What are bank holiday’s for these days? Why do we get two of them in May but none in June or July? I’m certainly not complaining, especially as the weather is all set to be excellent again. But since most banking is done on-line these days via smartphones, our business with our banks will continue whether the bank is on holiday or not.

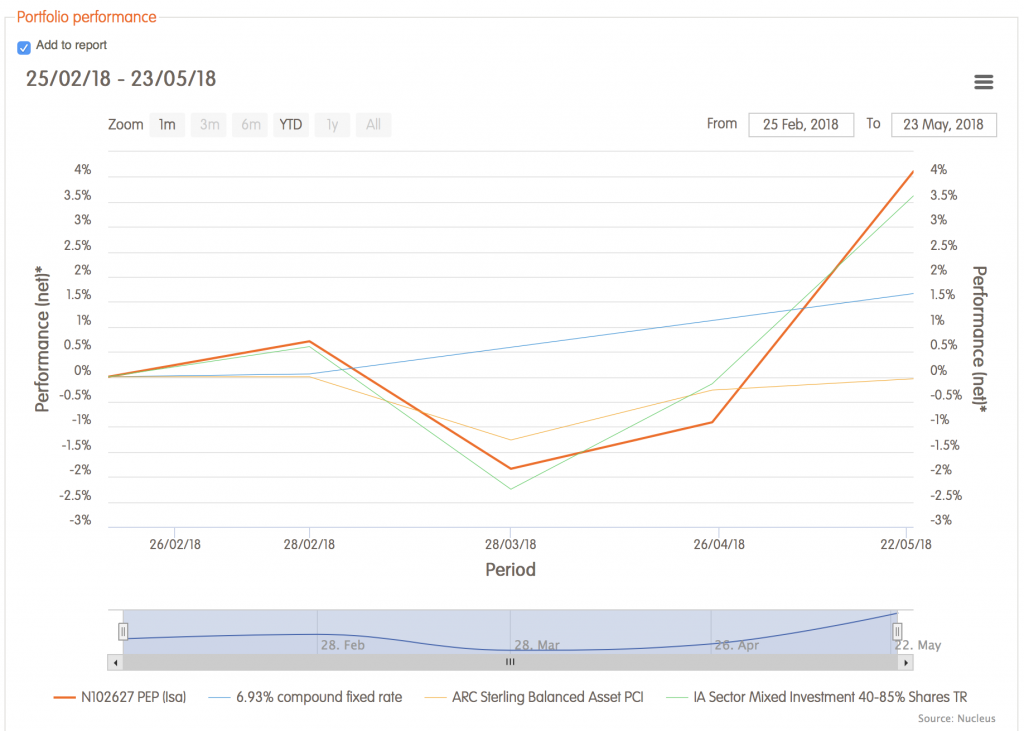

May has been a good month. Good weather, great investment markets (Our Moderate Portfolio shown above) and I’ve finally seen the back of a whole batch of tedious legislation. Hopefully as clients you have not seen much in the way of change. We have tried to keep it business as normal. Just like a bank manages whilst it’s technically on holiday.

In the run up to the end of 2017 it was MiFiD II legislation which came along. That took some man hours to comply with. The legislation was aimed at bringing the fund management industry to book, fortunately for me I had already turned my back on most of it years ago as I didn’t believe it offered us investors value for money. Here is a bit of what it has finally revealed.

Surprise surprise as Cilla would have said

There is a huge difference between what funds have been disclosing as their charges and what they have actually been taking. I’d guessed this but had no proof. All the results aren’t in yet, I guess those who haven’t responded so far have even more to hide. Here’s a few examples of the previously well hidden real annual costs.

| Fund | Was | Now |

| BlackRock Euro Dividend Equity Absolute Return | 1.42% | 6.90% |

| Polar Capital UK Absolute Equity I Income | 1.78% | 10.28% |

| RIT Capital Partners plc | 2.32% | 4.03% |

| Barings Korea I Acc GBP | 0.91% | 3.67% |

| Standard Life Investments Property Income Trust | 1.50% | 3.25% |

The cat is now out of the bag. I’m sure clients don’t look at this sort of stuff, but there will be a whole lot of embarrassed advisers out there who believed what the large investment groups were telling them. It will change the recommendations that advisers present to their clients in the future. After all, since commission was banned in 2012, it’s the clients who pay the adviser’s fees, not the investment groups.

We went fee only in June 2005 to deliver transparency and value. These revelations tie in with what I talked about in my last blog in the paragraph entitled The Latest Contender

Alphabet Soup

So that was MiFiD II and now I’ve just completed what was needed for GDPR. Both look like bad Scrabble hands to the uninitiated. I’m sick of hearing about GDPR as we started to plan for it way back in January.

I have just sent you an email to confirm you want to continue to receive my blogs. You see, me just mentioning those absolutely pants funds above, could be interpreted as a me trying to sell you something! Therefore to send my blogs to you in the future requires your permission.

So if you responded to my email by clicking the link and agreeing to allow me to send you further marketing emails, you win. You get to receive more of the information that makes us all wealthier.👍

If you didn’t then this is your last blog. 😬

Have a great long weekend.