Happy New Year!

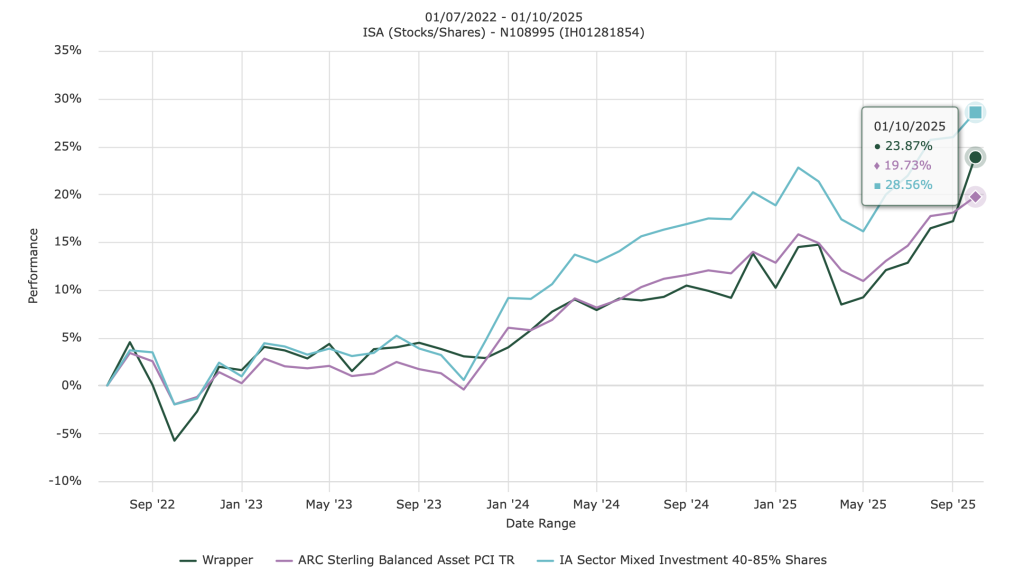

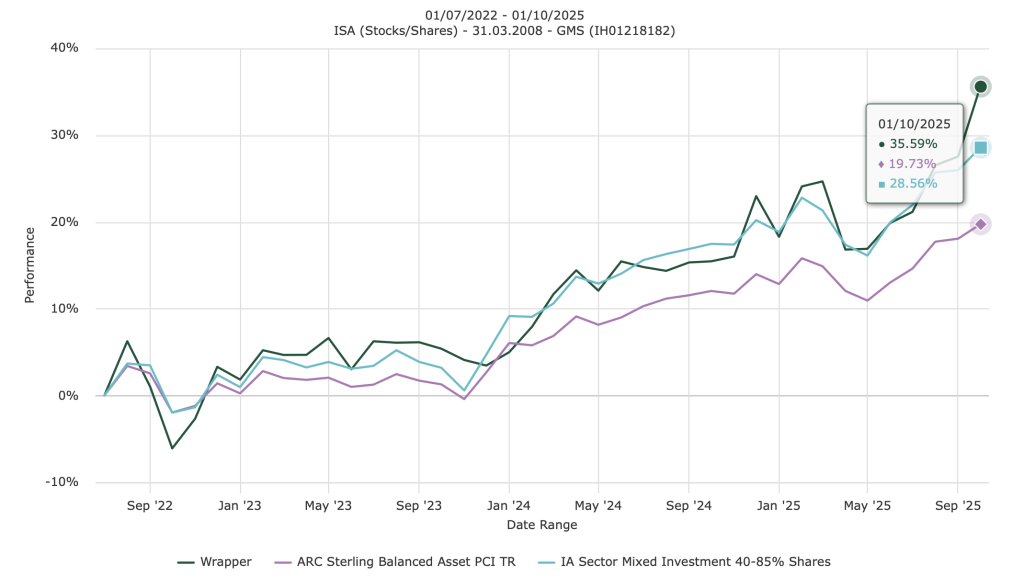

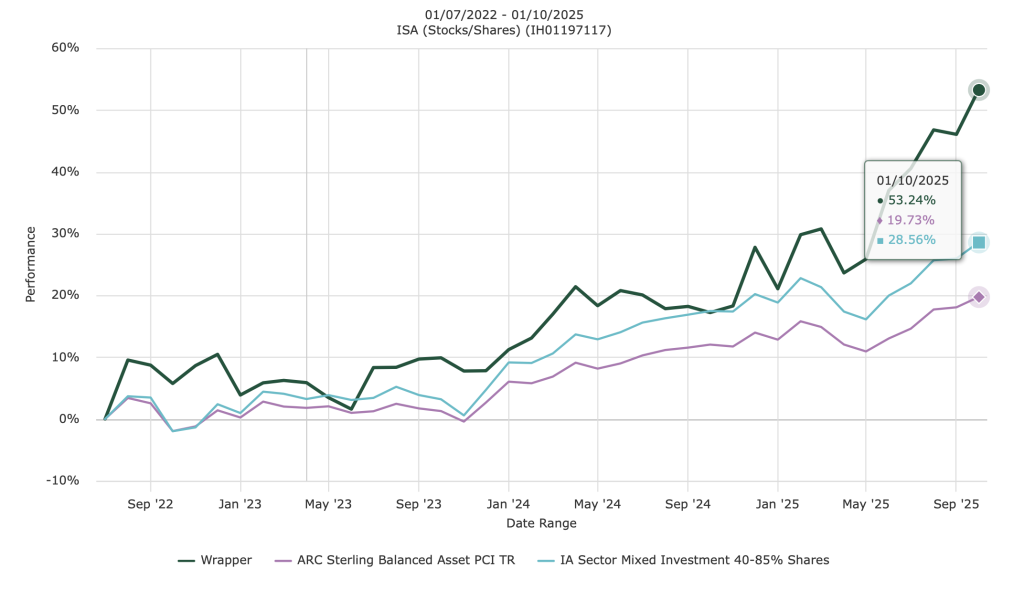

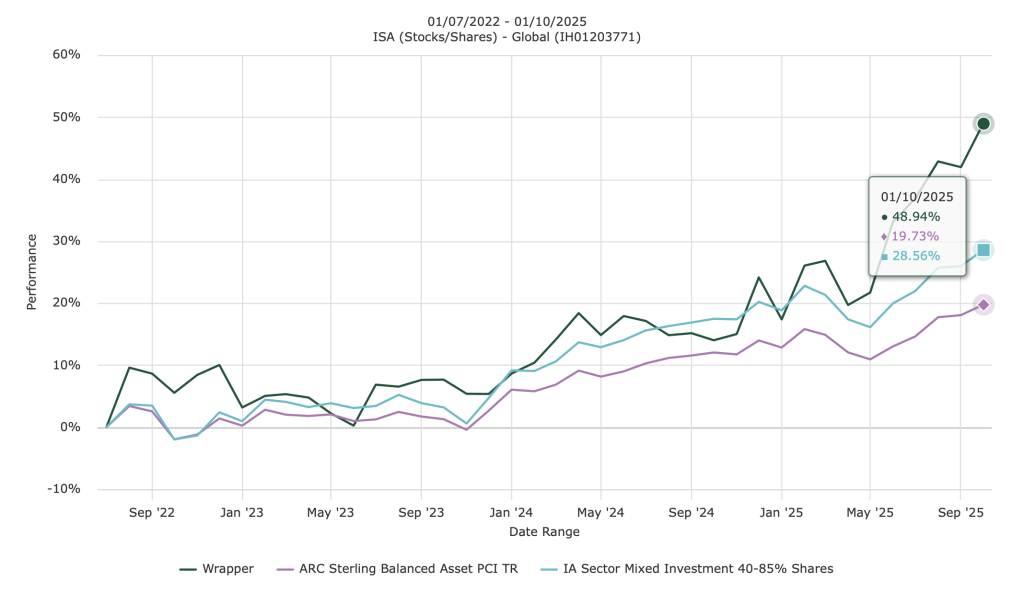

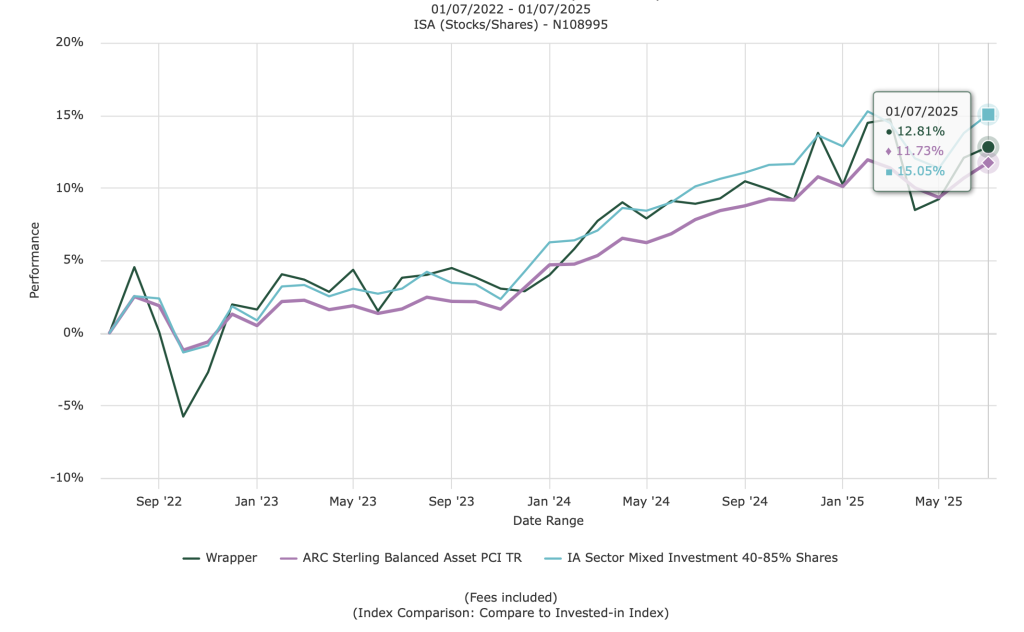

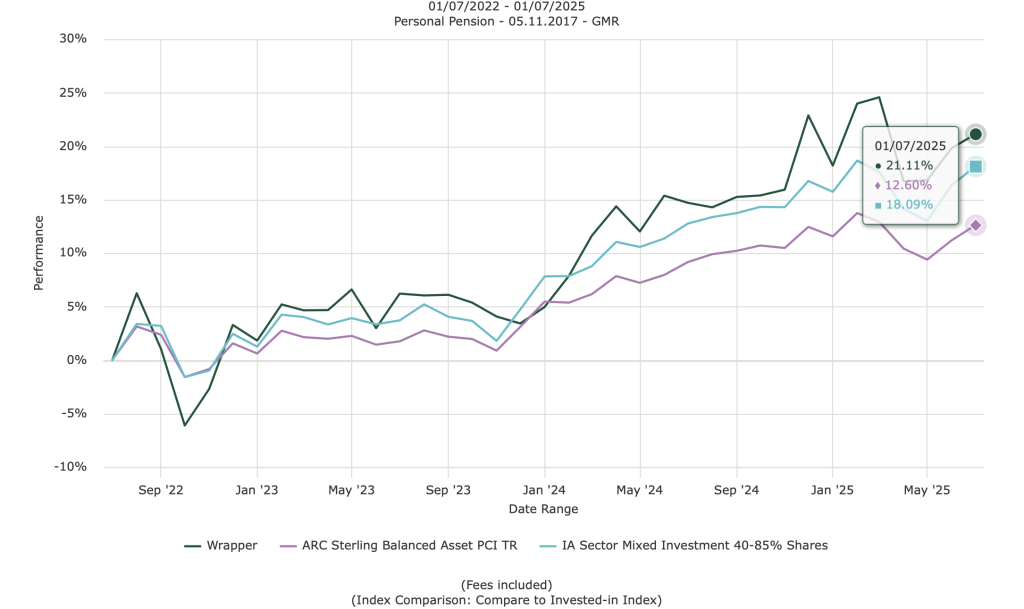

