In a week or so we will all be in the new tax year. Let’s take a look at how the last one played out for us as investors.

Although it has been 5 years or so since I watched a single game of football (no World Cup, no Euros, no Manchester United) I thought I would add a football theme to this performance blog. Like football, investment can be tedious at times and stretch our patience, but then there are moments of magic too. Let’s hope the current magic continues.

Football verses Soccer

Although I haven’t watched a game of soccer (US speak for football) I have watched many games of football (US speak for American football). If only the Yanks would speak English, it would make understanding much easier. Language difficulties are not just linked to sport. In investment we have shares they have stocks, we have gilts they have treasuries, we have bonds and they have….bonds. OK there are some similarities too.

I love the strategy behind football (I’ve started so I will stick with it), I like the concept that the two teams never meet. Unlike in soccer , where the same 11 players of the first team play the 11 players of the opposing team. Striker can tackle striker and defender can tackle defender. In football there are two teams and special teams too. Star quarterback never goes up against the opposing teams star quarterback. The offensive team is met by a defensive opposition, and vice versa. 11 players on, 11 players off when the tide turns. Talk about parking the bus, in football they bring on guys the size of a tranny van and then park a second set of vehicles behind that row.

Individual team members are chosen because;

- They can throw a ball, but not necessarily catch one well.

- Catch a ball, but probably couldn’t throw well.

- Run fast.

- Dodge.

- Block.

- Kick.

- Think.

- Be thoughtless.

There are parallels to be had in investing. Defensive shares versus growth shares for instance; there is a time in the game to choose one or the other or both. The list above is a proxy for asset allocation in investment. But I’ll be honest, I just love all of the football stats.

A Game of Two Halves

In fact I could probably break the investment year down into a game of 4 quarters. Like a long boring game of American Football, nothing happened much for the first 3 quarters. Our defensive team was on the field for most of the period. Constantly pounded by the markets, headway only being made because we remained cash heavy over much of the period. They were the hard yards where the best we could do was to hold our own. In those times of uncertainty we had no clients questioning how much cash we held in reserve, as cash was bringing in an acceptable risk free return. Over the previous year, many clients, including those who could now best be described as veteran investors, needed reassurance that “this time it’s not different”, the recovery would start eventually.

Yes, there were hostilities breaking out globally, the (bad) news media proclaimed endless dramatic end of the world, climate-change scenarios, interest rates increased and political uncertainty reigned across the western world, but investment progress was finally forthcoming.

We stuck to our guns until we could bring our offensive team out on to the field. Once out, they were swift to score touchdown after touchdown resulting in all the main portfolios bettering their benchmarks over 1 year and 3 months periods.

The Benchmarks

ARC (Asset Risk Consultants) and IA (The Investment Association). Charts can be produced on the Transact platform including these benchmarks

Performance

| | 12 months | 3 months |

| Our Cautious Portfolio | 8.00% | 5.14% |

| ARC Cautious | 2.71% | 0.00% |

| IA Mixed 20-60% Equity | 7.76% | 2.47% |

| 12 months | 3 months | |

| Our Moderate Portfolio | 11.58% | 9.30% |

| ARC Balanced | 4.79% | 0.60% |

| IA Mixed 40-85% Equity | 10.09% | 4.79% |

| 12 months | 3 months | |

| Our Adventurous Portfolio | 11.20% | 9.93% |

| ARC Equity Risk | 7.62% | 1.70% |

| IA Flexible | 10.07% | 4.44% |

Team of the Year

Our Moderate Portfolio is home to around 70% of our assets. The aim of the portfolio is simple. Double in value every decade. For only the third time since its inception on 1st January 2008, the portfolio had fallen below target. At the worst point in October 2022, the portfolio had slipped temporarily to almost 25% behind target. Today it stands at just 4.6% below target. With the market momentum that has been built, we are expecting to be back on target by the summer.

The Moderate target is 7% compound a year net of all charges. The portfolio continues to allow many of you to just get on with enjoying your retirement.

