Many of you have probably noticed that post Brexit, your portfolios are the highest they’ve ever been. One of the reasons for this is the amount of international funds we held prior to the referendum.

Last week you may have seen the contract notes for the sale of one of these international funds, the DB X-Trackers S&P CNX Nifty…our Indian fund.

Just the facts – Why We Bought

- We bought our Indian fund because we believed in the resolve of the Prime Minister Narendra Modi, alongside his chosen Bank of India governor Raghuram Rajan.

- As usual we waited for a drop in the market before we bought.

- Like our chinese takeaway we intended to hold the fund until it had achieved our target

Just the facts – Why We Sold

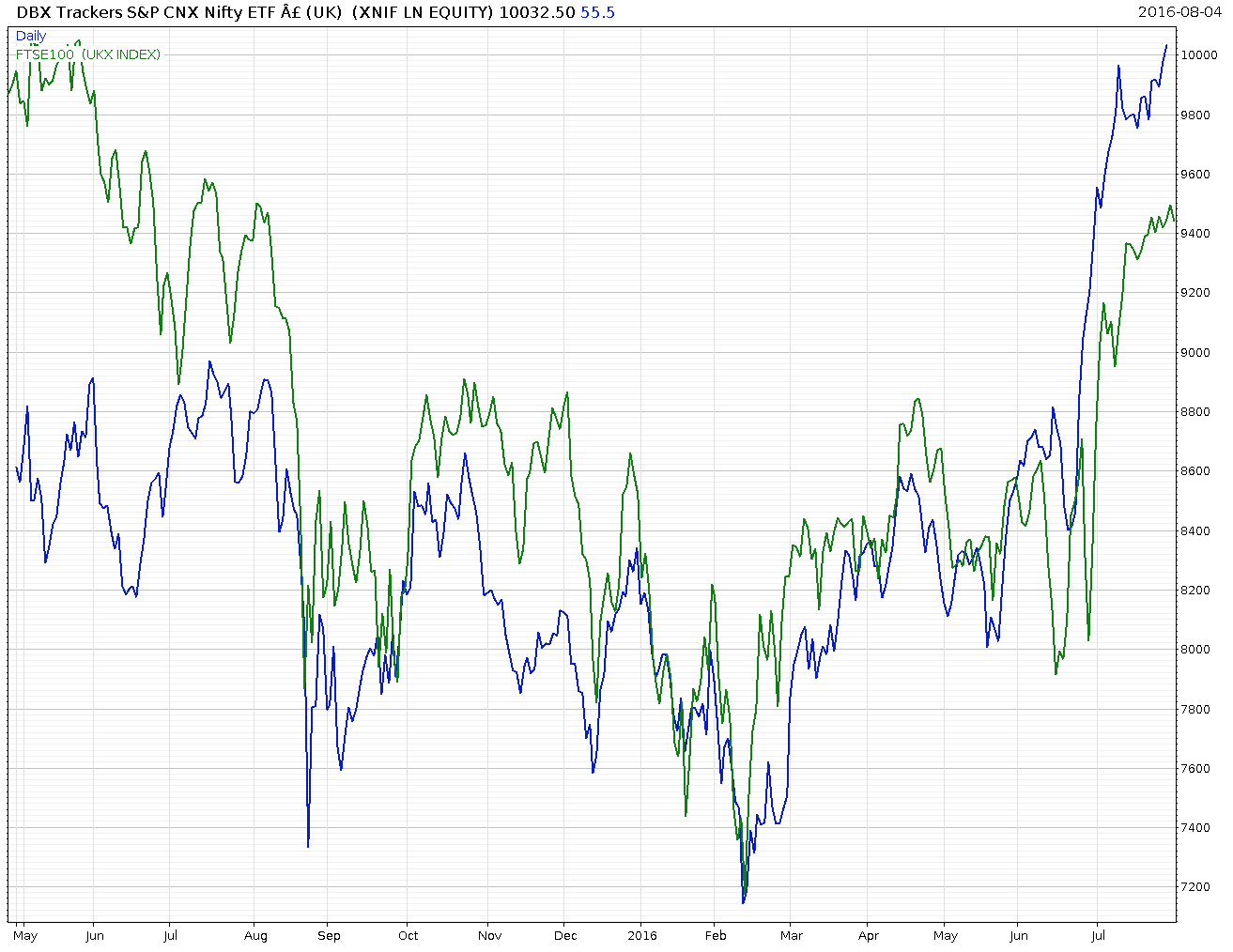

- From the chart above you can see the fund rose 15% in 15 months. It grew very nicely thank you, and like all the best takeaways, it came quicker than we anticipated.

- Obviously thanks to Brexit, part of the return is the rise in the value of the Rupee against the Pound!!

- Our experience tells us that when a fund grows very well, very quickly, it seldom continues to rise as quickly, it generally at some point goes backwards. So we took the decision to sell our holdings.

- A further reason for the decision to sell was the fact that Bank of India governor Raghuram Rajan has announced that he is stepping down in September. Given international investors general dislike of change, this was too big a factor to ignore.

Further plans for that capital going forward.

Although this sale leaves us with more liquid cash than we’ve ever held in our portfolios, we currently don’t believe that’s a bad thing over the late summer, and rest assured we’ll be deploying that cash back into the markets when we feel the time is right.