Have you ever wondered;

- What is money anyway?

- Why do we trust money?

- What’s that five pound note in your pocket really worth?

- Where does money come from and where does it go?

I’m guessing the answer is probably not. Money is just an everyday thing. It’s there, we just spend it or save it.

Our own currency that we spend everyday is taken for granted, except when we travel and it’s no longer accepted as currency. Why is it even called currency? Well the answer to the last question is indeed predictable. It’s the current value of our money versus other countries money. Which in itself begs the questions;

- What was our money worth previously?

- Was it worth more or less?

To answer these questions we need to go back a long way in time. To a time before money existed.

Sapiens

I have read some very influential books in my time. Very few have been works of fiction. I’m intellectually poorer for that I guess. My Northern upbringing of seeking “value for money” has directed me solely to books I can learn from. One such book is Sapiens – A brief history of mankind by Yuval Noah Harare. Before reading this book I believed the Agricultural Revolution was the time before tractors. But no. The agricultural revolution was the time when primitive humans ceased to be hunter-gatherers and became the farmers of crops and livestock. Who knew? That transition changed everything. Prior to farming, life was free, but probably not easy. Food was collected as needed, a free for all endless all you can find buffet. Once all the food was taken from one area, individuals moved on. A truly nomadic experience. Nobody was a landowner, primitive tools were the only possessions, used to dig for roots perhaps. Recent Bill Gates funded research wouldn’t have been needed back then, like today’s Aborigines, we would be happy obtaining protein from grubs.

Post the Agricultural Revolution, we domesticated animals for food and grew crops in fields. Land ownership was born, along with the primitive defence industry of the time, fences and spears to confine and defend valuable food sources from marauding outsiders. Local government and the legal profession began too, allowing local confirmation of property ownership. Mankind’s defence arrangements have progressed over millennia from fences and spears to prevent the loss of crops and livestock, to drones, hypersonic missiles and Lockheed Martin F35s burning aviation fuel in Rolls Royce jet engines. I have skipped a good few stages and millennia here, but I’m sure you get my point.

No one can trade corn for a jet fighter. A form of exchange is needed. Enter sovereign sanctioned money stage right.

Physical Money

Paper money as a form of exchange was first described in the travels of Marco Polo in the settlement that is now known as Bejing, mentioned in a second influential book. The secret wealth advantage: How you can profit from the economy’s hidden cycle – by Akhil Patel. (A cheesy title which shouldn’t put you off reading it)

Prior to the “invention” of paper money came amongst other trading commodities, gold which Marco Polo was familiar with. We are also familiar from reading the Bible, or at least from Christmas cards, of the three wise men bringing gold, frankincense and myrrh to Bethlehem. Gold is a form of exchange that has stood the test of time. We own around 5.5% in our portfolios of physical gold along with a further 4.5% in the “creators” of gold, the miners such as Newmont inc.

The reason paper money is required today is a 1oz gold krugerrand now costs £2600. In denominations of that size it’s not much use if you only want to buy 6 Warburton’s crumpets and a pint of milk. For smaller purchases you need smaller denominations. Like pounds and pence, Dollars and Euros.

Governments used to back their currency with gold reserves, but not any longer. Today sovereign nations back their currency with thin air.

Where do English £5 notes come from?

Well the short answer is they are printed by a French company De La Rue, with a footprint in Westhoughton. I know it sounds like I’ve made this up, but it is true. But who comes up with the £5 to convert into a £5 note? I’m sure you’ve guessed it, it’s the UK government. But probably not many of you guessed the institutions in the UK who hold a banking licence can also create money that can be converted to currency. That’s a little misunderstood notion that is again true. Banks can also create money out of thin air to lend to the public and businesses.

Here’s how money creation works. By the way if we tried to create currency, we would end up like a monopoly player that had picked a bad Chance card. Go to Jail, go straight to jail, do not pass go, do not collect £200. It’s illegal to create money as we are neither a Government nor hold a banking licence. Shame really.

