We have all experienced some astonishing increases in investment value recently. Instead of accepting our good fortune as long overdue, several clients have become anxious. Worried that from here our portfolios will now go down. That feeling of loss is natural and has kept us safe over millennia. Primitive man who always expected a sabre tooth tiger could be hiding behind the rock survived. Those with no fear were eaten for breakfast.

Market Timing

It would be wonderful if we knew when to tap the brakes just before the crazy driver pulls out right in front of us. Unfortunately nobody possesses a crystal ball. Whoever says they know the market is about to crash is a liar. Please don’t listen to them. Nobody knows for certain when the next drop will occur. We can theorise, join a series of dots and create a credible story. But let’s remember, it’s just a story. One of 1000 possible outcomes. Timing the market is impossible.

Unfortunately we have many setbacks we need to accept over our investing lifetimes. Our perseverance in the bad times allow us to stay the distance and benefit from these better times.

Bubbles

I’m pretty convinced Nvidia is a problem. A bubble. A company cannot be bigger than all of its customers and still grow. Without the promise of continued growth, the share price must fall and dramatically so. Recently Nvidia has engaged in a circular arrangement with a customer. Imagine I walked into a Rolls Royce dealership and said I fancy that car, (I don’t, it’s just an example) but I don’t have the money to pay for it. Would I expect Rolls Royce to say “that’s OK Rolls Royce will lend you the money if you take our car”? No. Have they made a car sale? No. They have given me the car, especially if I can’t afford to pay them back. What could possibly go wrong?

Nice analogy but am I just bitter because I sold Nvidia for us all too early. We made 18% in a short period of time but could have made much more if we would have still owned Nvidia shares today. From my standpoint I probably don’t like admitting I was wrong so I’m calling it a bubble. I’m convinced it will end in tears. On 4 prior occasions Nvidia shares have lost over 50% of their value. I’ve passed on the opportunity – it’s a bubble waiting to go pop.

“There’s a bubble in AI!” – Probably said by any man who has never benefitted from the growth in Nvidia.

“There’s a bubble in Crypto!” – Only said by those who don’t own any Crypto. Oh and regulators who don’t allow us to discuss it.

“There’s a bubble in stock markets!” – Never ever said by those who over the years have benefited from the long term excess performance of shares over bonds, cash, commercial property, gold – you name it. “Bubble” only said by those who missed out on the gains.

Investors endure the ups and downs even after the numerous car crashes that sideswipe us along the way. Such as;

- The Great Financial Crisis of 2009

- The insolvency of Greece and the close to collapse of the Euro – twice

- Brexit 2016

- Covid 2019

- Post Covid supply chain issues 2021

- Rampant inflation 2022

- The dramatic increase in interest rates 2022

- The invasion of Ukraine 2022

- October 7th pogrom and Israel – Iran war 2023

- Trump’s Tariffs 2025

I could go on, but you get the picture. It hasn’t been easy over the last 15 or so years.

