From ChatGPT:

“The premise of Strange Case of Dr Jekyll and Mr Hyde (1886) by Robert Louis Stevenson is a psychological and moral experiment taken to its catastrophic conclusion.

Dr. Henry Jekyll, a respected London physician, becomes obsessed with the idea that human beings are not unified personalities but composites of opposing forces — broadly, civilized virtue vs. primal impulse.

He develops a chemical serum designed to separate these elements, allowing each side to exist independently.

The experiment succeeds — but asymmetrically.

The moral, socially acceptable identity remains Jekyll. The uninhibited, amoral persona emerges as Edward Hyde.

Hyde is not merely less restrained; he is concentrated malevolence, physically smaller and vaguely deformed — a suggestion that evil is both regressive and evolutionarily primitive”.

Markets are Jekyll one day, Hyde the next.

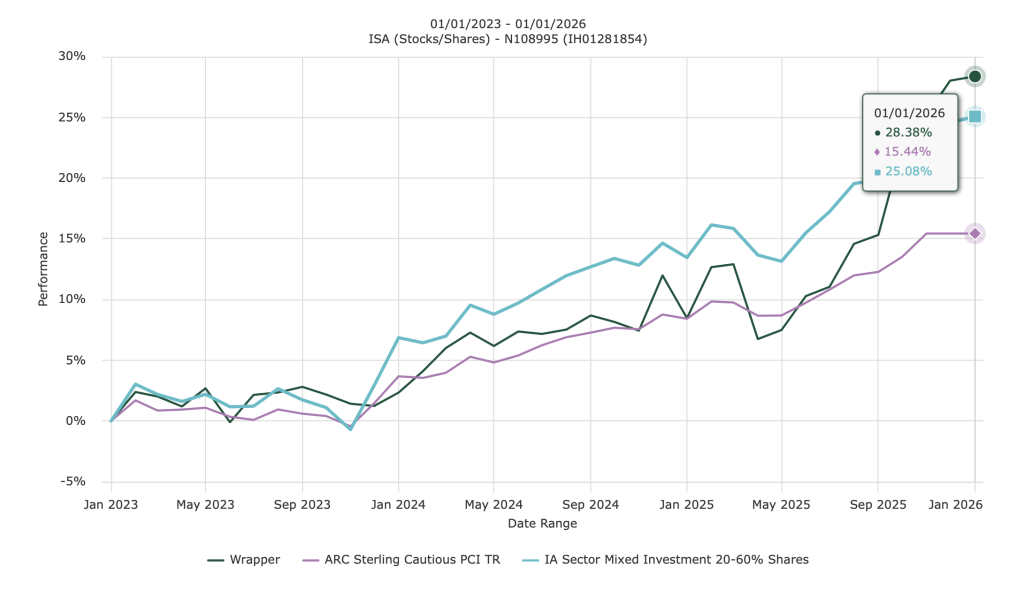

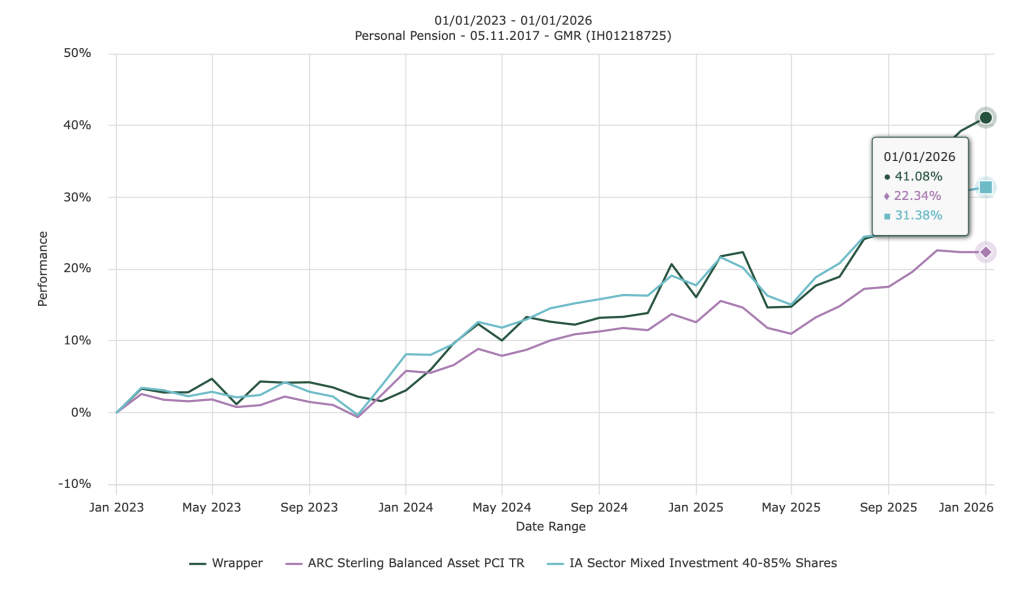

