We first began moving clients from Nucleus to Transact late 2021. This quarterly review shows our performance versus our industry peer group across our portfolios for a little over a 3 year period. 13 quarters so far.

In all of the charts below, each of our managed portfolios are shown by the bold green line. Our peers performance is shown in blue and purple lines.

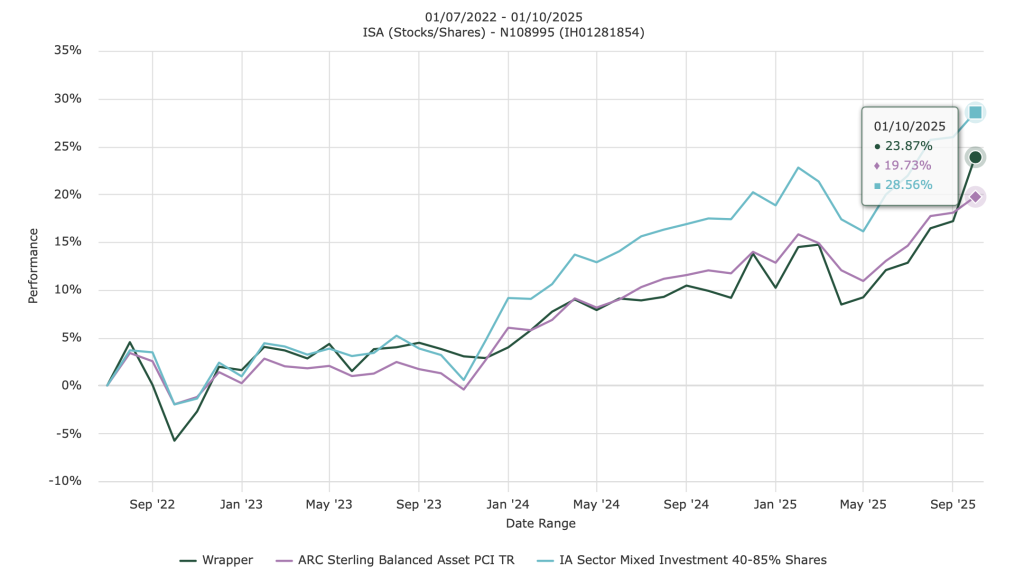

Our Cautious Portfolio

Our Cautious Managed Portfolio unfortunately is not a fair comparison versus its peer group as care home fees of several thousand pounds are withdrawn each month for the client in question. This reducing balance has blunted the true performance somewhat.

