A Happy New Year to all of our clients. We hope 2025 brings you all that you wish for. Here’s how each of our managed portfolios performed against our industry benchmarks over the last 12 months. I’m happy to say we beat all of our industry benchmarks once again.

H.J.Scott & Co. Cautious Portfolio versus Benchmarks

| Portfolio | 12 month Performance |

| H.J.Scott & Co Cautious Portfolio | 7.98% |

| ARC Sterling Cautious PCI TR | 4.37% |

| IA Sector Mixed Investment 20-60% Shares | 7.81% |

“Very few clients are invested in our Cautious Portfolio. Trying to remain cautious in such a challenging investment environment, whilst giving a meaningful return over simply holding cash, remains a difficult proposition. I’m pleased to say we have beaten both our industry benchmarks (only just) and a cash only return too.”

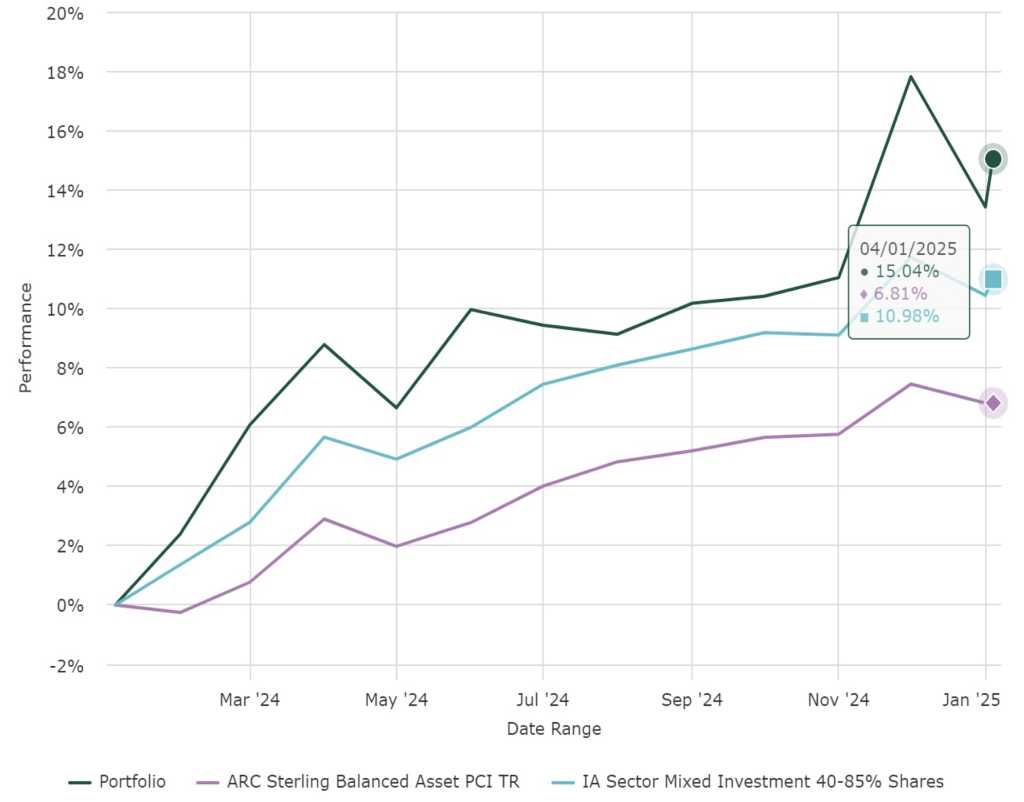

H.J.Scott & Co. Moderate Portfolio versus Benchmarks

| Portfolio | 12 month Performance |

| H.J.Scott & Co Moderate Portfolio | 15.04% |

| ARC Sterling Balanced Asset PCI TR | 6.81% |

| IA Sector Mixed Investment 40-85% Shares | 10.98% |

“Our Moderate Portfolio is suitable for most of our clients and holds around 70% of the assets we manage. We have managed to beat our industry benchmarks meaningfully this year by, I’m sorry to say, mostly forgoing investment in UK shares. The FTSE 100 ended the year only 6.5% higher than it started and is lower now than when Sir Kier Starmer came to power. Our decision to move investment platforms from Nucleus to Transact in early 2021 continues to give us direct international investment opportunities.”

