This week we sold all of our remaining fixed-interest holdings. Now I do believe that usually investors should hold a variety of different asset classes. I have said it before here

diversification through asset allocation is the only free lunch available to investors.

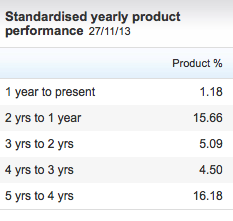

So therefore it is with regret that we announce the late departure of the iShares £ Corporate Bond Fund from our portfolios. We will be sad to see it go. Here are the investment returns we have enjoyed from this fund over the last 5 years. It has been a lovely, lower-risk little earner, but as you can see this year has been a struggle.

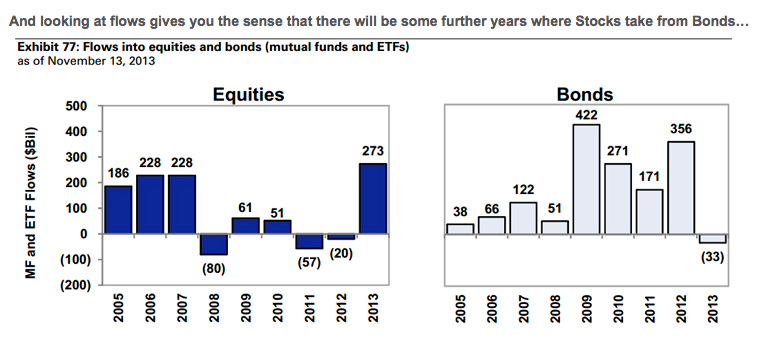

Something out there has changed and it’s something big. I attended a meeting last week and saw this chart (courtesy of Goldman Sachs so it must be true). It shows what the Americans are doing and because of the size of their investments, what they do counts globally.

So the “Great Rotation” that was muted 6 months ago has indeed commenced. Cash flowing from bonds into equities has begun and that movement has a long way yet to go. Americans are getting afraid of what will happen when the FED takes the US economy off life-support and ultimately lifts interest rates. Rising interest rates are always bad for fixed-rate investments. I have previously blogged about the FED here.

As well as the push factor there is a pull factor. US companies are once again doing very nicely thank you, tempting reluctant investors back. We never want to be the last investors in any asset class, so I decided enough was enough. Investment returns are always governed by supply and demand – never fight the flow of money

I have already begun to dump our fixed-interest investments in August 2011. Until then we had done very nicely holding Index-linked UK government gilts but inflation was beginning to fall. If we had kept those low risk investments our return since would actually have been less than UK inflation. Due to the ratings agency down-grades, the risk of holding any government gilts has increased since 2011 but the return has decreased.

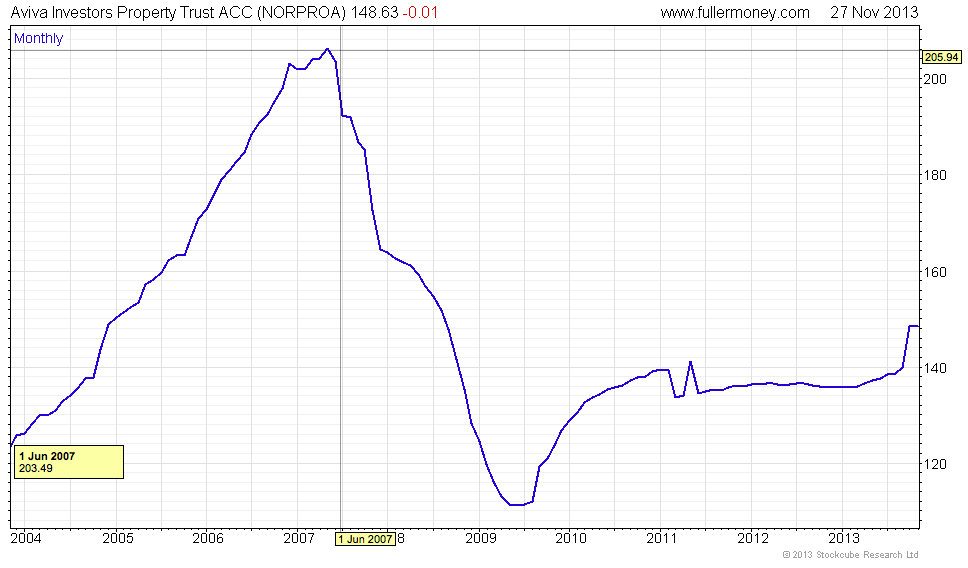

Previously in June 2007, I turned my back on Commercial Property as an asset class and sold all of our holdings. The rest was history as the chart below shows – a free fall of 45% and investors locked in the funds as the property couldn’t be sold fast enough to meet redemptions. The value has not been recovered 6 years later. I don’t expect the same bloodbath or the same lucky timing, but capital values for fixed interest investments could fall by 20% over the next couple of years.

If diversification means we hold investments which are more likely to loose money than make money over the next 2 or 3 years, then I don’t think it makes sense. As the Dragons would say “I’m out”

However where do we invest our money? Taking fixed interest funds out of our asset choices for now means we need to find another low risk/low return offering. As ever we are watching and waiting for developments.