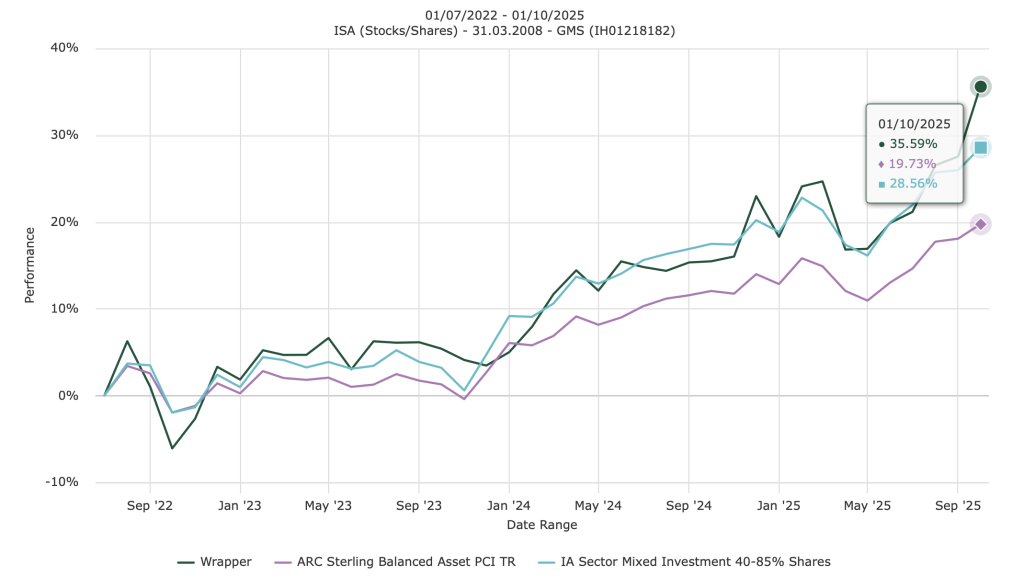

Our Moderate Portfolio

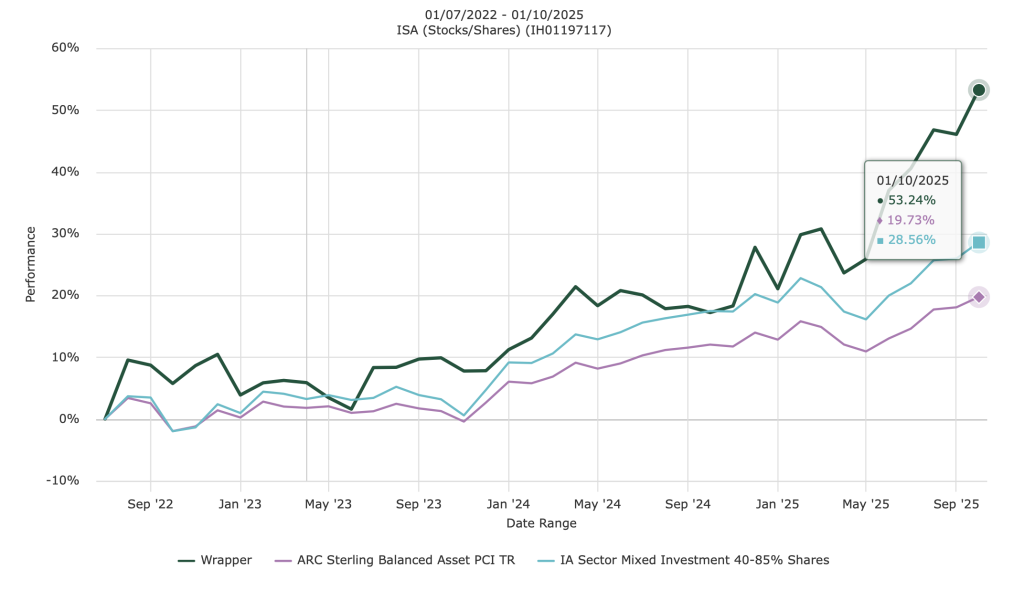

Our Aggressive Portfolio

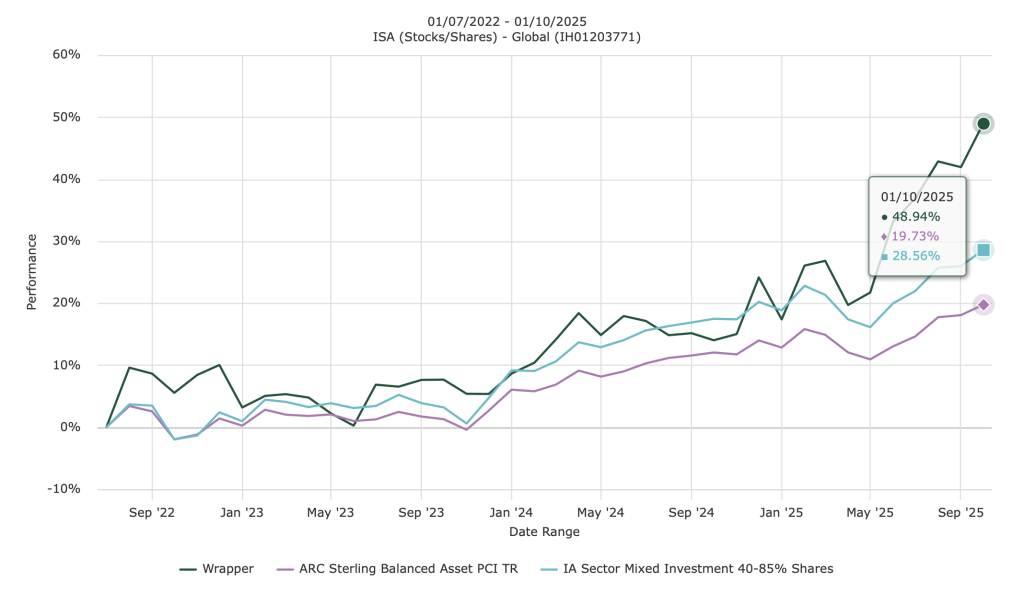

Our Very Aggressive Portfolio

Each of the charts above are actual client portfolios.

