Investment knowledge is a journey not a destination. Nobody can ever say they have perfect knowledge. After 30 years I’m still learning everyday.

We all need to start our journey somewhere, so I would like to commence by explaining a little about UK Shares. Hopefully a few facts will make you a little smarter.

Let’s start off with a few of those investment facts.

- All in all, we only have the opportunity to invest in a relatively small number of companies listed on The London Stock Exchange. Some star companies like Barbour, Boden & Independent Advice Ltd. are privately owned. You will not find them on any stock exchange.

- Secondly the UK Stock Market holds some companies that neither live in the UK or trade in the UK. Many basic raw materials companies, miners like Glencore PLC., have an office in London but don’t dig up anything from beneath UK soil. I could be wrong, but I don’t think they sell anything to the UK either.

- Thirdly the FTSE 100 index isn’t what many individuals expect. We are told it’s index level every workday in newspapers and on the TV and radio, but do we know what that number means? Let’s start with it.

The FTSE 100 Index

Here’s a little quiz for starters.

Q1: Which one of the following statements about the FTSE 100 index is correct?

-

- A: It’s made up of 100 shares.

-

- B: It’s a good benchmark over time as it never changes

-

- C: It’s made up of the very best 100 UK shares.

-

- D: It’s made up of the safest 100 UK shares available.

-

- E: The rise in the index over time, equates exactly to your total return if you held each of the shares in it.

-

- F: Each of the 100 shares make up exactly 1% of the index.

I apologise, it was actually a trick question. Amazingly not one of the statements is actually true. Confused? Then read on.

A: It’s made up of 100 shares.

Until fairly recent times the FTSE 100 index consisted of 102 shares. That’s when it contained Schroders A & Schroders B. Today it contains both Royal Dutch Shell A & Royal Dutch Shell B, taking the total to 101. The correct statement would be it’s made up of 101 companies.

B: It’s a good benchmark over time as it never changes

I have confirmed this isn’t true above when I said “That’s when it contained Schroders”. The FTSE 100 is the Premier League and the FTSE 250 is the Championship. Just like in football leagues, there are regular promotions and relegations. The FTSE 100 never (well hardly ever) ends the year as it starts. That’s because a reshuffle occurs every 3 months.

Two shares swap places each time. In September it was Royal Mail & Provident Financial who were relegated, replaced by the newly promoted NMC Health & Berkeley Group Holdings.

C: It’s made up of the very best 100 UK shares.

Again the answer here has already been aluded to. Hands up who has head of NMC Heath? No one. If we haven’t heard of a member, it can’t be the best of the best can it? It’s merely the biggest 100 shares listed on the London Stock Exchange. The number of shares are multiplied by the share price to work out the total value of each firm. This is called the “Market Capital” of a firm. Remember this because I’m going to mention it again shortly.

The FTSE 100 is simply the 100 largest firms listed on the London Stock Exchange.

D: It’s made up of the safest 100 UK shares available.

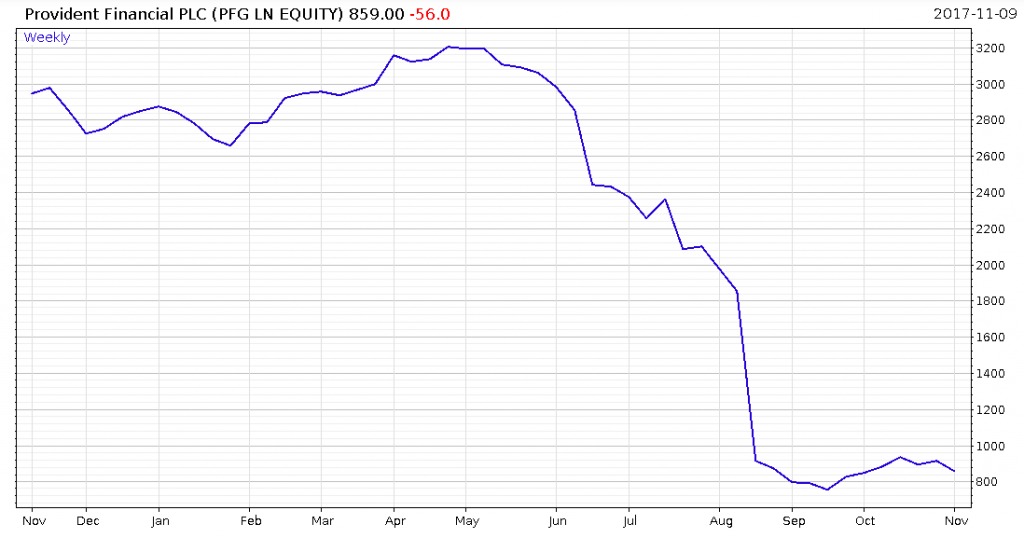

Remember Provident Financial that I said was demoted in September? Here’s how it has performed recently.

Now I wouldn’t call that a safe share to invest in! In just one year it has reduced in value by 75%.

E: The rise in the index over time, equates exactly to your total return if you held each of the shares in it.

The FTSE 100 index began life in January 1984 at exactly 1000 points. Today it’s around 7500 points. You would therefore expect that if you matched it share for share over the period, then each £1000 you invested in 1984 would by now be worth £7500. In fact you would have made much more. The index does not include any dividends paid by any of the companies. If these were re-invested as they were paid out, your total investment today would make the rise in the index alone seem small.

F: Each of the 100 shares make up exactly 1% of the index.

Take a look at the chart below. Just 14 shares make up over 50% of the value of the FTSE 100. The other 49% is divided across the other 87 shares. (Remember, there are 101 shares in the index.). So what gives? Remember when I talked about “Market Capital” earlier? The FTSE 100 index pays more attention to the big shares and less to the smaller ones. It is a market weighted index. As you can see, just 4 companies – Shell, HSBC, BAT & BP together make up over 25% of the total. If any one of them coughs, the FTSE 100 index catches a cold. Two oil & gas companies, a producer of fags and a bank!

So forget the diversification afforded by holding 100 shares. Forget too that the rise in the index is a good indicator of how the U.K. is performing. Since 85% of the earnings of the FTSE 100 companies are generated abroad, the index is currently an indicator of how our currency exchange rate is doing against a basket of foreign currencies.

That’s all for today. Next time I will give you a few facts about the FTSE 250 index if that is what a consensus of clients asks for. If you have found this article useful or not, then please tell me. If you would like me to explain any investment topic or answer any general financial planning question, then please also add a comment below.

Loving the educational blog- Knowledge is power!