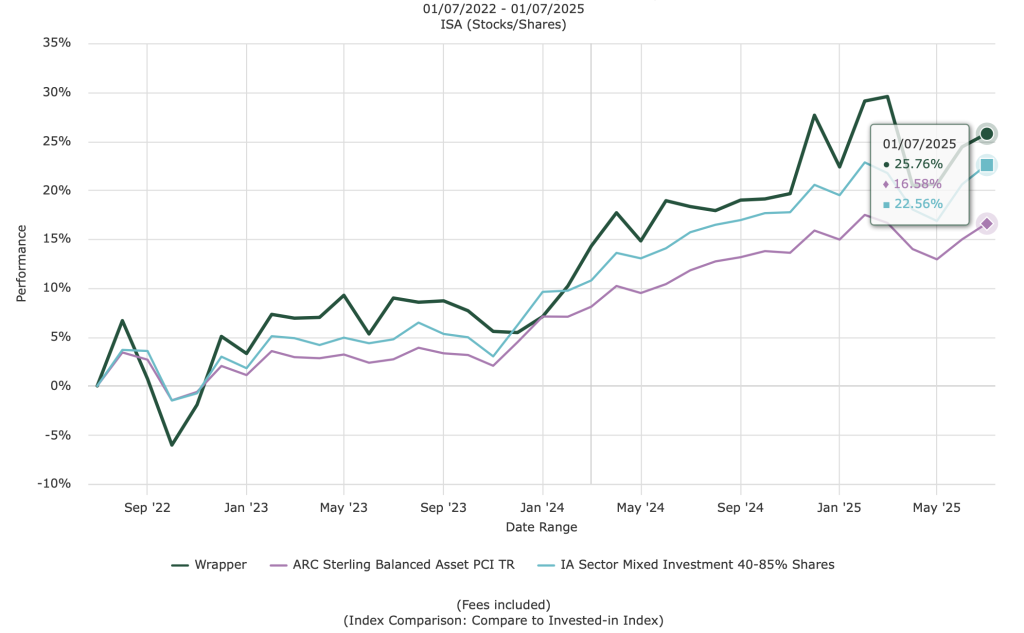

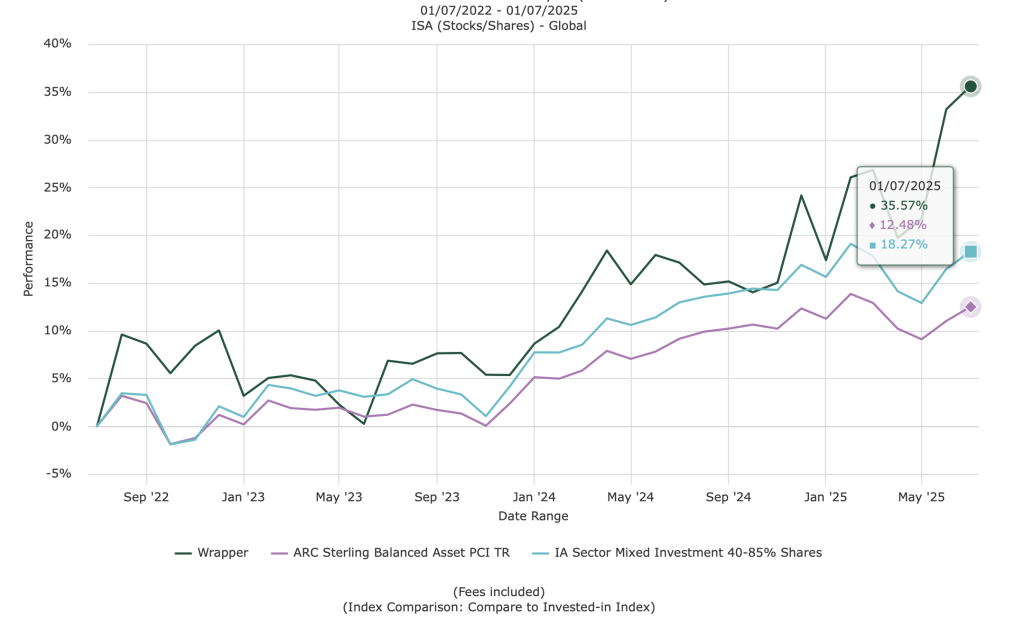

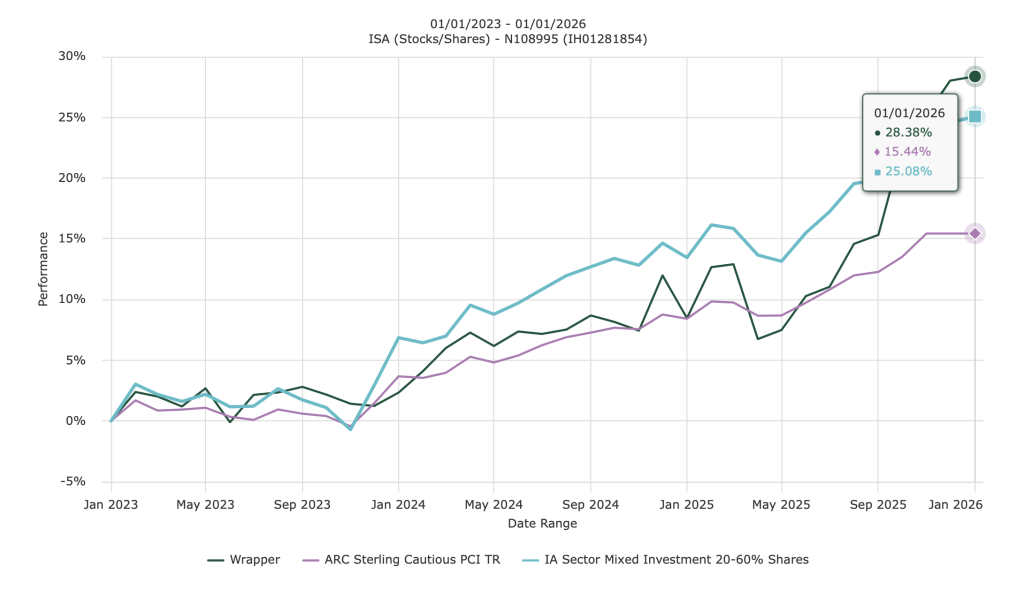

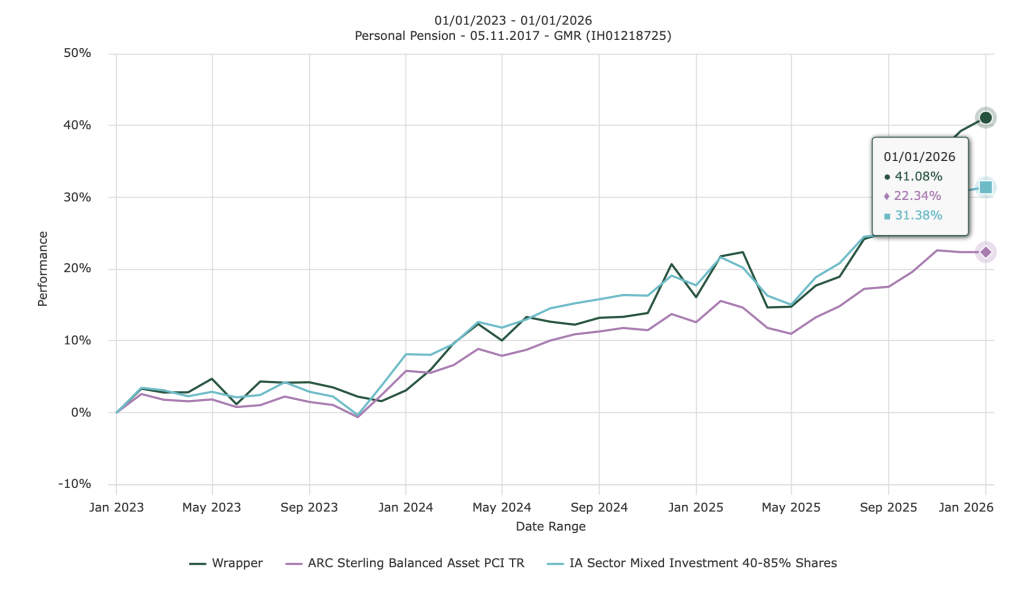

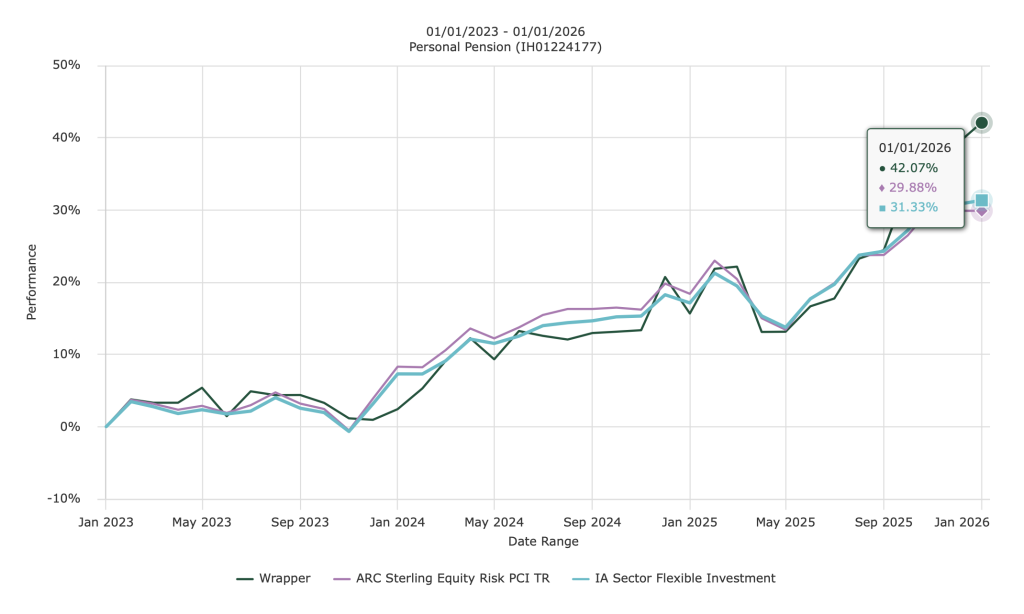

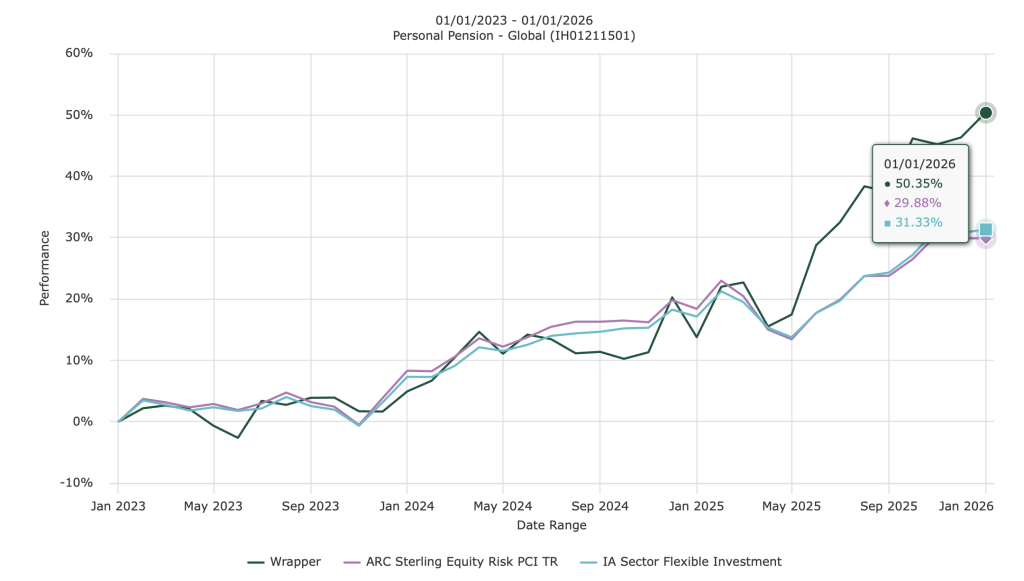

In all of the charts below, each of our managed portfolios are shown by the bold green line. Our peers performance is shown in blue and purple lines.

Performance is shown net of our fees, trading fees and Transact fees.

This quarterly review shows our performance versus our industry peer group across our portfolios for a rolling 3 year period.

Our Cautious Portfolio

Our Cautious Managed Portfolio unfortunately is not a fair comparison versus its peer group as care home fees of several thousand pounds are withdrawn each month for the client in question. This reducing balance has blunted the true performance somewhat.

Our Moderate Portfolio

Our Aggressive Portfolio

Our Very Aggressive Portfolio

Our Very Aggressive Portfolio lost a little ground versus our Aggressive Portfolio whilst we exited some speculative positions before we could buy some precious metals and miners.

Each of the charts above are actual client portfolios.

Continue reading “December 2025 Performance Review”