Happy New Year!

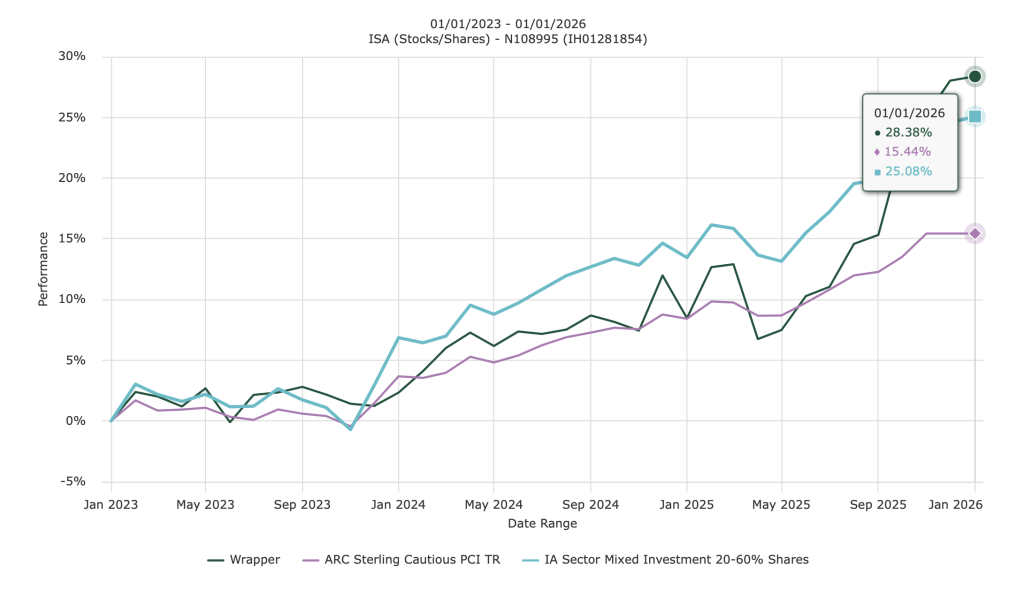

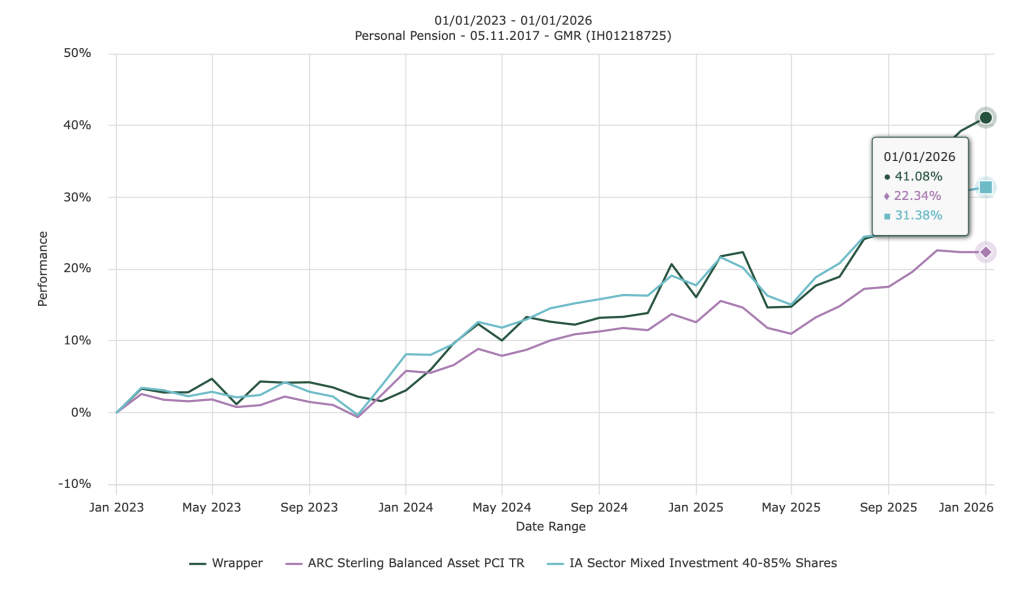

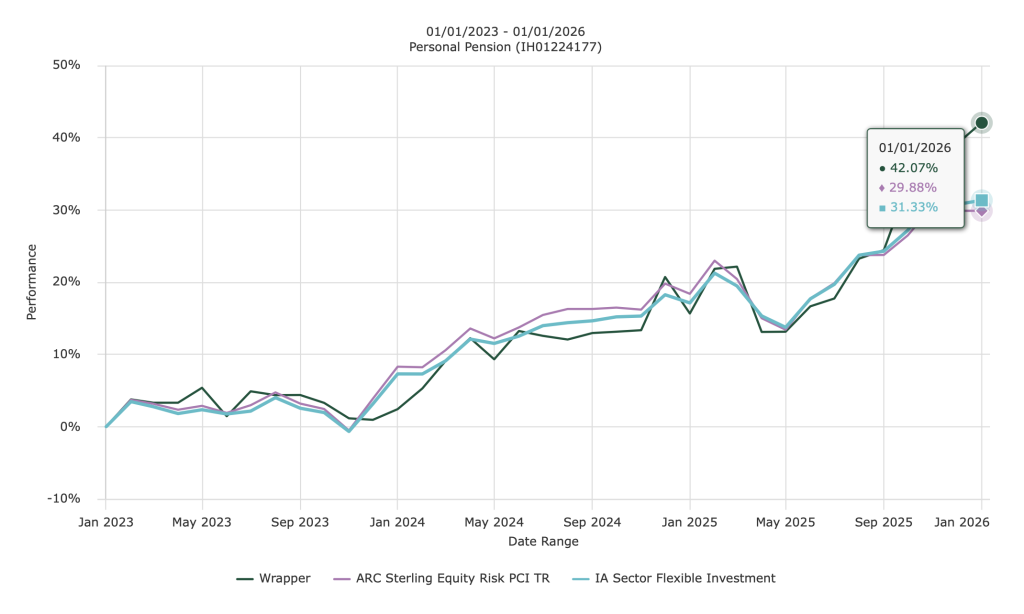

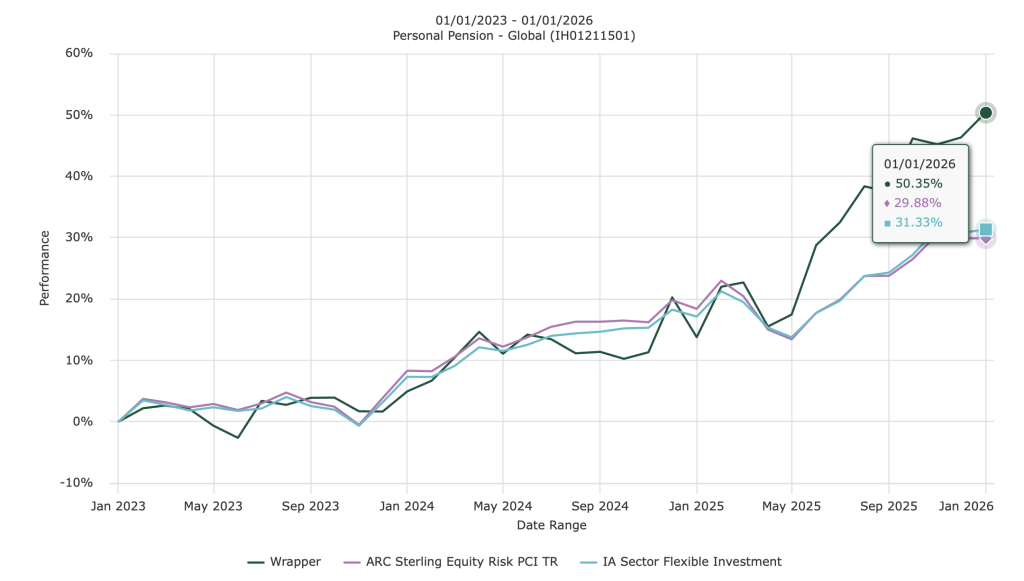

In all of the charts below, each of our managed portfolios are shown by the bold green line. Our peers performance is shown in blue and purple lines.