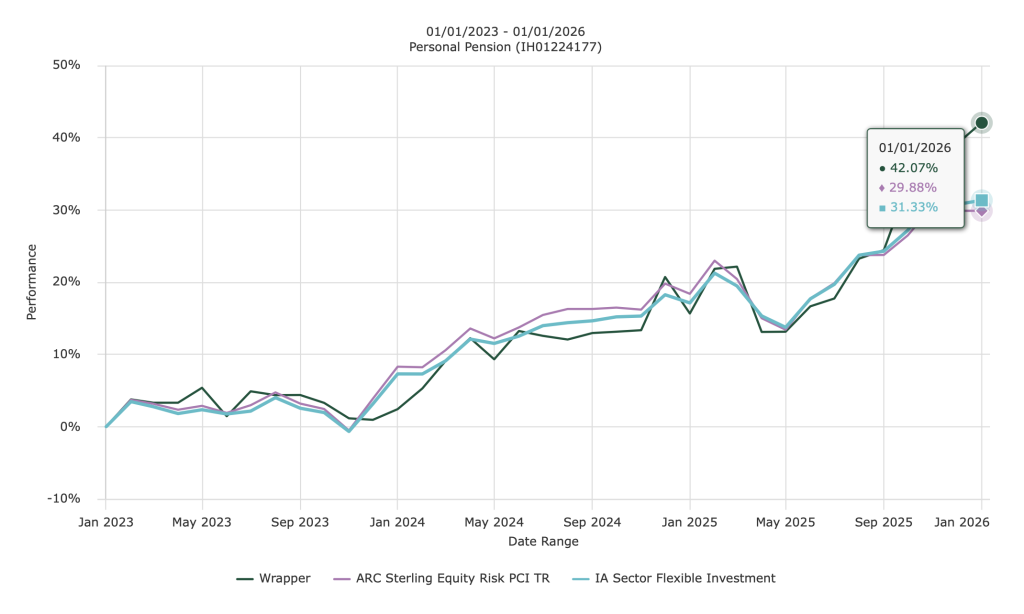

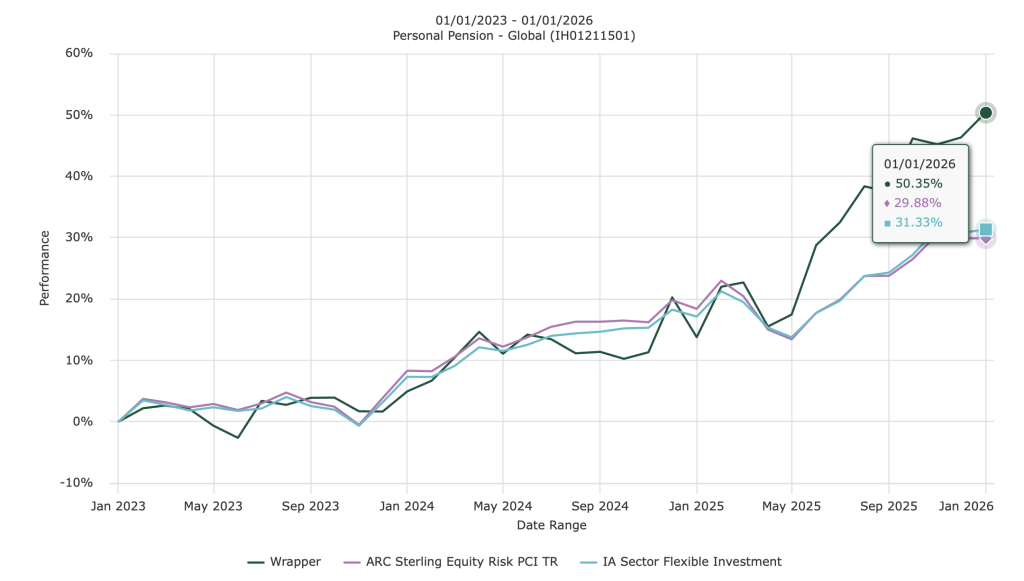

The above introduction brings me neatly to today’s blog subject. The daily rapid gyrations of our investment portfolios that we are all currently experiencing. We manage somewhere between £106 million and £113 million, seemingly dependent on what day of the week it is. These daily extremes are un-typically poles apart – like Jekyll and Hyde. Two sides of the same coin. A battle unfolding not between good investors versus evil investors, but to a great extent those invested for long term steady reward, versus those who see the markets purely in the short term. Investors versus speculators. Those of us who pick and hold long term investment opportunities and themes, against those who gamble daily on a commodity or share price. Any commodity or share price. Rising or falling in the next day, hour, minute and even second. Typically your crypto-currency speculators. In then out quickly.

Continue reading “Jekyll & Hyde”