It was October 2016 when I last made a lot of changes to our portfolios. Back then I changed our focus to begin to hold mainly individual UK listed shares in our investment portfolios.

This change was ushered in following the Brexit vote. With many of our long-standing overseas funds looking too good to be true following the UK’s currency devaluation, I figured all overseas funds would suffer the future headwind of Sterling gradually strengthening.

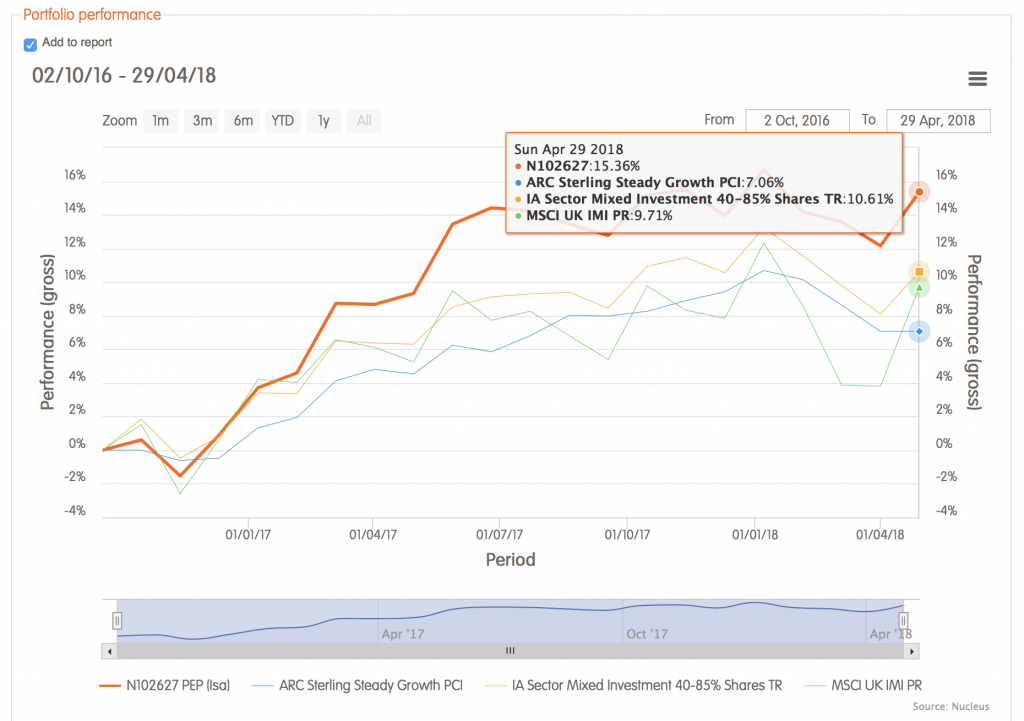

Since then the Pound has strengthened marginally, and most of our U.K. shares have done what I expected of them. Some have lost, some have won, some won big, some lost big. The chart below shows the performance of our Moderate Portfolio since we made the changes in October 2016. Overall we have won, and our returns have been higher than those of our peer group. (More about this later)

Many of you have recently noticed the changes I’ve been making and one or two of you have asked me what I have in mind. What comes next?

I’ve only had the benefit of experience of holding shares directly for a relatively short period of my career. Just the last 4 years out of 31 years. With much more to learn, here’s what I have learned so far.

WYSIWYG

What you see is what you get. I love the transparency of seeing every transaction and every share price movement. For most of my career I was forced to believe the returns we were given. We could never challenge any outcome, as all transactions were covered by the all encompassing movement in just 1 daily published fund price movement. Did we receive all of our dividends? What internal charges were being deducted? We never knew. Now we can see everything.

Sure it hurts when a business I believe is rock solid completely tanks. The U.K. population continues to die and spend more on funerals, but Dignity managed to lose 2/3rds of its value. But at the same time we experience the thrills and benefits of Fyffes or Worldpay being taken over for 40% premiums.

Diversification

I’ve held many shares that in theory compete with each other. There should be winners and losers. We should benefit by holding more rather than fewer shares. But sectors have moved in lockstep irrespective of whether one company out-performs another. We haven’t seen the diversification benefits. Going forward I’m going to concentrate on fewer shares.

