What’s in a name?

Life insurance doesn’t exist. Obviously you are insuring against the event of your death, not the event of your continued life. But hey, who would buy a “death insurance” policy? That’s nice marketing spin by the insurance companies.

So who wants to invest in shares listed on the Alternative Investment Market? The AIM. It just sounds decidedly dodgy doesn’t it. Someone needs to apply some marketing spin to make this investment sound like a more attractive proposition. Please can we lose the Alternative?

Describing something as alternative, automatically makes it sound worse. At least less than optimal.

We apologise in advance if your first choice meal is unavailable….

Upon hearing this you already know that there will be no steak left by the time the trolley-dollies reach you in row 44. You are going to have to accept the less attractive alternative. Usually veggie curry. The alternative to steak just isn’t steak.

And alternative comedy? In the late 90’s I had absolutely no idea what Alexii Sayle was talking about, never mind finding it remotely hilarious. “Hello John. Gotta new motor” The alternative to comedy just isn’t alternative comedy.

Never judge a book by it’s cover

So I had spent much of my investment career regarding the Alternative Investment Market in the UK as an opportunity to be best avoided. Of course I had been directly marketed in the past by boutique investment houses offering their very expensive (2.5% p.a., but oh so worth it) AIM portfolios. But as a somewhat stubborn individual I usually run the other way when a salesman of any sort presents me with a rock solid, exciting, buy-now-whilst-stocks-last investment opportunity. However I reluctantly opened the book with that un-attractive looking cover.

Today we manage a portfolio of AIM Shares for several clients including myself. I believe that investing in the Alternative Investment Market is indeed still investing. It’s the road less travelled. We simply needed to take more time, carry out much more research and dig deeper.

What changed my mind?

August 2013 brought about a small change in financial legislation, allowing individuals to hold AIM shares within ISAs for the first time. AIM was going mainstream. Back then I asked Lucas to begin our research to see if it was an area that could be of future interest to our clients. Specifically those clients who needed to plan to reduce their families future inheritance tax liabilities.

As the ISA changes began to find column inches in the newspapers, a few clients began to ask me what my views were. We had already chosen our portfolio of 20 AIM shares and were monitoring their performance and their volatility, to ensure we could recommend them in the right circumstances in the future. Becoming brave enough to recommend smaller shares wasn’t easy.

What the regulator hates about AIM shares

- Smaller companies are in theory riskier than much larger companies.

- Much less volume of smaller shares is traded on a daily basis which could mean selling some AIM shares in a hurry could prove difficult and/or costly.

- The worst AIM shares do go out of business and that means a total investment loss!

What I like about AIM shares

- Many large companies today graduated from the junior market up to the FTSE All Share index. They became large shares.

- They are indeed small companies, but the largest of them have a market capital of over £1 billion. Not that tiny after all.

- Companies on the AIM include household names which are far from alternative like Jet2 Holidays, Mulberry & Vimto.

- Many AIM companies still have the same families at the helm as when they were privately owned. I love skin in the game.

- Let’s not forget that even big good companies can go bad. Remember how Northern Rock shareholders faired? Size is no guarantee of safety anyway.

- Unlike all funds, shares owned directly are free to hold, with no annual management charges to pay.

- Unlike owning funds, you know exactly the small shares you do own. Many large funds own AIM shares anyway but don’t disclose it.

- On average, over a long period of time, a portfolio of smaller shares should deliver a larger return than larger shares.

Why am I telling you this?

Now 2 years since we began to manage our AIM Portfolio, we are about to add these AIM shares to our full Aggressive and full Moderate Portfolios. Obviously the Aggressive portfolio will receive a higher tilt towards the AIM shares, investing in all 20 shares, whereas the Moderate Portfolios will invest in only 10. These shares will form the top tier of our investment cake. The risky end. Cautious clients will own none.

