3 Today!

We were granted our discretionary investment permissions by the FCA in October 2012. We applied solely to speed up the model portfolio rebalancing process. Since we obtained our permissions we have learned of several good businesses who tried but failed to gain the same permissions. We applied expecting to pass the regulators stringent standards, we didn’t even know we could fail. Three years on, I think it’s time to see just what our 3 main model portfolios have achieved; free of the time delays previously encountered when we needed to collate every clients permission before we could rebalance a portfolio. I would like to thank all our clients for having the faith that allows us to make investment decisions on their behalf.

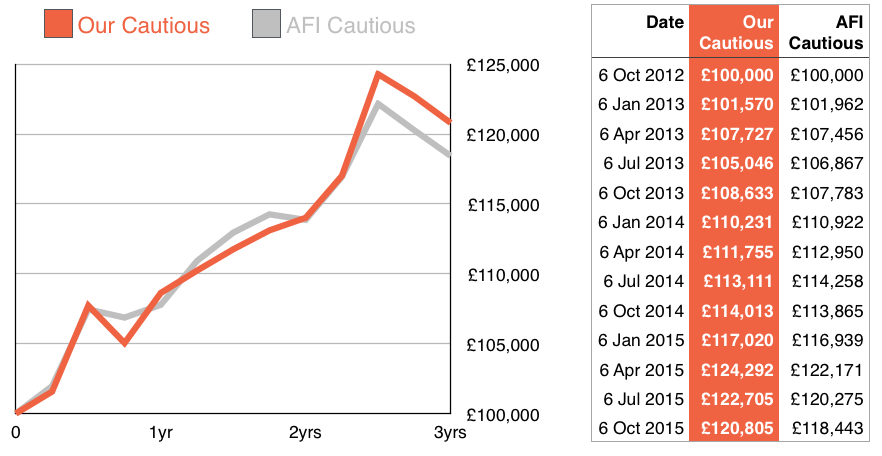

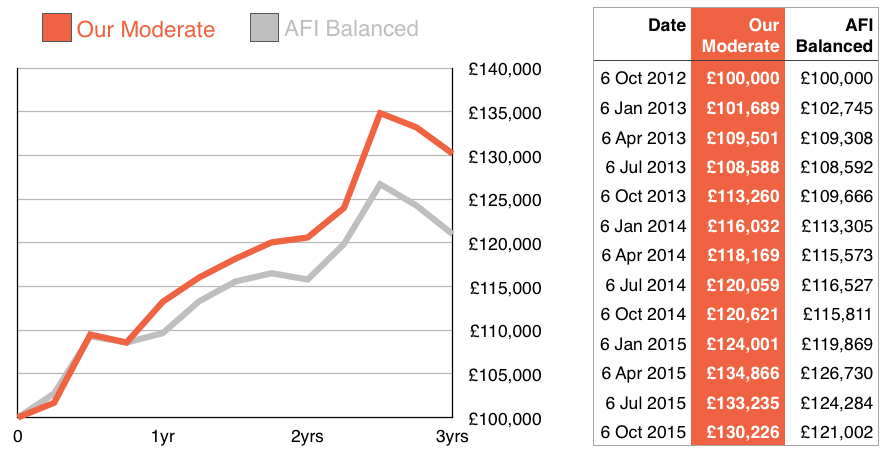

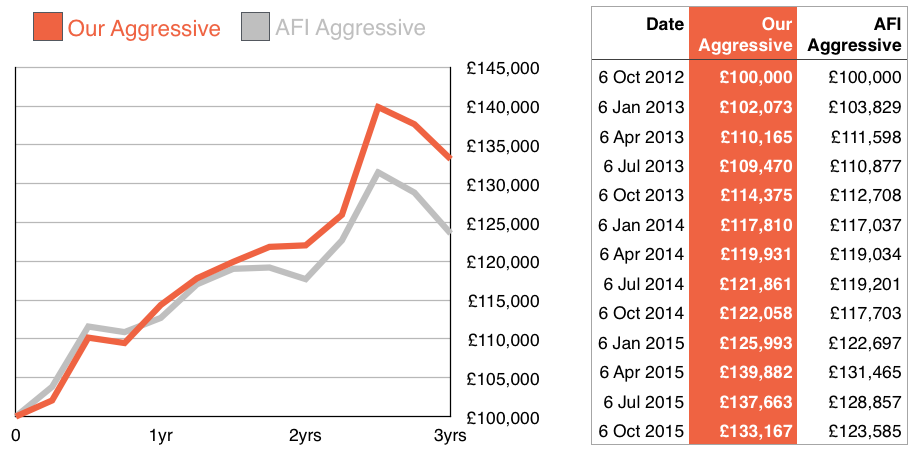

The FE Adviser Fund Index (FE AFI) is made up of the recommended portfolios of a panel of leading UK financial advisers. Based entirely on the funds actually recommended to clients, the FE AFI Aggressive, Balanced and Cautious portfolios carry real-life credibility, and provide insight in terms of the benefits of holding top quality funds.

Over three years we have beaten our peer group with our Cautious Model Portfolio. Not by much, just 2%, but our figures include platform costs and our advice fees. Our figures show the return in your pocket, the AFI Index figures include no advice or management fees, nor any platform costs. Those costs for us come to about 3% over the period. To get a like for like comparison either add 3% to our figures or deduct 3% off the AFI Index.

Over three years we have beaten our peer group with our Moderate Model Portfolio. Around 70% of our clients invest in this portfolio. Our model portfolio has beaten the AFI index by a credible 7.6%. Again our figures include platform costs and our advice fees. Our figures show the return in your pocket, the AFI Index figures exclude advice, management fees and any platform costs. Those costs for us come to about 3% over the period. To get a like for like comparison either add 3% to our figures or deduct 3% off the AFI Index.

Over three years we have beaten our peer group with our Aggressive Model Portfolio. We beat the index by 7.75%. Once again to get a like for like comparison either add 3% to our figures or deduct 3% from the AFI Index.

As you know our main job is that of trusted adviser and lifetime financial planner. We help you to plan for the future and we help you make those decisions that make the future look brighter. Making your life savings grow is simply part and parcel of that process. We would prefer to be judged by the value our advice brings. But it’s not bad when we beat our opposition on performance and value. ??

Remember past performance isn’t necessarily a guide to the future