Governments create money, they spend it with contractors or distribute it as benefits. I’m just 30 months away from my state pension, when I too, will trouser some of that newly minted folding. I’m looking forward to my “two monkeys a month” which after tax is only about ! monkey for me of course. However creating new cash out of thin air can’t go on forever. With construction must come destruction. So what is the process to remove that cash so we don’t just end up to our necks in coins and notes. The journey of that magically created money continues into the economy. Both currency and bank transfers are passed around businesses purchasing raw materials, paying for labour and forms of energy to make consumables, like crumpets. Companies make profits and pay Corporation Tax on profits back to the treasury, they employ labour and pay an ever increasing amount of National Insurance to HMRC ( Rachel from accounts – employers like me will never forgive you), and punters like you and me buy those goods and pay 20% in VAT on their purchases. But not on the purchase of crumpets, because most food purchases are VAT free. Perhaps crumpets were a bad example but you do get my gist I hope. Oh and finally we die. It’s not a happy ending to this story as many of our children will lose 40% in IHT of what they were left by us loving, but still too careful with our money, parents. ( Rachel from accounts – pension savers like me will never forgive you).

What the Lord gives, the Lord taketh away. As you can see Governments create the money and take it back by various taxes and cancel the money. Banks create money by way of loans. They then cancel it as the capital on loans and mortgages are repaid. Their profit is just the interest charged, obviously after Rachel has deducted her corporation tax and bank levies from time to time.

So the reality of the situation is money is created from thin air and then cancelled back into oblivion. It has a variable lifespan between creation and cancellation. For some currency, perhaps as briefly as the blink of an eye, but other money enjoys a longer time on planet Earth. The currency that hangs around with us, that remains in bank accounts, ISAs and pensions is known as savings. And savings is where governments problems lie. Especially socialist governments. You see we believe our savings are ours, which is inconvenient. Because Governments believe our savings are theirs. They created the money in the first place and they need it back. So they can cancel, create more so they can spend more. To some of you I know this will be an awful awakening, it was to me when the truth sunk in. My savings are not mine, they never were. The savings I have weren’t created by my hard work and prudence – my savings are borrowed from the government and will be taken back eventually.

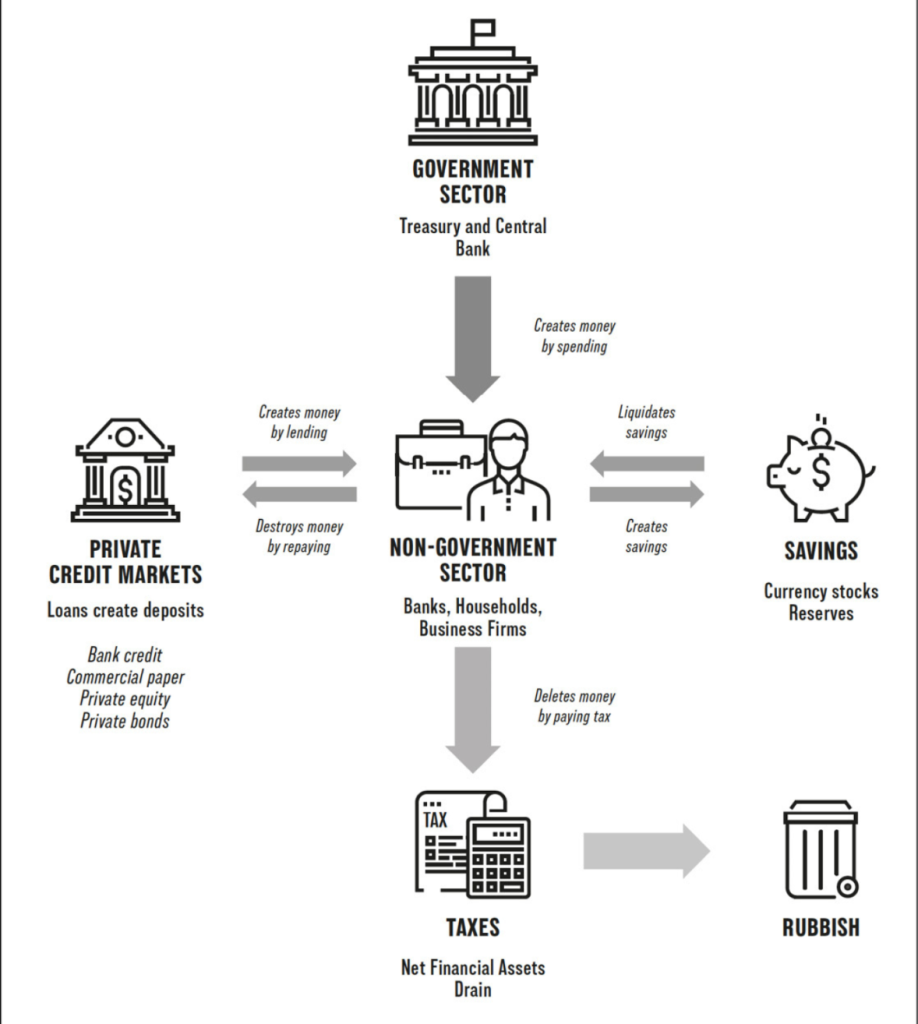

The diagram below explains the life cycle of money.

