Wasn’t 2008 & 2009 scary

I know the world’s stock markets are doing well currently, but let me take you back to the dark times for a moment. The period from the end of 2008 to early 2010 saw the UK stock market bottoming at half of the level it is today. At it’s worst, it had fallen to almost half the level it was in 1999. Ouch! We tend to forget the scary, uncertain times like those.

Back then I was looking to buy into the UK share market whilst it was still low, for myself and my clients. I didn’t want an expensive fund, run by someone who thought they not only knew more than the rest of the market did, but considered themselves able to consistently know more than the market forever. No, I wanted a cheap tracker. But I did not want to just buy a FTSE 100 tracker, because the FTSE 100 as an index was full of failing financials and retailers. With many large institutions suddenly collapsing like Northern Rock, the Halifax, MFI and Woolworths, it was impossible to know who would be the winners and who would be the losers?

Vanguard asset management arrives

Like a knight in shining armour a huge American fund group silently slipped into the UK in late 2009. At the time it brought with it an outlandish idea. It brought “pile them high and sell them cheap” to the UK. Previously funds cost investors 1.5% per year. Vanguard’s fund cost just 0.2% per year. It couldn’t be any good could it? After all you tend to get what you pay for.

I was drawn to its cheapness, but more importantly it’s ethos. It wasn’t going to employ expensive experts who were going to dust off their crystal balls and pronounce who the future winners and losers would be. It couldn’t afford to do that, charging just 0.2% per year. No it was going to select every company in the FTSE All Share Index. Every one, as long as they paid a dividend. I thought that was just brilliant. Simplistically I thought that if companies didn’t pay a dividend, they could be one step away from going out of business themselves as they had no cash to distribute. If conditions continued to be bad and the company needed some cash they couldn’t turn to the banks. After all the banks had no money and were going bump themselves.

The rest is history. It did exactly as it said on the tin and continues to do so.

The times they are a changing’

Now every company in the FTSE 100 bar three pay dividends. The reckless pursuit of income by investors has forced all companies to pay dividends, whether they can afford to or not. Remember HMV with its 9% dividend, just before it folded? The fund hasn’t changed, but the UK Stock Market has. If I just wanted to track the index I could do it now for only 0.08% per year. And no, that isn’t a typo.

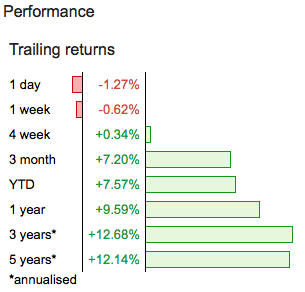

So guess what happened on Monday? After 5 years of being delighted with the fund, with compound growth of 12.14% per annum, I sold half of our remaining holdings. It was hugely difficult. Back in 2010, 40% of our savings were in the fund, now just 10% remains. When the UK market hit 7000 points on Monday it seemed like a good exit point. With a General Election around the corner that threatens to do more harm than good, I may also sell the rest shortly.

Don’t worry, I have my plan ready to go for the next 5 years. The next blog you get will accompany your quarterly valuation. I think you will be pleased.

Greatest Hits

If you want to track our love affair with the Vanguard UK Equity Income Index Fund since we bought it, then check out some of my earlier blogs containing a nod to the fund. In the early days I often waxed lyrical about its performance, but since then the fund has soldiered on as an unsung hero in the background, like Michael Carrick in Manchester United’s midfield.

- Jan 2011 Investment Reviev

- April 2011 Investment Review

- Sept 2011 FTSE Update

- Dec 2011 FTSE Update

- Jan 2015 Investment Review

Thanks for the memories

So long Vanguard UK Equity Income Index Tracker – you have been loved by all invested in you. You have bought us cars, set our children up in their first homes, taken us on exotic holidays and helped us to collectively realise many of our life’s goals and childhood dreams.