No Crystal Balls

I hadn’t even considered the possible case which could bring about the biggest drag on our investment performance. The biggest consistent falls have occurred due to the growing threat of a future Marxist Government along with their threats to nationalise much of our infrastructure. A pie in the eye idea as far as I can see, because just taking the railways, electricity supply and the gas and water companies back from the shareholders would amount to theft. They would need to be repurchased with borrowed money. It’s obviously a vote winner though. Sometimes it’s prudent not to try to fight battles where there will be no winners.

I will be keeping some utility companies, I just intend to focus on fewer.

Who dares wins

It would have been easier just to follow the likes of a star fund manager like Neil Woodford. After-all he is forced to disclose his top ten holdings. Neil actually discloses all of his holdings, so following him would have been easy. Or it would have been even easier just buying the entire FTSE 100 Index and receive it’s performance less fund charges. Just going with the Status Quo is easy. Straying from the well travelled path requires strength and accepting the repetitional risk that goes with failure.

I’m happy to say that if I had chosen to match Neil Woodford then we would have ended the period lower than we did. Interestingly the FTSE 100 has beaten us over this period of 18 months or so, but that was due to the extremely low level it started from post Brexit. We have done better over 5 and 10 years.

It’s a life sentence

This is a continual process, it can never be considered just a project that will ever be finished.

Buy the correct investments, hold them continuously, live happily ever after from the proceeds.

Obviously the hopes and dreams of 190 families, supported by their combined investments of around £76 million is a huge commitment. One that requires personal input every single working day. I would be foolish if I didn’t consider the alternatives. So I continually assess our options.

The latest contender

I won’t mention names, but I was approached by one of the largest U.K. discretionary fund managers last week, to see if I would like to invest our clients capital with them. They had won all the industry awards, are headed up by an individual who regularly appears on the television and they are huge, managing over £5 billion. They had studied our website, seen what we did here and considered it would be better letting them do the heavy lifting of investing our combined life savings.

I naturally asked for their performance figures and they sent their fund factsheets. Now I know factsheets don’t show the whole charging story, so I asked if they would forward the actual returns a typical client actually received. Nucleus has facilitated this possibility through their tool called Narrate. I have shown many of you a personal report of your returns at our review meetings. I was involved in the testing of the tool, so I have absolute confidence that the results given reflect to the penny, the returns any given client achieves.

The discretionary investment manager agreed to a head to head over the last 5 years.

Now I wouldn’t be telling you all this if they had achieved a better investment return than us. I would just be suggesting we invest with them going forward. After all, if I could find a company that could do a guaranteed better job of looking after my family’s wealth, then surely I would use them too.

On paper their performance looks good, however they like many companies exploit flawed FCA rules. They can minimise declarable costs to look great value for money, but in the background there are huge unseen costs that cause a significant difference between a fund’s performance and a client’s returns. It’s all perfectly legal. Thankfully changes are coming.

It was suggested that the last 5 years could have been a flash in the pan, maybe I had just been lucky. I showed them our 10 year returns and they have gone all quiet, after a week of thrice daily emails.

Conclusion

The conclusion I came up with years ago seems to have been proved to be absolutely true. We have been ripped off for years in the background. Investment companies keep a greater return from our investments than we the investors do.

As long as we cut out their excessive charges, we will achieve better returns than average. Once we have bought any share it costs nothing to hold it indefinitely. No third party gets to syphon anything off on an ongoing basis in the background. I believe that gives us a better opportunity to prosper in the future.

I don’t need to be an expert or a genius to achieve a higher than average return, managing other peoples’ life savings like it was your own is enough. Picking better than average shares is just a bonus and to a large extent is subject to luck.

The harder you work the luckier you get… My real question however is can you please hurry up and get a banking license so we can escape their thieving grasp too:)

Seriously though, over the years we’ve built up a modest portfolio of 20 or so equities which overall are doing ok, but the seemingly increasing lack of business factors affecting their core value and growth increasingly worries me, is it time to modify equity/cash balance?