £100bn [of goods] and we only send £10bn there – I didn’t want to get too graphy, but here are a few graphs.” He’s not kidding. The man is nothing if not meticulous.

Dyson exports far more to the rest of he world (81 per cent) than Europe (19 per cent). “We’re very pleased with the European market – we’re number one in Germany and France – but it’s small and the real growing and exciting markets are outside Europe.”

He says the much-trumpeted single market isn’t really a single market at all. “They have different languages which, for an exporter, means that everything from the box to the instruction manual has to be in a different language. The plugs are different. The laws are different. It’s not a single market. The only communality is that there’s no tariff, but the pound going up against the euro is far more damaging than any tariff. If the pound rises, £100 million is quickly wiped off.”

The problem with the EU’s free movement of people is that it doesn’t bring Dyson the brilliant boffins he needs. “We’re not allowed to employ them, unless they’re from the EU. At the moment, if we want to hire a foreign engineer, it takes four and a half months to go through the Home Office procedure. It’s crazy.”

He produces another staggering fact. “Sixty per cent of engineering undergraduates at British universities are from outside the EU, and 90 per cent of people doing research in science and engineering at British universities are from outside the EU. And we chuck them out!” He gives a trodden-puppy yelp.

So hiring a low-paid barista from Bratislava is no problem, but a prized physicist from Taiwan is a logistical nightmare. The Government claims that, if a non-EU citizen gets a job within two months of finishing their research, then they can stay here for two years. “The point is that it’s completely mad not to welcome them,” he says, “why on earth would you chuck out researchers with that valuable technology which they then take back to China or Singapore and use it against us?

Softly spoken, Dyson’s Home Service Received Pronunciation tones become incensed when he talks about what he sees as our disloyalty to Commonwealth countries. “They fought for us in two world wars. So that particularly upsets me. We’re missing out on all those people who have helped us and with whom we have a great affinity, often a common language.

“Culturally, it’s all wrong. We’re not only excluding them from our country, we’re charging them import duty because we’re forced to by the EU. And the food’s cheaper, too.”

His views on Brussels have been shaped by bitter experience. Dyson sits on several European committees. “And we’ve never once during 25 years ever got any clause or measure that we wanted into a European directive. Never once have we been able to block the slightest thing.”

Ah, so it’s a bit like the Eurovision Song Contest – Royaume-Uni, nul points?

“If only!” He laughs. “At least they have voting at Eurovision. These sessions are dominated by very large companies who agree on their approach before the meeting and so vote together as a bloc. And that’s why we never get anywhere. We think that’s anti- competitive practice and we would love to prove it but…” he gives a helpless shrug.

Years ago, when a practically penniless James was tugging his first vacuum cleaner round Europe, he came up against what he brilliantly calls “vossn’t-invented-here syndrome”. Nothing changes.

His wife calls him stubborn and he must be because several times he has joined battle against the multi-headed hydra at the European Court.

In one notorious case, Dyson argued that vacuum cleaners should be tested in real homes, just as consumers would use them, in line with what the EU claimed it wanted. His competitors, who make machines with paper bags which clog, insisted the tests should take place in laboratories with brand new bags and filters. And no dust. Guess who won?

“The court said there isn’t a test for home use, which is a complete…” he searches for a kinder word, “…untruth. So it’s a politically motivated court of justice. Politically motivated to protect vested interests. I know what they’re like. I know how we have absolutely no control of what goes on in the EU and it’s starting to affect what we do here.”

Dyson’s slight hesitation in speaking out is that he thinks that David Cameron and George Osborne are good at their jobs and would like them to stay on after the referendum.

Sir James says he started the company because he was frustrated at existing technology

“It’s just that on this issue I think they’re fundamentally wrong. I don’t just mean from the business point of view, I mean from the point of view of sovereignty and our whole ability to govern ourselves. We will create more wealth and more jobs by being outside the EU than we will within it and we will be in control of our destiny. And control, I think, is the most important thing in life and business.”

He says what he fears is staying in. “There is no status quo. Europe’s going to change. We all take risks, but they’re very calculated risks. The last thing I would ever want to do is to put myself in somebody else’s hands. So for me the risk is in putting ourselves in the hands of Europe. Not just the other countries, but the Brussels bureaucrats. What I simply can’t understand is why anyone would want to put themselves under their control.”

Last Chance

We must all vote because we won’t get the chance to do it again. This is a once in a lifetime event.

Excellent copy of Spectator article in today’s Mail.

ALSO the IMF confuse me on the one hand they urge UK to stay in and on the other hand rate the risk of a Euro break down as very significant. Why are we being encouraged to go down with a sinking ship unless they have it in mind that UK will be forced to contribute to a Euro rescue if we are still in?

Dick

PS How is gold doing?

Brilliant Howard

Really enjoyed ready that

Dyson is a good engineer. As an alternative here is a view of an expert https://news.liverpool.ac.uk/2016/06/16/watch-dishonesty-industrial-scale-eu-law-expert-analyses-referendum-debate/.

It’s worth 25 mins listening before you finally decide.