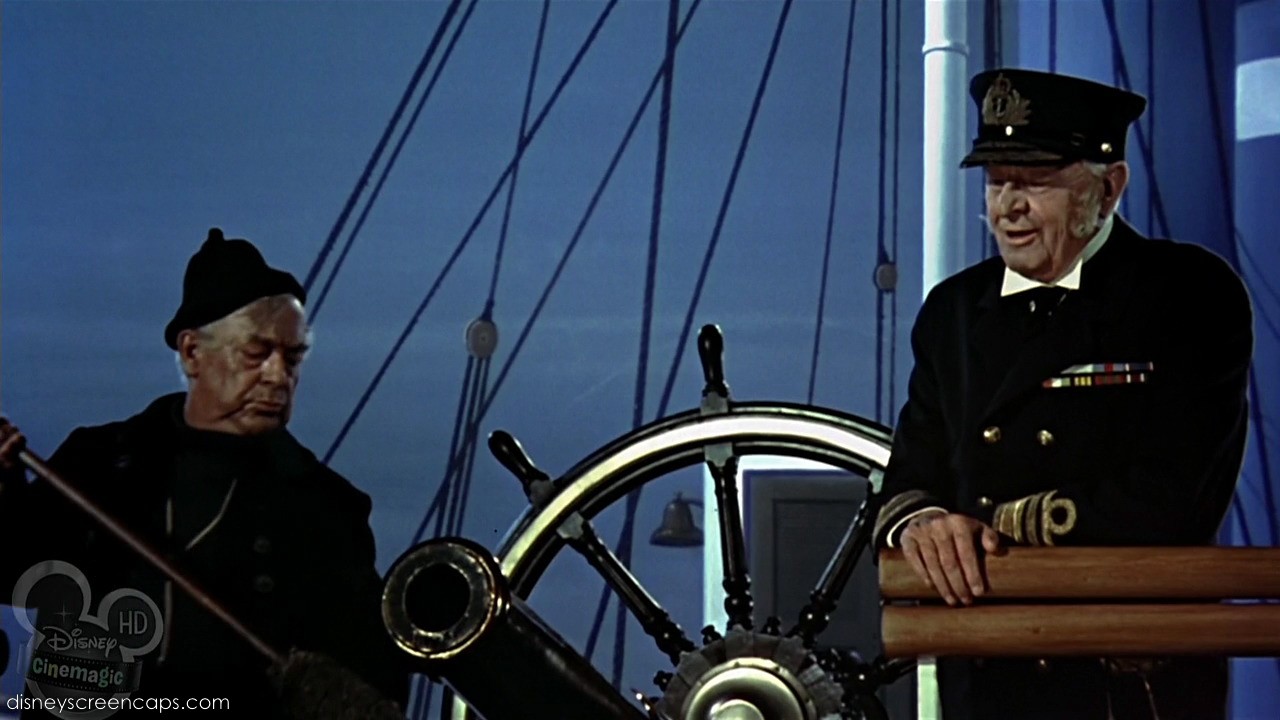

Admiral Boom:

Wind’s come around, blowing dead on from the West!

I’m sure many of you will remember the basic storyline of Mary Poppins. She is blown in on the East wind and only stays until the wind changes. I only mention this great Disney film from my childhood because it best describes how I feel about the threat to the markets from a possible collapse of Europe Union.

We have been under the influence of an ill wind blowing from Europe for a couple of years now, but I feel the wind has changed. Don’t get me wrong, I do not believe all the debt problems are fixed, or ever can be, but I feel that Europe will now muddle through and avoid the doomsday scenario which would drag all global markets considerably lower. Mario Draghi, the Italian at the helm of the European Central Bank, has had a considerable calming effect since he took over from the Frenchman Jean-Claude Trichet. Thankfully the ECB didn’t place Supermario’s fellow countryman Francesco Schettino at the helm.

So I am ready to recommend that we deploy spare cash into the markets and I will be utilising for the first time in three years two additional constituents to the model portfolios. I will be including a European Fund, because there is now a lot of catch up potential to be had over the next couple of years. The European markets are around 20% cheaper than the UK and the US and they are now attracting the attention of larger fund managers. Secondly I will be including a Gold fund as I believe it will be a good holder of value against higher inflation in the future. Its price is still well below its peak of $1900 after it suffered a setback over the Summer. We should see the price of Gold now moving gradually up to $2000.