This month I celebrate 38 years since the beginning of my career. In the beginning it was purely a sales job. Armed with a suit and a rate book, I was unleashed on the great British public to spread the gospel according to Abbey Life. I was taught to sell savings plans and life assurance plans. With a little further training and an additional rate book my sales repertoire extended to “personal retirement plans” the fore-runner to personal pensions which arrived in 1988. And so it was for 10 years.

I’m proud to say that some of those initial clients are still with me today. Thank you;

Rory, Ruth, Mo, Stuart, Joan, Ruth, Dek, Janet, Tony, Robert, Belinda, John, Roy, Kim, Brian, Julie, Ken, Geri, John, Chris, Diane, John, Philip, Graeme, Wendy, John & Andy.

I lost my insurance company religion when I realised that Abbey Life was making more money than the policyholders were and became an Independent Financial Adviser in 1997. If you want to read the full career backstory you can read it here.

Privatisations.

When I joined Abbey Life, Margaret Thatcher was our Prime Minister. She was re-elected with a manifesto to sell off state owned monopolies. She dreamed of turning ordinary citizens into an army of private shareholders. Thatcher vowed no industry should remain in private ownership. Do you remember the TV advertisements to, “Tell Sid” that British Gas was to be privatised?

Those privatisations left a lasting impression on me. I managed to invest £100 here and £100 there and made a profit in the short term. I couldn’t hold on to those shares for the long term unfortunately as there were mortgages to be paid, and children to be brought up. I’ve no regrets, but……

A little recent research revealed that if you invested £1000 in British Gas on flotation –” in 2023 you would now have £40,600, of which £24,400 is due to dividends being reinvested to buy more British Gas shares”.

Frugal West Indians

Another past discovery which was pivotal to the design of our investment proposition, came about when I was introduced to a lovely Caribbean gentleman who lived in Trafford Park. It was around 1990. From only modest savings and regular trips to the local stockbrokers, he had built a portfolio of £100’s of thousands. All from buying and holding individual shares over the long term. Tellingly, not from investing in Insurance Company plans or Investment Companies funds. Since then I’ve met several other long term investors with £1 million share portfolios, built again from very modest levels of regular saving. A particularly memorable £1 million+ portfolio encounter was with a gentleman, a welder by trade with no investment knowledge whatsoever.

Politics & Pensions

Coming back to Margaret Thatcher, my career so far has seen 10 different Prime Ministers of both stripes;

Margaret Thatcher, John Major, Tony Blair, Gordon Brown, David Cameron, Teresa May, Boris Johnson, Liz Truss, Rishi Sunak & Kier Starmer

But more to the point, during the period there have been 29 ministers for pensions, many like our new minister were just not old enough to understand how a pensioner feels and will never have to rely on either the State Pension or private pension provision. He can argue about equality all he wants, but that will be from a position of having a public servant pension being built for him. “Do as I say, not do as I do”.

Steve Webb was the best minister in my opinion, but survived only 5 years. He still consults on pensions and unlike many other ministers, he actually cares and has taken the time to understand more than just the pensions basics.

Below is the current pensions minister alongside the opulent Department for Work and Pensions. Situated in Westminster, just down the road from the Houses of Parliament and Westminster Abbey. Not exactly in the cheap seats – it’s a shame then that less than 50% of the workforce turn in to the office for at least 2 days a week. Maybe the offices should be sold off and then the pensioners could get their winter fuel allowance back from the proceeds.

I’ve included a picture of the current minister, because if you blink, you will miss him. Torsten Bell is a career political socialist, studied PPE at Oxford (obvs), previously working within the left-wing Resolution Foundation. Most of his previous policy recommendations, if enacted, would be detrimental. for us long term pension savers. I’m guessing Torsten will be moving on soon anyway to take over from “Rachel from Accounts” when she has done filling her black hole.

Torsten Bell. He has a brother called Olaf. His brother isn’t the snowman from Disney’s “Frozen” in case you ask.

My Future

As they say “You can’t keep a good dog down”. My career is now set to survive longer than UK tax efficient retirement savings plans. I still enjoy my day job. I have no plans to apply for the gold watch just yet or to hang up my boots. I’m lucky to have the dedication of Melissa and Charlotte to help me with the daily workload in the office. The internet and smartphone have changed the job dramatically. It took around 18 years from the commencement of my career before the technology and legislation came along that allowed the masses to easily and cheaply own shares directly in their pensions and savings plans. For 14 years I have been able to manage portfolios of shares on behalf of clients. That’s 14 years of cutting out the costs of the middlemen insurance companies and investment funds. 14 years of transparency of every investment cost. Unsurprisingly, like Mr. Burnett of Old Trafford and Mr. Hughes, the well travelled welder, owning strong companies over the long term, out-performs the packaged products of the UK investment industry. Today our client assets are approaching £100 million.