Our Very Aggressive Portfolio lost a little ground versus our Aggressive Portfolio whilst we exited some speculative positions before we could buy some precious metals and miners.

Commentary

We continue to out-perform our peer groups in all portfolios.

Charlie and I are happy with our achievements so far. The Transact platform has given us a huge investment universe of direct equities to choose from, with very reasonable custody, currency and trading costs.

This quarter once again the performance has come from owning defence shares, due to global conflicts and the increasingly poor security outlook and mid-sized US shares. There is undoubtedly an appetite in the US to favour smaller shares, hardly small at between $2 to $10 billion, over companies valued in their $ trillions. We hope to introduce several more smaller shares over the next quarter.

Undoubtedly an influential factor in our performance over the last quarter has come from the education we receive from our US analyst Eoin.

The Commodity Super cycle.

15 years ago I was selecting funds for clients back when the previous commodity super cycle peaked. However by the time the fund managers hit the road peddling commodity funds to advisers with their stories of outstanding performance, the game was already up. Many advisers allocated too late and got burned, suffering double digit losses. I’m no longer being nudged into where we should invest.

We introduced The Royal Mint Responsibly Sourced Physical Gold fund into the portfolios almost 12 months ago, which has so far provided 26% growth. Eoin pointed out the value of gold moves first, then the companies who make the gold (the miners) jump because excavation costs remain the same but the selling price has now grown higher. Thus boosting profits and driving up the share price. We introduced a gold miner Newmont Corporation around the same time. We bought early and we bought cheaply. So far Newmont has provided 52% growth.

Finally Eoin explained that the price differential in the value of gold to other precious metals, namely silver, platinum & palladium will eventually close. Gold shot up 100 times the price of silver; silver therefore had to follow. We found it impossible to find an investment opportunity that held physical silver cleanly and cheaply, so we jumped a step and invested in a silver miner. First Majestic Silver Corp entered the portfolios only a month ago, but so far has added 26%. Around 20% of our Moderate portfolio is held in physical metals and miners. To maintain balance we cannot go further and must reduce in the future as we rebalance. This super cycle still has strong legs to run with for as long as there is political instability on the planet. Thankfully this cycle I’m not late to the party

Eoin has been an analyst we have followed for almost 2 decades. We began working with him much more closely 2 years ago. His market history knowledge is phenomenal and it’s great for a small UK investment manager like us to have boots on the ground in Dallas, Texas.

The above performance is net of our fees, trading fees and Transact fees.

We remain dedicated to looking after your, and our, life savings.

If you have any questions don’t hesitate to ask. After all, unlike your friends and acquaintances, you can talk to the investment managers who look after your savings in person. If you would like to understand more about how we manage investments you can read it here.

Obviously I have to say at this point………..Past performance isn’t necessarily a guide to the future.

Brilliant! Thanks Howard, Charlotte and the team.

Hi Howard and team,

Great results and well done!

I recently read in various places that the likes of Soros and Buffet have been selling US shares at furious rate (one such article below). Is this something we should be worried about ?

https://www.saferetirementstrategies.org/billionaires-dumping-stocks-economist-knows-why.html#:~:text=Despite%20the%206.5%25%20stock%20market,shares%20at%20an%20alarming%20rate.

Hi Chris

Thanks for the link. I thought all of our clients would benefit from my reply so I’ve launched a new blog post. I hope it answers your question. On a quick read through the article it looks like the author sells annuities so he is hoping to benefit financially from his theory. To me it seems Warren Buffett was simply profit taking. Soros is under attack from Trump – probably doesn’t want his US assets sequestrated? Who knows. Let’s have a chat if you feel you would like to lower your investment risk for now.

Thanks for answering in the separate post, Howard. Much appreciated.