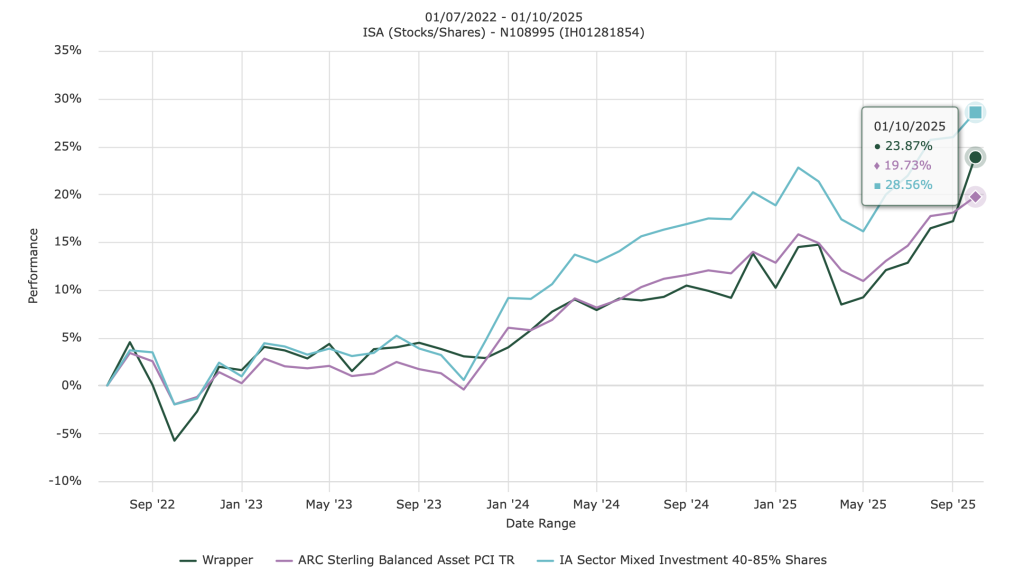

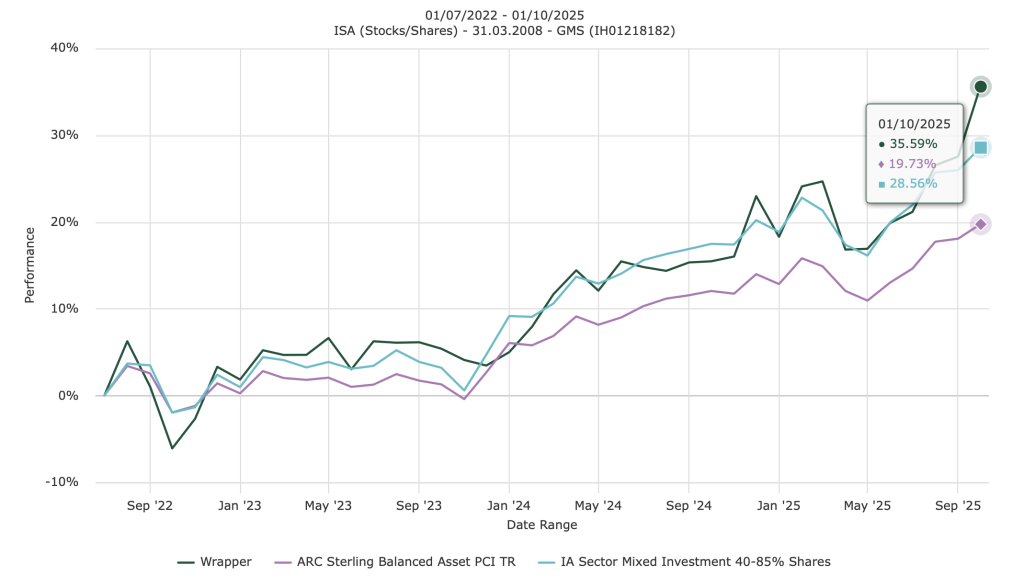

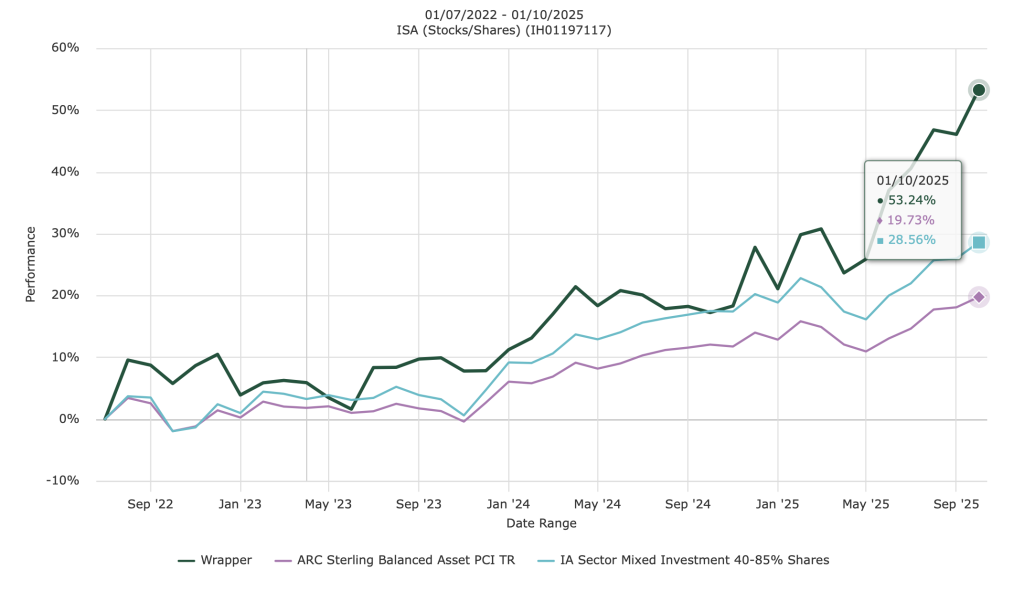

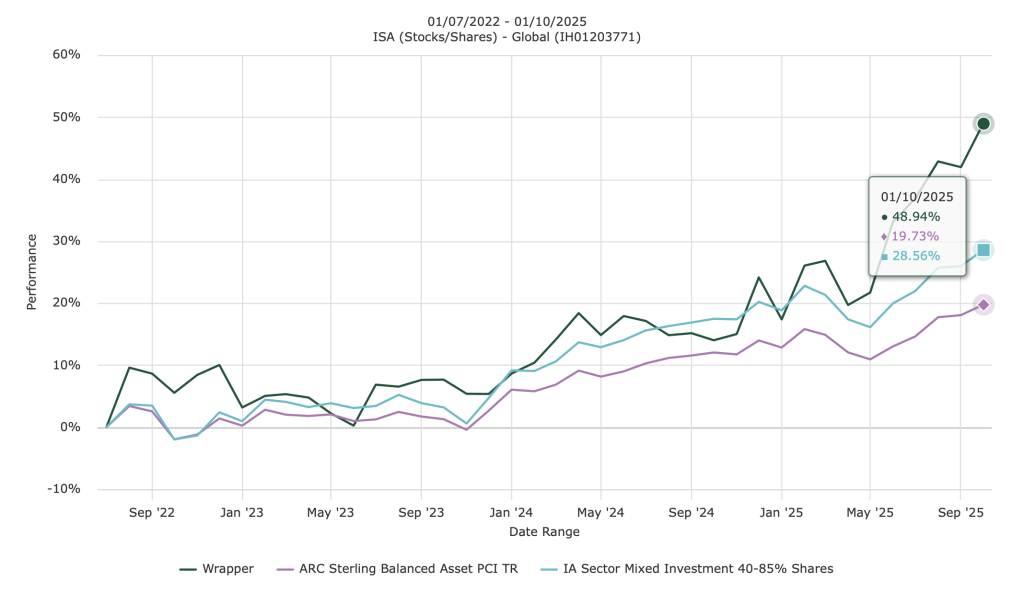

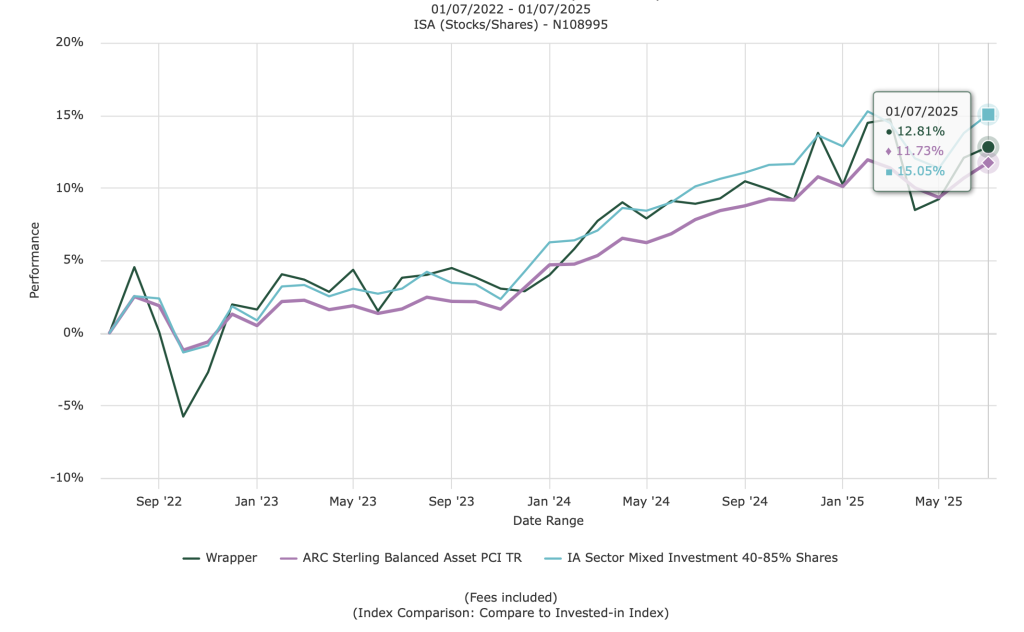

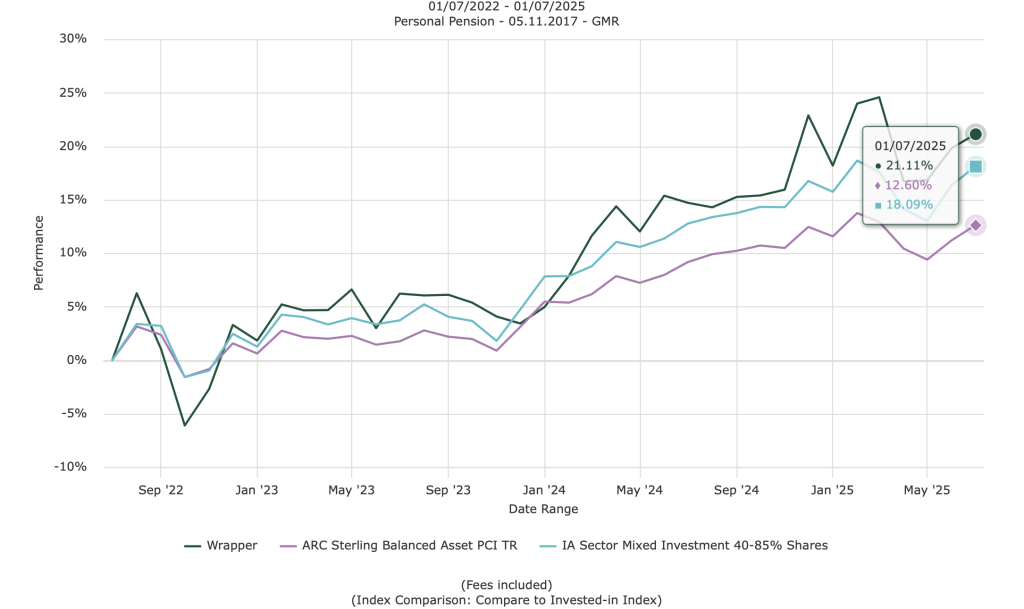

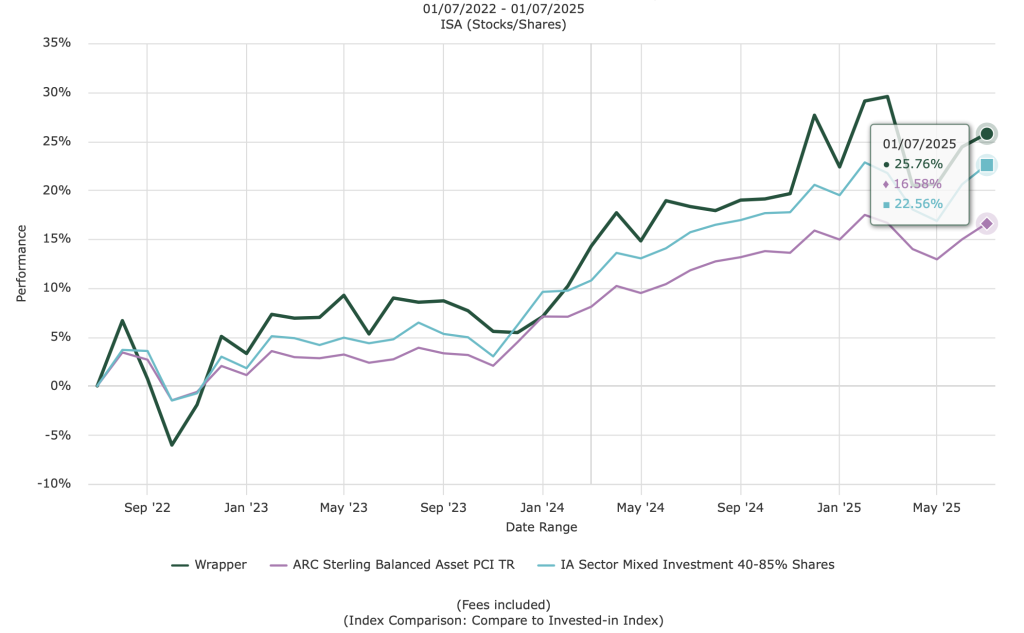

