We first began moving clients from Nucleus to Transact late 2021. So we can now show our performance versus our industry peer group across our portfolios for a full standard 3 year period.

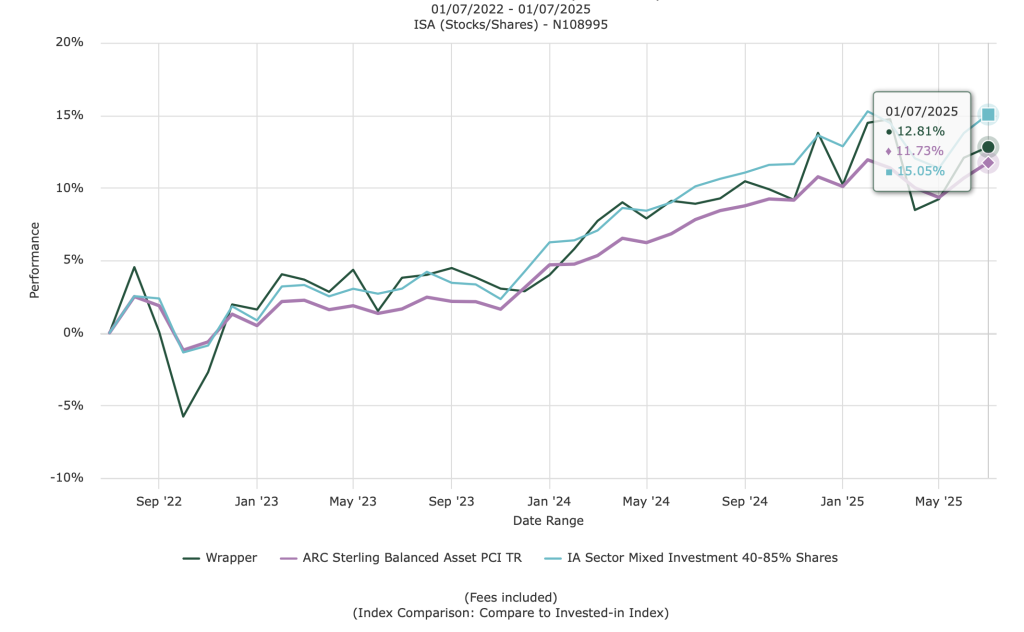

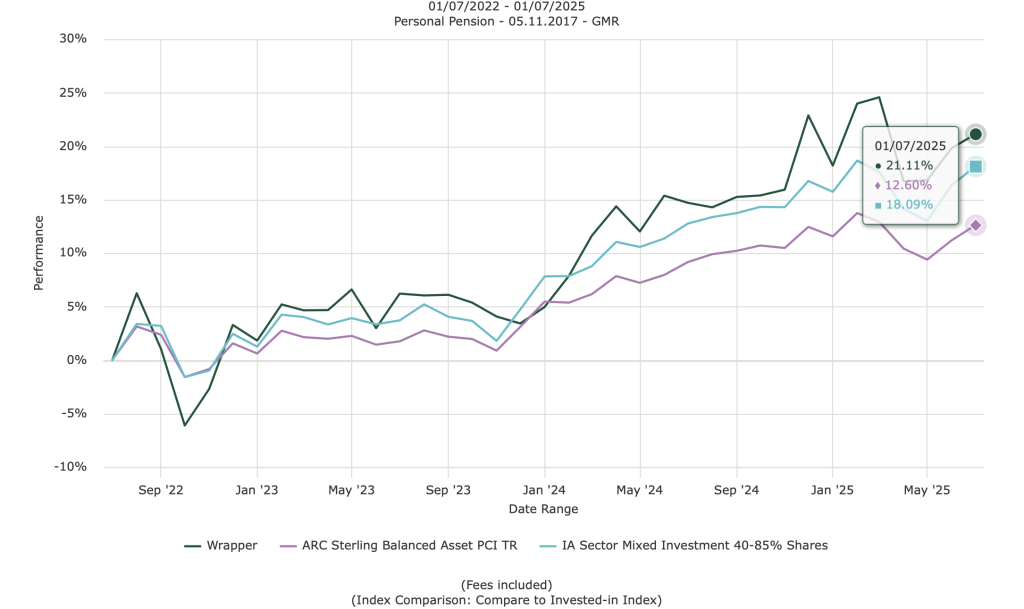

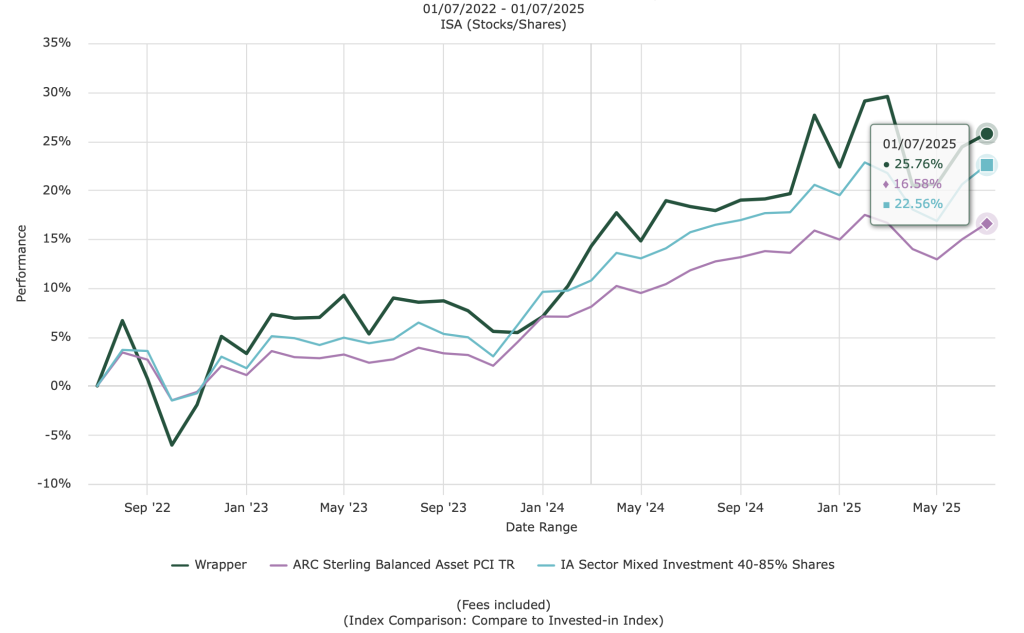

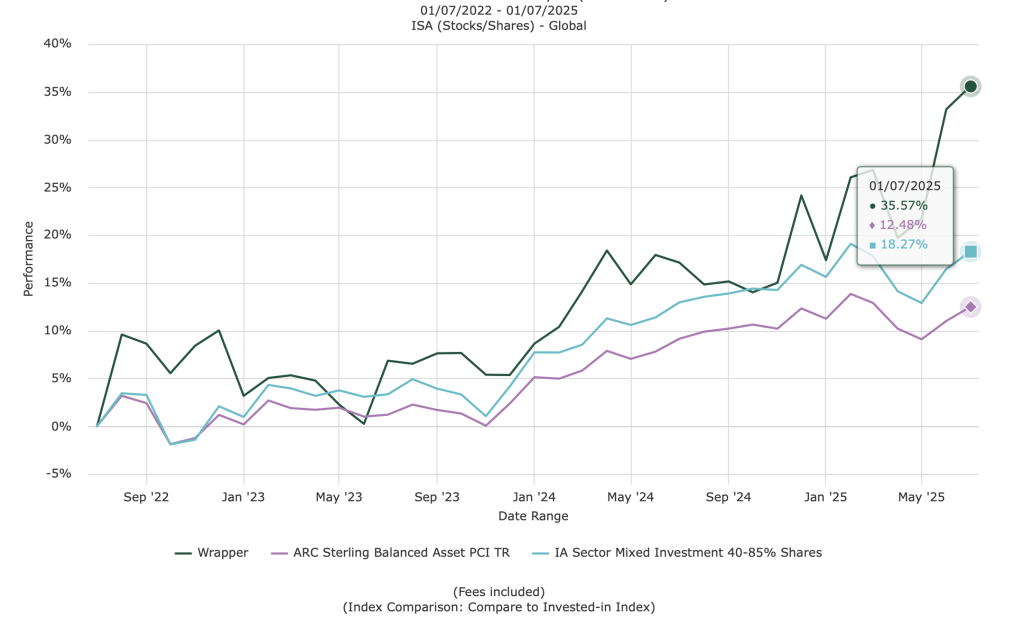

In all of the charts below, each of our managed portfolios are shown by the bold green line. Our peers performance is shown in blue and purple lines.

Our Cautious Portfolio

Our Moderate Portfolio

Our Aggressive Portfolio

Our Very Aggressive Portfolio

Each of the charts above are actual client portfolios.

We continue to out-perform our peer groups in all portfolios. Our Cautious Managed Portfolio unfortunately is not a fair comparison versus its peer group as care home fees of several thousand pounds are withdrawn each month for the client in question. This reducing balance has blunted the true performance somewhat.

Charlie and I are happy with our achievements so far. The Transact platform has given us a huge investment universe of direct equities to choose from, with very reasonable custody, currency and trading costs.

The above performance is net of our fees, trading fees and Transact fees.

We remain dedicated to looking after your, and our, life savings.

If you have any questions don’t hesitate to ask. After all, unlike your friends and acquaintances, you can talk to the investment managers who look after your savings in person.

Obviously I have to say at this point………..Past performance isn’t necessarily a guide to the future.