Where do I start?

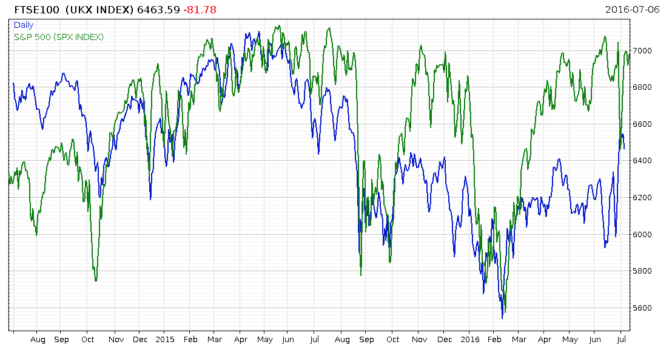

It’s easy to take our eyes off our goal when we are bombarded by the media with their endless disaster prophecies. I understand it is difficult, but we must stay focussed on our long term goal. We have just withstood two weeks of turmoil, but markets tend to look 18 months forward, not just 18 hours. Looking at the chart above we can see that the blue line of the UK FTSE 100 index reached it’s peak in April last year, 15 months ago now, and has declined significantly since. What is telling from this chart is the true effect the EU Referendum has had. The green line charts the progress of the US S&P500, it is much higher than the FTSE 100 today. Fortunately we remain invested globally, not just nationally.

Rational Investors?

If you believe “Modern Portfolio Theory” then the events that played out in the markets over this last fortnight should never have occurred. Modern portfolio theory describes our expectation of a rational investment market populated solely by rational investors. Forget it! Last week the UK’s major trading platforms all crashed due to investor panic. This week there has been a stampede for the exit for those investors, including ourselves, that held the “steadying effect of Commercial Property” in our portfolios. All the major UK Commercial Property Funds have now said we cannot have our money back. The lock-in had happened before and will happen again. Within a couple of days around £20 billion of investors capital became tied up. No further withdrawals are possible now. Thankfully, we avoided the 2007 lock-in and once again we escaped the lock-in this week. We got out because of three inescapable facts.

- We eat our own cooking. We hold the exact same investments as our clients do, so watching out is second nature.

- We don’t believe in committees. Many large firms operate an investment committee, which meets regularly to discuss the future direction of the investment portfolios. Action is minuted and then eventually implemented. Absolutely useless when the speed of the decision is more important.

- We hold discretionary permissions. So having decided we should head swiftly for the exit, it was only possible to take our clients with us because we have authority to act on your behalf. It’s the only way we can watch your back

How have we done?

All clients have had their personal quarterly valuations. But here is how the three model portfolios that we operate have performed where no contributions have been added and no withdrawals have been taken

Portfolio |

April – July |

|---|---|

| Cautious Moderate Aggressive |

-1.45% +0.14% +2.97% |

Who Dares Wins

As you can see simply trying to preserve capital for Cautious Investors has been pretty much impossible over this quarter. There has been simply too much risk around. I’m not in the business of giving my Cautious Investors sleepless nights. For my Aggressive Investors I have the mandate to “go for it” relative to our other portfolios. It was a strategy, which I described last time, that paid off. The bulk of my clients in our Moderate Portfolio received a return somewhere between the others.

Had I taken a snapshot on a period that started a little earlier or a little later, then the fortunes would have looked reversed with Cautious Investors in the black, whilst the Aggressive Investors would be in the red.