Performance is shown net of our fees, trading fees and Transact fees.

This quarterly review shows our performance versus our industry peer group across our portfolios for a rolling 3 year period.

Our Cautious Portfolio

Our Cautious Managed Portfolio unfortunately is not a fair comparison versus its peer group as care home fees of several thousand pounds are withdrawn each month for the client in question. This reducing balance has blunted the true performance somewhat.

Our Moderate Portfolio

Our Aggressive Portfolio

Our Very Aggressive Portfolio

Our Very Aggressive Portfolio lost a little ground versus our Aggressive Portfolio whilst we exited some speculative positions before we could buy some precious metals and miners.

Each of the charts above are actual client portfolios.

Commentary

2025 was a strange year for investors, as the normal playbook was torn-up in late March by one Donald Trump. The introduction of US tariffs sent markets in to a tailspin, with talk of global recession and international stock market crashes. Many investors sold what they could, expecting the worst. In the end we had an outstanding year of investment returns. A year of returns that many investors missed out on by selling and running to safety. Our above average returns were possible because we threw away the old playbook and embraced the New World Order. America first, Europe was told to stand on their own two feet, international distrust of the US as a trading partner and most of all, the understanding that the Dollar and the SWIFT international monetary settlement system could be weaponised against America’s enemies and allies alike. Whilst most investors concentrated on the Magnificent Seven and the AI race, we looked towards the oncoming precious metals commodity super cycle, as governments all over the world bought gold, then silver as a hedge against the hostile suspension of Dollar assets.

Platforms matter

We first began moving clients from Nucleus to the Transact platform in late 2021. This move gave us the increased global investment opportunities we required to navigate an ever complicated geo-political world. If need be, we could turn our backs on our domestic stock market completely.

The growth opportunities for UK businesses, where the bulk of their income came from transacting business within the UK, had begun to stagnate. Successive UK governments had progressively increased the burden of corporate and payroll taxation, increased stifling employment regulations and allowed the strengthening of trade unions. Only the largest shares did well last year. By comparison the FTSE 100 (stuffed with international mining stocks) returned ~21% versus the FTSE 250 (smaller mainly domestic firms) returning ~9%.

We continue to out-perform our peer groups in all portfolios. Our choice of Transact as our partner platform continues to give us the opportunity to out-perform.

We are Here

We remain dedicated to looking after your, and our, life savings.

We will remain realistic and vigilant. We believe the commodity cycle has further room to run, the US will continue to be the home of very cash generative companies and despite all the talk of peace, there continues to be a global need to re-arm. As we move into the “difficult” 2nd year of the US presidential cycle for equities and the more concerning end of the long term property cycle, as witnessed by increasingly lax lending requirements, we understand all good things eventually come to an end. Expect a gradual de-risking of the portfolios as we move towards the end of the year.

If you have any questions don’t hesitate to ask. After all, unlike your friends and acquaintances, you can talk to the investment managers who look after your savings in person. If you would like to understand more about how we manage investments you can read it here.

Obviously I have to say at this point………..Past performance isn’t necessarily a guide to the future.

Big round of applause and very well done. Thank you for using your investment nouse to gain so much for my portfolio. Keep it coming!

Happy New Year and keep up the good work!! Best wishes Lesley

Happy New Year to all, and many thanks for an incredible year’s performance

Allan & Sheila

Morning team Scott, a happy New Year to you & yours.

Always appreciate the honest summary of what’s happened and happening in the world.

Also appreciate having been allowed to come on board.

Looking forward to a positive 2026.

All the best everyone.

Hi Howard, firstly Happy New Year to You and all your Team,

Thank you very much for the update, we very much appreciate what you and your team have achieved in 2025. May you continue to think positive thoughts. look for realistic opportunities and most importantly enjoy what you are doing. Best wishes Val, Mal and John