So Anthea. Let’s see the scores on the doors

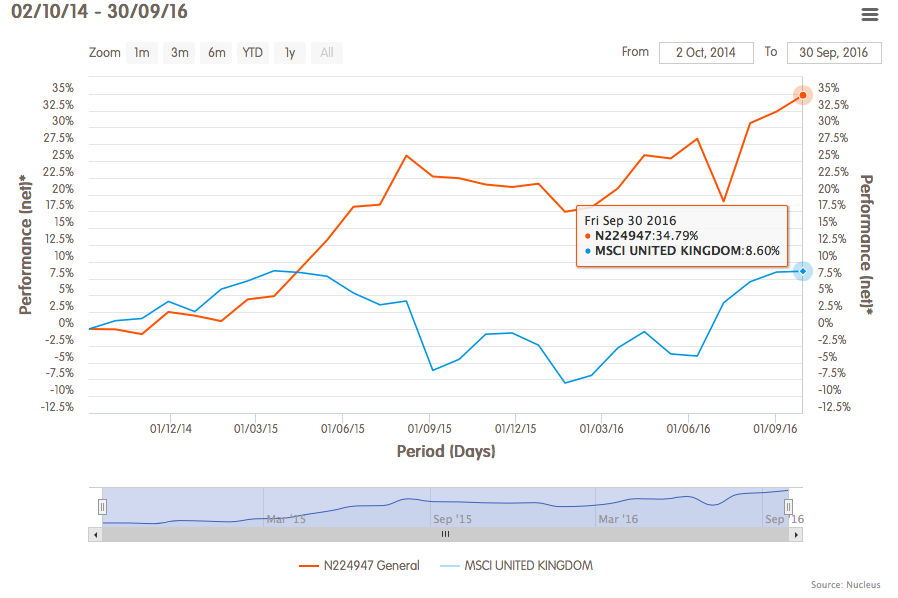

This is how our AIM Portfolio has performed over the last two torrid years. Here is an actual 2 year old portfolio shown below. As usual the return “in your pocket” is shown after our 1% management fee and the 0.35% fee Nucleus charge for their service. Bargain!

![]()

Let’s now try to cover my regulated backside

- Past performance isn’t necessarily a guide to the future.

- Investor’s Capital is at Risk – the value of an investment can go down as well as up and investors may not get back their initial investment.

- AIM Stocks can carry considerably greater risk, are less liquid and can be more volatile than larger listed stocks.

- This is not general financial advice. After all anybody can read this. I may not even know you. I only give regulated financial advice on a personal face to face basis

Howard,

Thanks for the blog. I don’t know whether you have come across any AIM listed companies that deal in “Specialized reactor chemicals” like Ether Sulphate or any companies which are investing in “battery technology” but these look like areas for growth to me and therefore worth looking at from a spread investment basis ?

Hi Mike

Thanks for your input to the collective Mike. Another client recommended Biomass. The more ideas the better.

Battery technology is difficult to access as an investment. It’s also easy to “back the wrong horse” as has happened with 3D printing technology. What was a 3D printing share that was performing fabulously yesterday, suddenly becomes worthless as a different company makes a further technology breakthrough, which renders the first companies patented product an antique, fit only for the scrapheap.

Batteries will enable wind and solar power to become a mainstay. Adding power to the grid via batteries, even when the sun doesn’t shine and the wind doesn’t blow. It will happen within 5 years.

“Wolf of Chorley New Road”? Are we talking about “penny” shares here?

Hi Rory

I love your sense of humour Rory. Absolutely not penny shares unless you know of any dead certs 🙂

Hi Howard,

I see that Fyffes are included in our portfolio. As they are most well know for their Bananas I thought this BBC article on the history and future of Bananas would be of particular interest. http://www.bbc.co.uk/news/uk-england-35131751

Thank you Peter. I’m sure many clients will find this article as fascinating as I did. Just for the record – I absolutely hate bananas and have never eaten one. As a child my asthma medicine was banana flavoured.