Our longer than long term portfolio

A Portfolio for those prepared to let compounding work its long term magic.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Very Aggressive Portfolio | 48.02% | 21.10% | 9.75% | -22.36% | 5.16% | 8.43% |

Chart Description

- If you hover your cursor on your computer, or touch your smart device screen over the “4x in 10 years” line on the chart, you can see that 100% invested became 235.11% on 01/07/2021, which was just 5 years from commencement. Post Brexit, Covid & high interest rates the portfolio has remains on target.

- To remain on target, savings must double again to 400% by 01/07/2024. (100 x 2 = 200, 200 x 2 = 400).

- Growth to our Very Aggressive Managed Portfolio has now added 407% to the original capital invested.

- Every £100 invested originally is now worth £507.

Our Calculations

- The Managed Portfolio returns are net of all charges. It is the actual return received by clients.

- Any Index shown is a total return including dividends. It is a hypothetical return as it is not possible to invest directly in an index. A fair comparison would deduct both a fund charge and a platform charge which would cost upwards of 1/3rd of a percent (0.33%) per annum.

Risk Warnings

It’s important to remember;

- Past performance isn’t necessarily a guide to the future.

- The value of investments can go down as well as up.

Portfolio Description

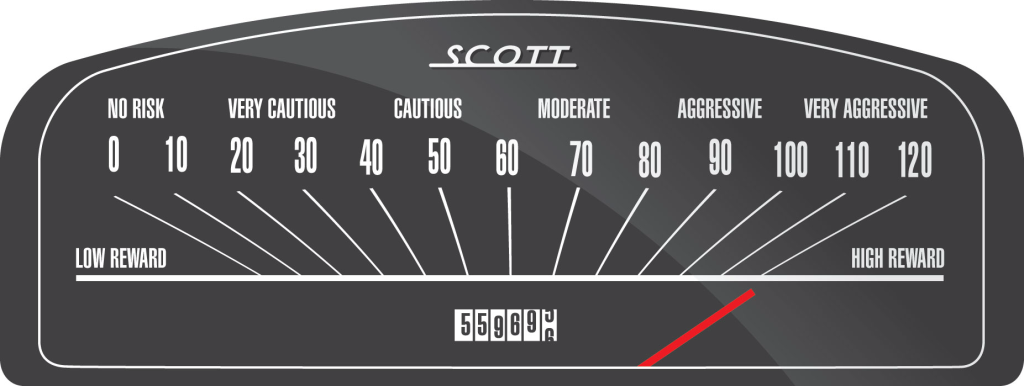

As the name suggests, this Managed Portfolio attempts to achieve very high levels of growth over the very long term. This portfolio typical holds up to 97% of assets in a concentrated number of growth equities.

Usually suitable only for a small portion of your overall savings, unless you are prepared to accept potential losses in value over multiple years in a row.

A difficult choice of portfolio to stick with when news is bad.

The goal of this portfolio is to attempt to quadruple your savings every decade.

A compound growth rate of 13.85% is required to quadruple an initial investment over a decade

Now Read on to see whether this portfolio could be suitable.