Our IHT Mitigation Portfolio

For individuals with an Inheritance Tax liability on their estate upon death.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Aim Portfolio | 30.29% | 2.78% | -11.76% | -30.70% | -1.61% | 2.11% |

| FTSE Aim All Share Index | 4.58% | 35.46% | -7.66% | -16.58% | -11.17% | -5.34% |

Chart Details

- Growth to our AIM managed portfolio has now added 27% to the original capital invested.

- Every £100 invested originally is now worth £127.

Our Calculations

- The Managed Portfolio returns are net of all charges. It is the actual return received by clients.

- Any Index shown is a total return including dividends. It is a hypothetical return as it is not possible to invest directly in an index. A fair comparison would deduct both a fund charge and a platform charge which would cost upwards of 1/3rd of a percent (0.33%) per annum.

Risk Warnings

It’s important to remember;

- Past performance isn’t necessarily a guide to the future.

- The value of investments can go down as well as up.

AIM Portfolio Description

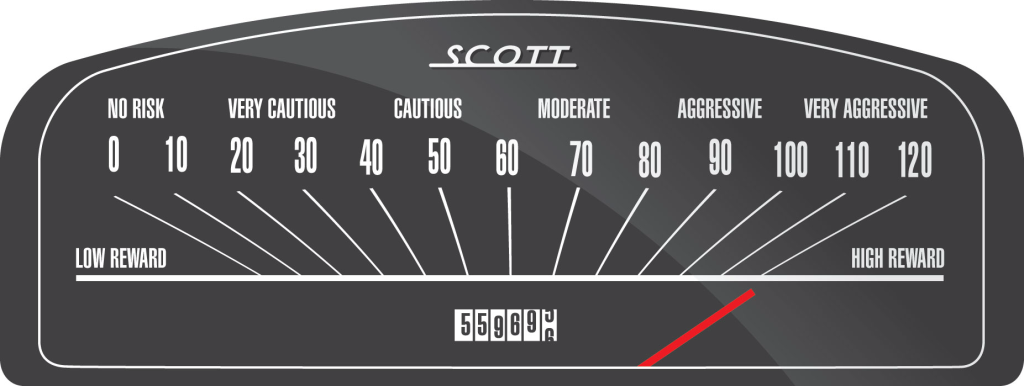

Our specialist Alternative Investment Market Managed Portfolio has the aim of reducing a client’s future estate assessable for Inheritance Tax on death. This portfolio is suitable for those client’s with a higher than average attitude to investment risk or those who simply wish to try to mitigate an impending future 40% IHT bill..

This portfolio is restricted to holding equities that qualify for business relief. It is a concentrated portfolio holding around 20 smaller UK equities, with approximately 3% held in cash.

Now read on to see whether this portfolio could be suitable.