2016!

As the individual responsible for the safety of our life savings, I can’t say I enjoyed every minute of last year. It was tough right from the get-go. The Daily Express reported the early January FTSE 100 falls as “Worst stock market start of the CENTURY”. Experience told me it mean’t nothing and we ignored their advice to panic right now. We all knew “Past performance isn’t necessarily a guide to the future”.

The year ended with President Elect Donald Trump.

And yet, the perennial gauge of how investments are doing generally, the FTSE 100, ended the year at almost all time highs!

In it to win it

Few can afford to invest in very risky conditions and many global investors chose to sit 2016 out. Indeed for much of the year I chose to hold large amounts of cash to limit our potential downside. Especially for those clients of a cautious nature, or where investment timescales were short, or where large withdrawals are coming from fairly modest pots.

Those who could afford to be “in it to win it” did very well.

Portfolio |

1 Year |

4 Years |

|---|---|---|

| Cautious Moderate Aggressive AIM |

3.55% 10.00% 16.83% 22.81% |

24.80% 43.13% 56.00% 45.68%* |

We have held our discretionary investment permissions for 4 years now.

*Our AIM portfolio began only 2 years ago.

Has the market risen too far too fast?

Experience tells me that when markets have risen this quickly then the next direction is likely to be down. Obviously! Thinning out has usually worked at a time like this. Sell now and buy back later at a cheaper price. But currently I’m not selling. Let me explain why.

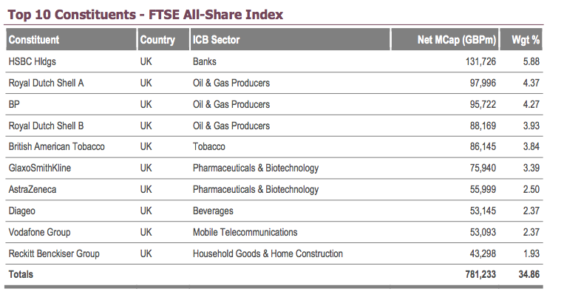

The FTSE All Share rose by 16.8% last year. Now we need to remember the index is weighted, based on the overall size of each company. Hence HSBC, the largest share constitutes 5.88% of the index on its own. The top 10 shares make up over one third of the index. The bottom two-thirds is made up of the other 626 shares. So the index reflects mainly how the big boys are doing. Sometimes this isn’t representative of the overall reality.

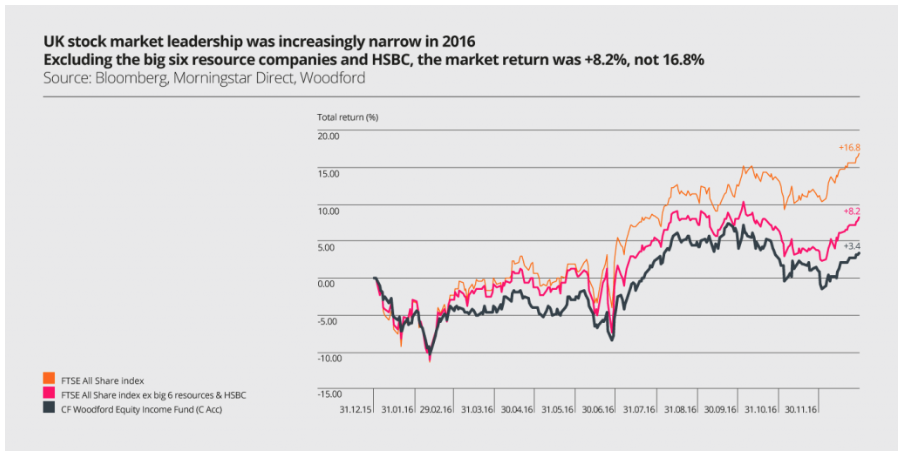

Neil Woodford has pointed out that last year if you took out the performance of just six resources companies and one large bank who funds many of them, then the return on the FTSE All Share was more like 8.2%.

Aren’t we worried after a growth spurt like that? We would be selling if we held any of this expensive resources sector, but we don’t. In fact we don’t own very much that lives within the FTSE 100 these days, so the fact it has hit an all time high is of little consequence.

The most hated stock market rally

This years political events have left sore losers along with sore winners. No one is sure of any facts anymore. Confusion reigns. How the markets have rallied despite all of this bad news is nothing short of a miracle. Normally when the markets hit highs like this it is on the back of good news. To many this year there has been no good news.

This rally has climbed the so called “wall of worry” it has been against the run of play. When markets rise on the back of good news it’s far easier to understand. Everyone wants to join in. Not this time, but at some point the abstainers will join in with this rally. More investors putting money in drives prices higher.

Turn on a dime

As always, the only thing that is a constant in this life is change. We need to adapt to stay ahead. What worked last year probably won’t work next year. We are always vigilant. We have your back. And remember “past performance isn’t necessarily a guide to the future”. Oh I’ve said that already.

I hope 2016 was kind to you personally and let’s all hope we have a happy and healthy 2017.