Simple stuff really; but if you want to sell a share, then you need someone else to buy it. If you held Northern Rock shares you will know this. There were thousands who wanted to sell, but not one person wanted to buy. The result was there were many small shareholders left holding the baby. A total loss.

Previously I have blogged about The Relentless Search for Income, if you missed it you can read it here

I also explained in March why I had halved our holding in a long time favourite fund, the Vanguard UK Equity Income Index Tracker. Here is the link if you have some time to re-read it. Just six weeks after that blog I then sold the rest of that fund.

Where are you going with this?

Well in the recent budget it was announced that there was to be a long-awaited over-haul of income tax payable on dividends. It was announced that investors could now earn up to £5000 per year tax-free in dividends. £5000 per year tax-free on top of our £10800 per year personal allowance free of income tax. How good does that look to the average investor who has loads of money sat outside the tax-free shelter of a pension or an isa?

Well I don’t think there was any need to further incentivise investors to choose high dividend producing shares. They cannot earn income in a bank and the returns on Government Gilts are frankly ridiculous for the potential downside risks that lay ahead. Individuals have been loading up with “safe” high dividend paying shares for years. More will follow due to the favourable income tax treatment. Where is it going to lead?

It’s a crowded trade about to get more crowded

UK Equity Income funds have become a very crowded, one-sided trade. I prefer to describe it as everyone is on the same side of the boat. If we are not careful we know what happens next.

Remember, to sell a share you need a buyer? When this many shareholders start to look for the exit together, buyers could look scarce. Just don’t expect to sell at a high price. The few of us who don’t own the shares will be looking for bargains.

The income tax they have saved could look tiny compared with the capital loss they could incur.

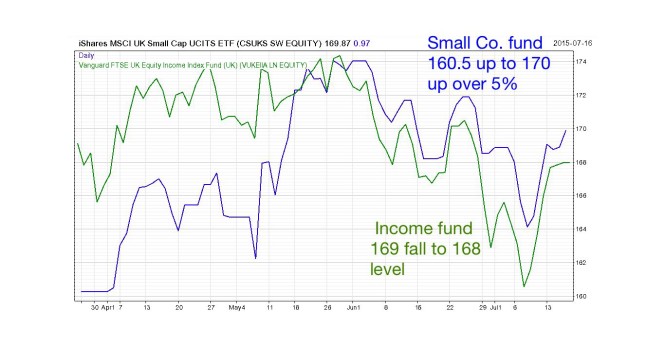

When we finally sold all of our UK Equity Income Fund, we replaced much of our UK holdings with a fund that tracks smaller UK shares. Many have been overlooked as they don’t pay dividends. It’s early days, but this is what has happened so far.

P.S.

I try to write these blogs well ahead of my deadline. The sharp eyed amongst you will have seen the chart above finished a fortnight ago. What happened next? Since the trades on 28th April, so just two months ago, here’s the up to date position

SOLD- Vanguard UK Equity Income Index Fund -3.6%

BOUGHT- iShares MSCI UK Small Cap +1.2%

I hope the investment boat slowly rights itself with investors naturally stepping away from the side. But I fear that the “tax free” draw will drag even more investors into the big dividend paying shares.

I used “Orca” as the boat in the photo above to illustrate my point of a sinking ship. I could have used “Poseidon” instead, but since I’m off on a cruise in a week…..