It’s all about the money.

Asking for financial advice is perhaps about seeking a solution to a current problem or opportunity. Perhaps you are looking to buy a house, perhaps you need insurance in case you die prematurely, suffer from a long term or critical illness which interrupts your ability to work and pay the bills. We don’t give that sort of financial advice, there are plenty other places you can seek out your own solutions.

We give advice to individuals, families, businesses and trusts that already have money. Obviously we need to be expert in all areas of Financial Planning and Taxation to give that advice, but we focus purely on your financial return.

Sure we could say we are holistic financial planners, building solutions to meet your every requirement, but we don’t. We look after your money.

Do all financial advisers not do that too?

Most financial advisors just take the easy route. They simply invest clients savings in tracker funds and automatically rebalance every quarter. Just buy, rebalance and hold. They invest your savings without taking the slightest amount of personal responsibility.

- “The market will give you the returns you need”

- “A discretionary fund manager takes care of the investment for you”

They carry no personal reputational risk when stock markets, the value of commercial property or fixed interest investments fall. It isn’t their fault if funds fail or become closed to redemptions.

No attempt is made to try to “beat” the market, because “evidence” dictates it is impossible to do so. Many haven’t even read the evidence, they just do what everyone else does. Exactly what the large banks and financial institutions, with their heavy vested interest, tell financial advisers to do. They say it’s impossible to beat the index over the long term, so don’t even try. However a tracker fund is always doomed to be below average. A tracker fund can never actually give a return equal the index, they may seem infinitesimally small, but those annual fund charges ensure you can never receive the full market return. Then there is tracking error, the failure of a tracker to do what it says it can do on the tin. This error, read tracking failure, will take returns further below the index. The tracker funds to avoid are those who look like they equal and occasionally beat their indices. It is impossible unless they are lending the shares you own to others and receiving a benefit. Legal financial witchcraft.

Indices

The trouble with indices is which one to choose? There are so many that in the US there are more indices than individual shares. How is that even possible?

40% of the value of the Nasdaq index in the US is in just 8 shares. 25% of the S&P 500 index is in just 5 shares. (There are 500 shares in the index, but you probably guessed that)

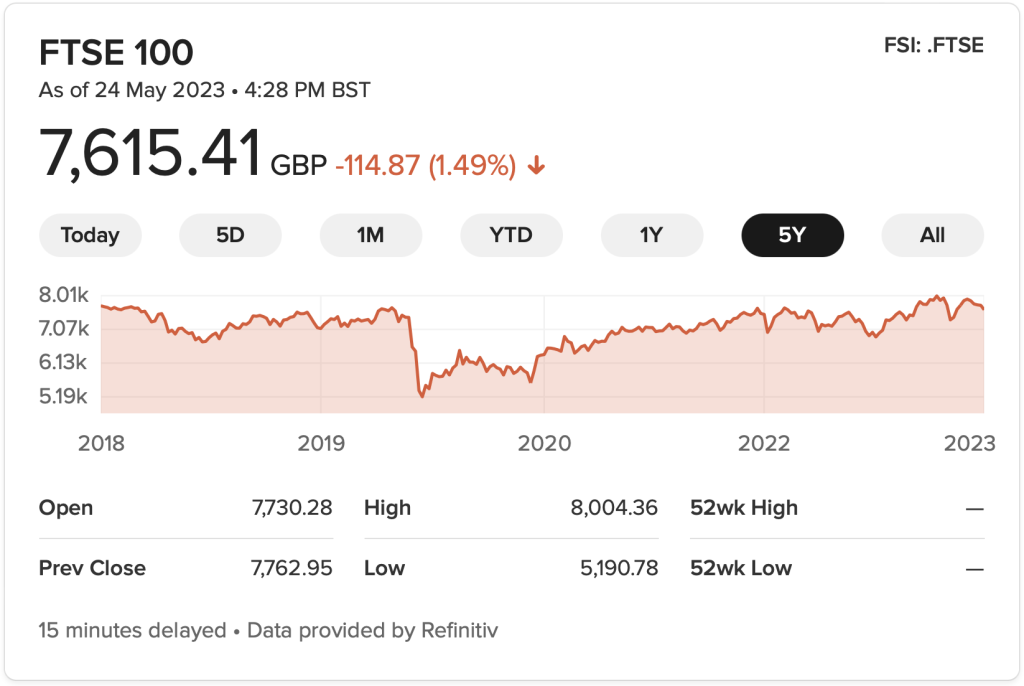

In the UK 15 shares within the FTSE 100 make up over 50% of its value. And the FTSE 100 Index has gone nowhere for over 5 years. It’s only been a 3 or 4% dividend income that has given a return. A return that then gets reduced by charges and then gets taxed. Check out the chart above.

Why pay to own a fund of all of the shares when your exposure to the vast majority is next to nothing?

Diversification

In 1952 Harry Markowitz, Nobel Prize winning economist, described diversification as the only ‘free lunch’ when seeking investment returns. The idea that if you hold a combination of US shares, US government gilts and US commercial property, then returns will be smoother over time and not significantly lower than just holding shares alone. The theory has been manipulated over time to include holding foreign shares, emerging market shares, frontier market shares, private equity, venture capital, gold, silver, platinum, palladium, oil, diamonds, teak forests, etc. In fact just about all the complex, dodgy and just plain daft investment ideas today are pushed by salesmen to financial advisers quoting the above theory. “Thou must diversify, so buy our **** fund”.