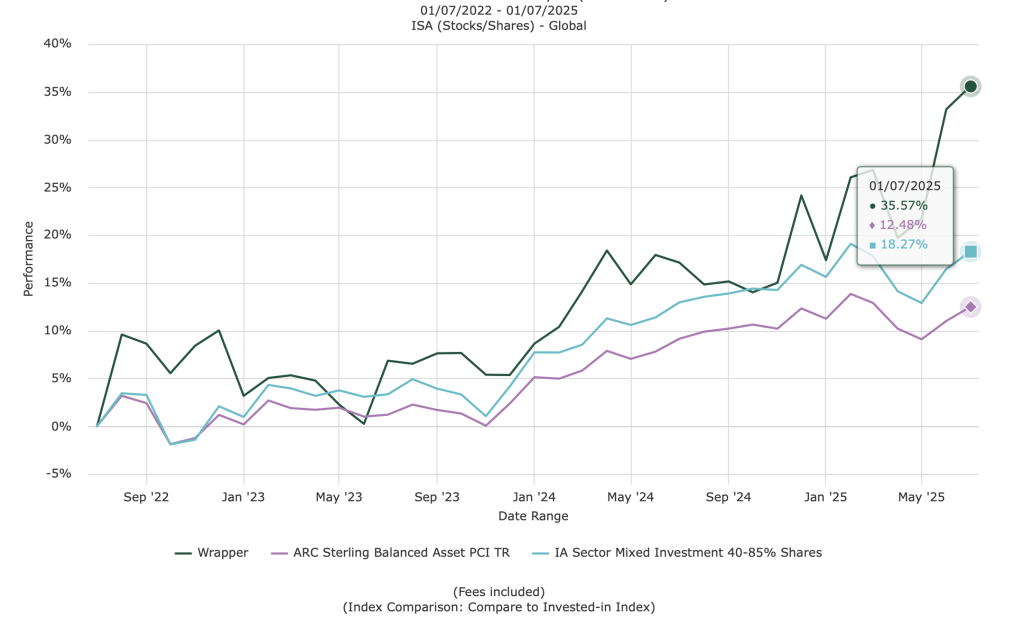

Where has our out-performance come from lately?

Our recent returns arrived by exploiting media induced fear amongst our fellow investors. Not from suffering the clickbait fear subjected on us 24/7. On reflection, our investment choices all revolve around a common theme of fear. The Fear Portfolio. Maybe that has a marketing ring to it? We certainly don’t manage a greed portfolio.

We haven’t made our outsized returns by following the crowd. We are not 34% exposed to just 6 AI dependent US companies like the vast majority of savers and investors. That is what you get if your US exposure is in an S&P 500 tracker fund. We have not leapt on that bandwagon. Our portfolios have swelled by recognising there is increasing fear out there.

Continue reading “Too Good To Be True?”