H.J.Scott & Co. Aggressive Portfolio versus Benchmarks

| Portfolio | 12 month Performance |

| H.J.Scott & Co Aggressive Portfolio | 15.94% |

| ARC Sterling Equity Risk PCI TR | 9.80% |

| IA Sector Flexible Investment | 11.25% |

“Our Aggressive Portfolio narrowly bettered our Moderate Portfolio. but as you can see from the benchmark comparisons, many managers avoided taking much more investment risk also (IA Sector Flexible Investment up to 95% shares returned 11.25% versus IA Sector Mixed Investment 40 – 85% shares returned 10.98%). Still for a client with a suitable attitude to risk, 15.94% is none too shabby. The 15.04% return for a client with a moderate attitude to risk is the outlier this year.”

H.J.Scott & Co. Very Aggressive Portfolio versus Benchmarks

| Portfolio | 12 month Performance |

| H.J.Scott & Co Very Aggressive Portfolio | 11.43% |

| ARC Sterling Equity Risk PCI TR | 9.80% |

| IA Sector Flexible Investment | 12.25% |

“With the Very Aggressive investment mandate I am encouraged to continue to take a high level of investment risk. For much of the 2nd half of the year, investors were not rewarded for taking higher risks. Then came Trump’s win which changed the markets from a risk off environment to a risk on bonanza. A significant setback followed with a bearish comment from Jerome Powell in the US, suggesting there would be far fewer reductions next year to the US interest rate. The markets have since digested this set-back and seem to be ready for the next leg higher.”

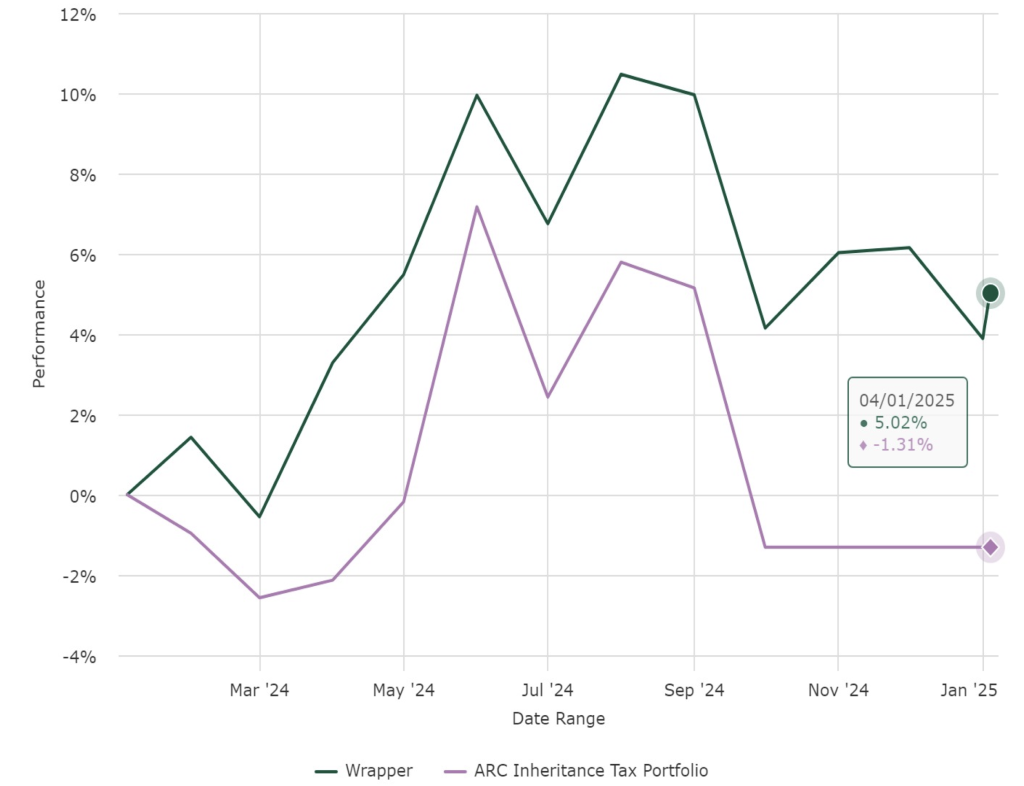

H.J.Scott & Co. AIM Portfolio versus Benchmark

| Portfolio | 12 month Performance |

| H.J.Scott & Co Aim Portfolio | 5.02% |

| ARC Inheritance Tax Portfolio | -1.31% |

“Our AIM portfolio by definition has to be invested in the UK, which has underperformed the US for many years. Worse still, the tax benefit obtained from holding this portfolio at death, of the reduction of one’s beneficiaries Inheritance Tax bill, has been slashed in half by this aggressive Labour administration. Whilst we once again meaningfully beat our industry benchmark, we will need to consider whether holding an AIM portfolio in the future remains worthwhile.”

The Charts

If you would like to see how your individual portfolios performed taking into account your individual top-ups and withdrawals, you can do so on the Transact Platform. Simply login to the desktop site and the select the following.