1952-2020 The theory is 68 years old and counting

Is it time to allow this almost 70 year old theory to retire? Today, how can you safely diversify into shares, gilts and property?

Shares. We can invest in some of these. Fine.

Gilts. The yield (interest rate) the UK Government paid on its 15 year debt was steady at between 4-5% per year between 1998 and 2008. Prior to 1998 it was higher still. It now lies continually around a measly 1% per annum. It has threatened to turn negative too like Germany & Japan. So today we can lend the UK Government our hard earned cash for 15 years and get about 1% per year in return. With all that extra Covid-19 debt, the risks of default must have increased. What’s the point in taking a risk without a return? No thanks. This isn’t diversification; it’s an invitation to lose some money after inflation is taken into account.

Commercial Property. We saw the first headless chicken panic set in within Commercial Property funds worth £billions, back in 2008. Then again in 2016 and again in 2019. Covid locked up commercial property funds again and has threatened the very basis of ever investing in the property sectors of office space (wrecked by “work from home”) and retail space (wrecked by the growth of on-line shopping). ever again.

Those panics necessitated fund after fund declining requests from investors who wanted their money back. Frankly rubbing shoulders with investors who panic on an ever increasing basis, causing funds to close to redemptions is not a place I want to put my money. We got out of our property funds unscathed twice, because the first Rule of Panic is, never panic. The second more important rule is, if you must panic then panic early. We last invested in commercial property funds in 2014 and we are not going back in there.

Gold. Gold never featured in the 1952 research. It has found its way into portfolios today because it’s price usually goes North when the price of shares go South. It hasn’t always been that way. I can’t decide whether speculating on the future price of gold is the safest investment to make, or the daftest. It reminds me of the “bigger fool” theory. “If I speculate on the price of gold today, then I will need to find a bigger fool to buy my bet off me in the future”. And let’s get this straight, we pay to dig the stuff up and then we pay to put it back underground to keep it safe? Sounds mad as a concept.

Industrial metals have consistently out-performed gold over the last decade and look set to continue that run with the global uptake or renewable energy.

Crypto-Currencies & Non-Fungible Tokens. This isn’t long term investment it is short term gambling. It’s just not what we do.

It’s been hard to diversify away from shares and cash since 2015.

Around here however we don’t look backward for very long. We keep moving forward. Opening new doors and doing new things. .

Walt Disney

So here is how we have invested since 2016.

Change is constant. Our business obtained its discretionary permissions from the FCA in 2012, allowing us to turbo-charge the investment decisions we made for all of our clients. We never needed to outsource our investment decisions to a discretionary manager, because we became a discretionary manager ourselves.

Since October 2012 we could buy or sell investments across all of our clients efficiently, but we continued to predominately use packaged funds alone until 2016. These conveniently packaged funds did however have an annual cost which I was anxious to avoid. They were still too opaque for my liking. There was just so much legislation governing funds to ensure clients got a fair return for the investment risk they were taking. Obviously the reams of legislation were needed

Why spend 1/2% each year to hold a fund that contains a selection of UK shares, when together we could just buy those same shares directly and save that 1/2% per year? 2016 welcomed in the next chapter. We took our investment proposition one step further and cut out the UK fund middlemen. We could do just that, because at that time, we held £60 million between us .

The first change become increasingly obvious to everyone as we gradually replaced 5 or 6 funds with 50 or 60 individual holdings. The second change became more obvious over a longer period of time. Increased growth brought about by lower ongoing costs over the long term. Holding shares directly – you can’t get cheaper than free.

There isn’t much that we can control when it comes to investment, but controlling our costs ultimately leads to better long term performance.

Nobody famous, just common sense

Reject, don’t Select

We don’t try to beat anything. We initially reject the asset types which offer no return and no diversification value. We reject those international markets that cannot guarantee a return of our money in the future – like China & Russia. We reject those shares we don’t wish to hold, like those businesses who have a business model that has been usurped by new technology. Like those that refuse to adapt. Like those who are in a contracting sector like coal mining & oil exploration and refining. The list is huge.

Why invest in sectors that the smart money avoids? Why invest in sectors that huge amounts of ESG investment refuses to touch? Who are you going to sell those Shell shares to in 2030?

Our managed portfolios can be held within ISAs, General Accounts, Pension Accounts and Drawdown Accounts.

Financial Planning

As you would expect we are Chartered Financial Planners, Certified Financial Planners and Chartered Wealth Managers. We hold the highest qualifications in the profession. Sure we offer a six stage bespoke process, discovering your needs etc.

But seriously what point is a 5 star plan coupled with below par investment returns. You may plan a world cruise for your 65th, but the plan alone doesn’t pay for it.

Value

Despite our increased workload to achieve all of this, we offer two jobs for the price of one. Our combined annual financial planning fees and investment management fees are just 1% per annum of the assets we manage for you. 200 families with over £100 million between them agree with our investment philosophy and the value for money that we offer.

Go your own way.

If you believe all investors should not all be on the same side of the boat, contact us.