Man of the Match

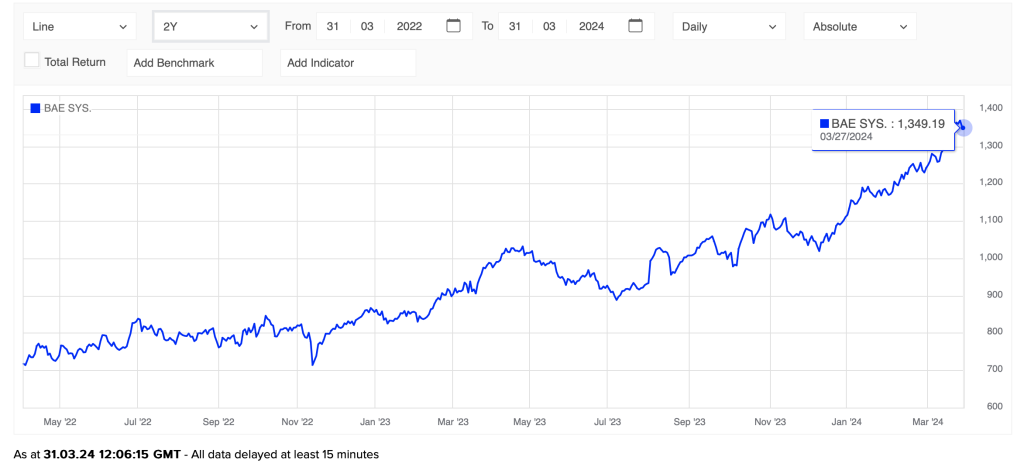

Man of the match over the whole game should go to BAE Systems which has added almost 75% to its value since it was bought in June 2022. It was also up 9.02% in March alone. The previous holder of the award was Centrica which added similar value (when gas was expensive), but was taken off the pitch and rested over the balance of the summer months. Centrica’s career as a member of our portfolios could now be over.

Members of the new offensive team worth a mention, as adding immense value last month are:

- Convatec Group Ltd. +16.05%

- Rolls Royce Group Ltd. +15.44%

- Nvidia Corp +13.93%

- Airbus +11.48%

Substituted

As I wrote back in February, there are several sectors I expected to continue to do well – defence contractors and stocks that benefit from AI.

We reduced our Apple holdings in late February, diversifying by adding Microsoft (+1.59% last month). Microsoft is developing its AI offering meaningfully whereas Apple was not. Apple was the worst performer in the portfolio (-5.13% over the month), not helped by several legal decisions going against it. I’m sure Apple will rise and play a meaningful part in our portfolios once again, but for now I’m considering benching it to make way for our new quarterback drafts. Form is temporary, class is permanent.

Extra Time

As always please feel free to comment. If you need a chat with the management, just knock on the door, pick up the phone or rattle the keyboard. It’s the advantage you have, trying talking to the management of Aviva or Invesco or St. James Place.

You can switch portfolios at any time, just ask and we will explain the differences and whether one or more are more appropriate than others.

Past performance isn’t necessarily a guide to the future (look at Manchester United)

This blog contains no investment advice and precious little else of value really.

Here’s some advice – If you haven’t watched Ted Lasso yet on Apple TV and you are a soccer fan, then look it up. Absolutely hilarious.

Ted Lasso: Heck, you could fill two Internets with what I don’t know about football. But I’ll tell you what I do know. I know that AFC Richmond, like any team I’ve ever coached, is gonna go out there and give you everything they got for all four quarters.

Ted Lasso – Apple TV

UK Football Reporter: Halves.

Ted Lasso: What was that?

UK Football Reporter: Two halves.

Ted Lasso: Right. Sorry. Halves, yeah. They’re gonna give you everything they got for two halves, win or lose.

UK Football Reporter: Or tie.

Ted Lasso: Right. Y’all do ties here. Sorry. That’s going to take some getting used to for me. ‘Cause back where I’m from, you try to end a game in a tie, well, that might as well be the first sign of the apocalypse.

Hi Howard

Thank you very much for your excellent update, it’s good to see a positive outcome for the year end

Thank you and best regards

Val

We actually had Ted Lasso managing my blessed Leeds Utd in the form of Jesse Marsch.

Didnae end well.