At the halfway point of the year

Well 6 months have flown by, and so far the returns generated in the portfolio reflect a “normal” investment year. If there is such a thing these days? The first quarter is usually strong, followed by a quarter of catch-up, which is reflected in the returns generated by our main portfolios so far this year. All portfolios remain on target to achieve their annual targets at this point.

What’s a “normal” year?

Veterans of our investment management service know that we generate the bulk of our returns in the 1st and 4th quarters of the year, with the 2nd and 3rd quarter usually only generating less than 25% of the years returns in total.

July to October should drift along nicely with little to show by way of returns, but hopefully without major wealth threatening dramas either. That said, July started with political meltdowns in France which potentially jeopardise the future of the EU as a trading block and of course the attempted assassination of a US President in waiting and the realisation that the current POTUS probably hasn’t been calling the shots for years. Political drama enough already!

Did we navigate the UK General Election in OK shape?

On the whole yes, but as always we could have done better in hindsight. We positioned for the likely result, which wasn’t exactly hard given every man and his dog also guessed the likely colour change in parliament. There was no shock in the markets as was expected by the UK shock index I referred to in my previous blog.

We expected a drop in Big Oils – Shell & BP (Labour’s Net Zero promises) and utilities UU, South West Water, Centrica etc. (The threat of nationalisation) – we have not held any of these shares for some time. However we did not position ourselves as heavily in social house builders eg. Vistry in particular and the others Barretts etc. as the FTSE 100 index does, which was perhaps a missed opportunity.

Also I mentioned in that previous blog why the current Prime minister and the political party he/she represents makes little difference to the real power base that is the UK Civil Service and the 1000 or so Quangos who decide on Government policy. (The Blob) This has now also seen to be equally true in the US where there is question of Biden’s cognitive ability. The question isn’t should he not run next time? The real questions are; When exactly did he cease to be making the day to day decisions of the POTUS? ; Who has been acting as the Head of the Free World for some time now? and finally; Does the lack of a POTUS explain the current opportunistic aggression from Russia, China and Iran?

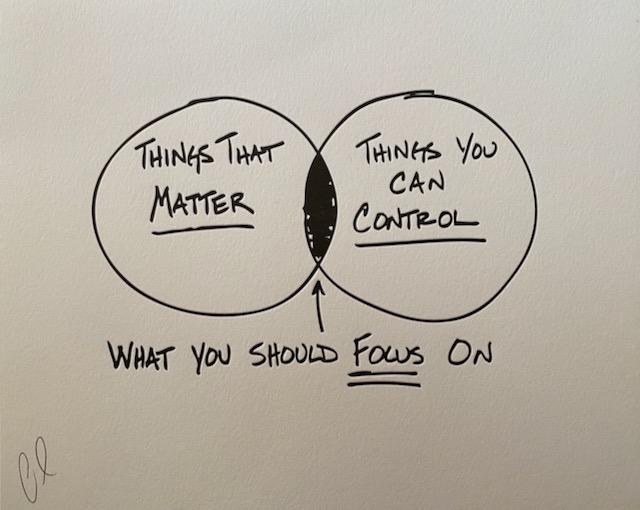

All mute questions really as we will never know the answers to any of those questions. Let’s continue to focus on the rewards available by investing in the best companies in the world. Thankfully we do not invest in Governments.

The Benchmarks

ARC (Asset Risk Consultants) and IA (The Investment Association). Charts can be produced on the Transact platform including these benchmarks

Performance

| YTD | 3 months | |

| Our Cautious Portfolio | 4.51% | 0.00% |

| ARC Cautious | 2.36% | 0.79% |

| IA Mixed 20-60% Equity | 3.62% | 1.08% |

| YTD | 3 months | |

| Our Moderate Portfolio | 9.20% | 0.20% |

| ARC Balanced | 4.22% | 1.29% |

| IA Mixed 40-85% Equity | 5.08% | 1.57% |

| YTD | 3 months | |

| Our Adventurous Portfolio | 9.82% | 0.12% |

| ARC Equity Risk | 6.86% | 1.88% |

| IA Flexible | 6.10% | 1.51% |

What next for the UK?

Pressure is building to channel investors into UK companies. It began with the “UK Shares ISA” which was immediately put on hold due to the impending General Election. It continues with an FCA directive to all platforms, which now have to alert clients of the “risks” of holding longer term investment accounts in a high percentage of cash. 25% is the current limit before client letters are triggered. Lazy investment managers will stay below 24% even if there is suggestion of an impending market meltdown. The expectation is this “spare cash” will find its way into domestic shares.

It’s also pretty clear that there is a renewed Labour commitment to Net Zero by 2030. The CO2 emissions from the UK currently don’t move the needle on the scale, accounting for only around 1% of the global total. I would suggest removing the UK’s 1% of CO2 globally will make zero difference to the planet’s climate (I will leave it there), but it will likely jeopardise UK jobs, UK inward investment and likely increase UK energy costs and weaken dramatically our independent energy security. I really can’t see evidence of these new “Green Jobs” promised since the Paris Accord in 2015. If there are any at all, they are all to be found within compliance. Very much white collar and few if any blue collar.

Expect pressure to be placed upon investors to not only invest increasingly in domestic markets, but also in sustainability first companies with the “correct” fit of CO2 emissions, gender diversity and worker representation targets at board level. None of which have ever shown a direct correlation with better shareholder investment returns.

As our fiscal responsibility remains with our clients, we will continue to fight any directive which puts the interests of The Blob before the interests of our clients.

Man of the Match over the Quarter

I won’t be mentioning our nation’s disappointment in the Euros Final. Instead Man of the match over the quarter should go to Nvidia which has added almost 60% to its value since it was bought in February.

Extra Time

And Finally….

Something deep down in me remembered “The Presidents Brain is Missing”. After two minutes detective work I tracked it down to the first series of Spitting Image aired for the first time an astonishing 40 years ago. As you will see comedy has changed dramatically over the period but the political themes have not. “The Presidents Brain is missing starts at around the 1.12 minute point. Enjoy. But if you don’t please don’t blame me.

Thanks Howard

Hope your all fit and well. Great job with all the turmoil going on. What’s happening with Savanah at the moment. Regards Pete and Janet

Hi Peter

Thanks for commenting. Savannah has now secured the licence needed from the Chad Government for its purchase of the gas field. Profits declared were ahead of target. They expect to submit the listing some time in Q3 which has now commenced, so we are checking the status weekly. We will be selling as soon as we can. It will not be replaced with a UK listed oil company for obvious reasons, most likely an American exporter of LNG to us. Probably Chesapeake Energy.

Thanks Howard.

Take care everyone

Thank you Howard for reliably good performance. On the voting issue, living in Chorley means that we do not get a choice. We don’t mind as Lyndsey Hoyle makes a good Speaker of the House.