I still have many lessons to learn, so much experience to successfully pass on to Charlotte. So many promises to keep that I have made over the last 38 years.

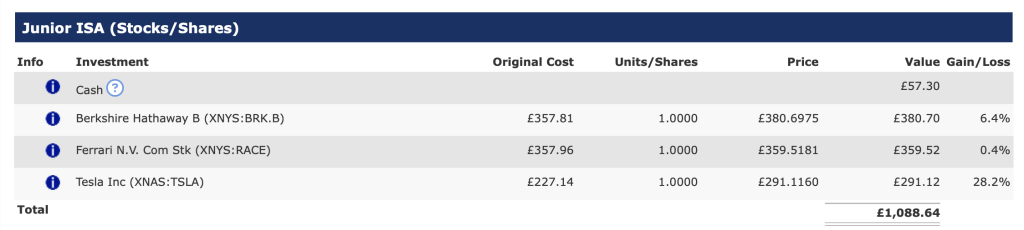

Last October saw the arrival of our first grandson, Harry. I have kicked off the long term magic of compounding for him by buying him 3 shares. One Berkshire Hathaway, one Ferrari (couldn’t help but buy him a Ferrari) and one Tesla. Who knows? With time his investment put could build into £1 million. Maybe, just maybe he will become an investment manager like his grand father and auntie Charlie.

Future Investment Opportunities

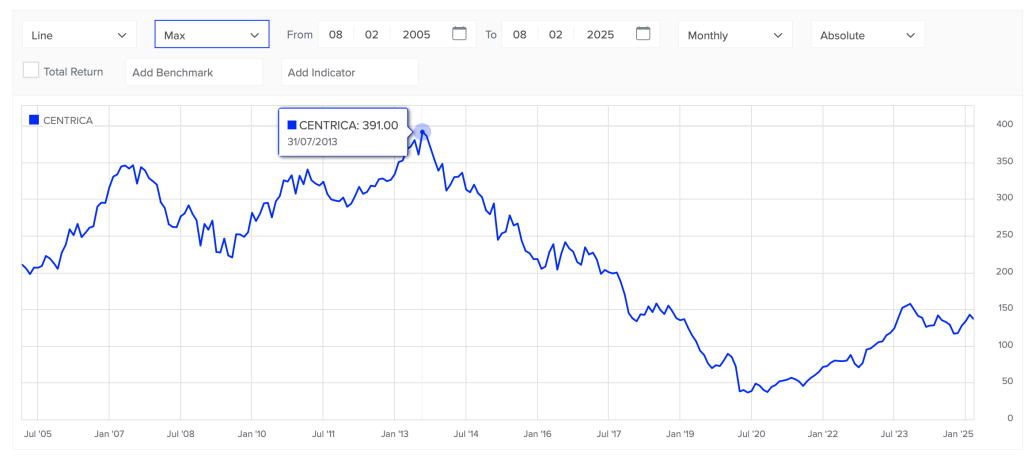

Remember British Gas that I mentioned earlier? After many restructures the current name is Centrica.

It is many years since Centrica hit their zenith. Without the receipt of dividends, it has not been a great investment success for holders of the share over the last decade. We did all hold Centrica in our portfolios for a short time in the past, but we saw the writing on the wall. Will we be buying Centrica shares again anytime soon? Well sadly no. Like many large UK companies with many, many staff, the incoming changes to employers national insurance contributions will make the company less profitable unless there is an increase in productivity brought about by a reduction in staff numbers. Most of our remaining UK registered companies that we still hold across the portfolios, like Marks & Spencer and Premier Foods have the same tax mountain to climb now. But it is our previously privatised companies, like Centrica which carry the additional threat of state re-nationalisation, which rears its ugly head from time to time and crashes the share price.

For now, our future investment opportunities remain outside of the UK I’m afraid. Thankfully after many years, with ever improving platform functionality and technology, we can now not just hold a handful of privatised UK shares, we can hold the shares of the largest, most dynamic companies on the planet.

Carry on Investing!

And Finally….

- Past performance isn’t necessarily a good guide to the future.

- The value of shares can both fall and rise over the long term.

- This is not a financial recommendation to purchase any of the individual shares mentioned above.

Congrats Howard on your long service! Here’s to the next 38 years….

A great summary of the past 38 years. Forget about the gold watch and boots hung up – surely it can’t be long before you publish a book.

Congratulations on your achievements and thank you for your very entertaining and informative blogs. By the time I get round to reading them, the comments have usually closed, so I thought I’d just register my appreciation while I still could!