From the first Dashboard page click View detailed chart

Have a play! Here’s to a prosperous 2025!

And Finally…….

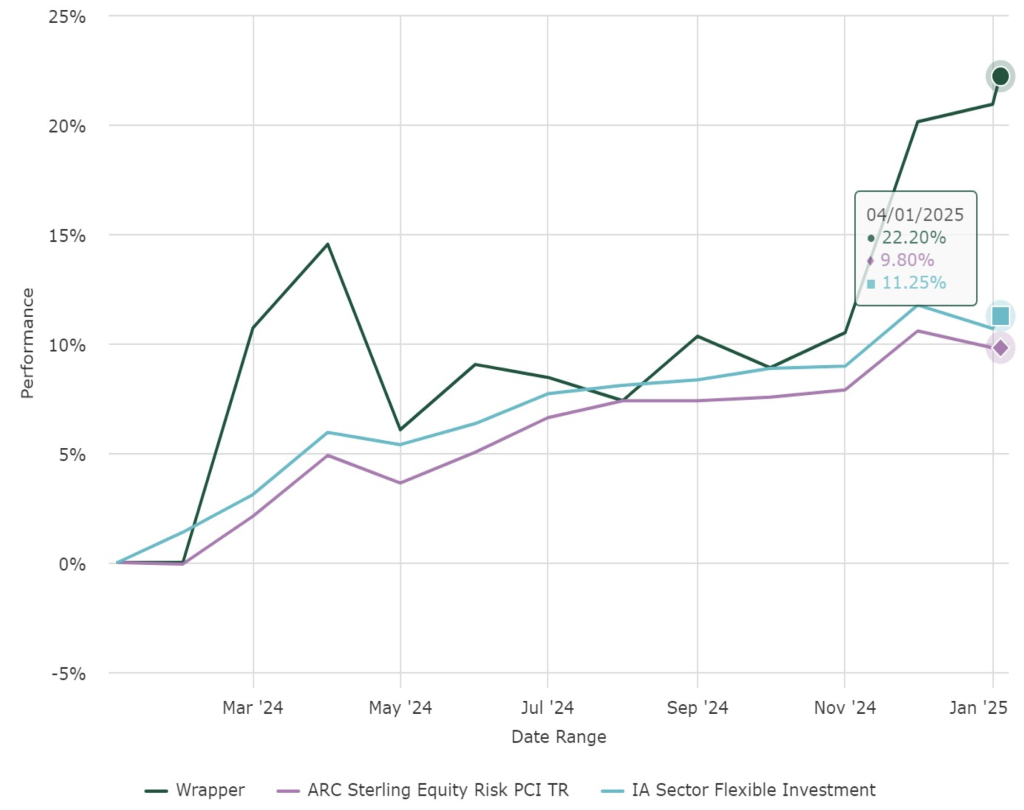

H.J.Scott & Co. “Charlie’s Choices” Portfolio versus Benchmarks

| Portfolio | 12 month Performance |

| H.J.Scott & Co “Charlie’s Choices” Portfolio | 22.20% |

| ARC Sterling Equity Risk PCI TR | 9.80% |

| IA Sector Flexible Investment | 11.25% |

“I’m proud, but also a little embarrassed to admit, that our top performing portfolio of the year was a shadow portfolio run by Charlotte alone. Beginners luck? A woman’s intuition? Call it what you want, but I guess we all wish our assets were invested there last year and captured that 22.2% growth. Her input has lead to several shares being added across our main portfolios. Go girl”

Nearly forgot….

Past performance isn’t necessarily a guide to the future.

Capital at risk.

Your capital and the income derived from it can go down as well as up.

Well done Charlie, good to know that when your old man retires the business is in safe hands.

Hi Dek

No sign of retirement yet. I’m just entering my 38th year and almost got the hang of it. Buffett will be doing it till he drops. Munger was 3 months off 100 when he dropped! Got to keep the grey matter engaged. Perhaps I’ll beat her this year.

Excellent performance in troubled times.

Keep it up Charlie the old man needs keeping on his toes.

Happy New Year to you all.

Peter and Janet Root

Happy New Year to everyone. Nice to see the competitiveness you’ve fostered with Charlie. Great research and decision making throughout 2024.

Happy New Year to all at HJScott from Jill and Peter.

Great performance Howard, in 2024, in very difficult conditions.Leaning to the US was inspired and shows excellent foresight and painstakingly accurate research. Thank you.

Well done to Charlie, that was a great performance to be proud of, you’re setting the bar very high for yourself. Congratulations!

Peter