“The flow of money from the UK government into the economy is a vertical one. This is depicted with the downward arrows. This is different from a horizontal flow of money that takes place in private credit markets (essentially, banks) and the non-government, or private, sector. Horizontal money is created by banks and destroyed when borrowers repay loans. Over the long term, this does not add to the total amount of money in an economy because whatever is created by borrowing is destroyed by repayment. On the other hand, vertical money issued by the currency sovereign remains in the economy until it is drawn out by taxes, and then it is effectively thrown away. As an economy grows, it needs more money to facilitate transactions. This growing need for money is met by the government.”

Is there any way of simply keeping this hard earned money?

Well interestingly the Treasury has recently stated that currently £50 billion in notes and coins that have been issued is now unaccounted for. It’s gone walkies. I know DFS has sold a lot of sofas during its sales that always must end Sunday, but that’s an awful lot to be lost down the back of the nation’s settees. It’s been trousered. I wish I had some of that endlessly circulating cash, because the government won’t be getting that back in taxation anytime soon. However they do try to flush it out occasionally. How? They change the design of the notes and eventually cancel the old ones. Remember white £5 notes or 20 shilling notes anybody? No. You must remember green £1 notes though. Eventually even the Governor of The Bank of England reneges on his/her “promise to pay the bearer the sum”.

To recap. Money is a construct. We think we own it, the Government who created knows it alone owns it and will eventually want it back so it’s free to create some more and start the cycle over again. Horrific to hear I know. I feel like I’ve just told you Santa Claus doesn’t exist.

Now let’s move on to where inflation comes into the picture and whilst we are at it we could cover non-cash assets and finally move on to International flows of currency, goods and services and exchange rates. And finally as a bonus we can add in the reason I started this blog. Tariffs.

Personal and corporate savings are bothersome to Governments. They would much prefer we spend our savings. Especially tax free savings. Whilst we have our grubby mitts on the money, it’s no longer free to circulate in the domestic economy, producing evermore Corporation Tax, Payroll Taxes like National Insurance and Income Tax and finally VAT. Sat in an ISA it’s not productive for the government, just for us savers. Gordon Brown plundered the tax free status of pensions long ago, taking a taxation bite out of previously untaxed dividends. Successive Governments say they want the nation to save. BS!. They need us to spend with velocity. We spend £1, by paying somebody for something. That someone else can then spend that £1 – less tax. That £1 less tax is then available for another person or business to spend – again less tax. A few more iterations down the line and that £1 is worth far more in tax than just a £1. We savers bugger-up this gravy train of never ending tax. £1 sat in an ISA is just £1 sat in an ISA. Zero velocity – zero tax.

Inflation

Enter the villain stage left. Inflation. Inflation instills in us motivation. If I don’t build that kitchen extension this year, it will be more expensive to build next year. That new car only gets dearer. Everything goes up. Without inflation there is no urgency. With the opposite, deflation, we would be better off waiting till next year, when prices are lower. Our generation has never seen periods of deflation, but if we were Japanese we would have lived through three decades of deflation or stubbornly static prices. With no incentive to spend, Japan’s economy has suffered for years.

Inflation is necessary for Governments too. You see they are not households. Unlike us there is no need to balance the budget at the end of each month. Expenditure cannot exceed income for long periods for us mere mortals.. But for Governments who create the money anyway, they can run a never- ending deficit. (Don’t try this at home) A deficit is a nice harmless sounding word. The reality for us is that if we ran our finances like a government, eventually we would be told we are living beyond our means.

As well as being able to create money out of thin air, they can also borrow existing money held by others. Why would they borrow if they can just create it anyway? Well the greater the amount of money that is in circulation, the greater the number of holders of that money there are to chase the same number of goods and services. With more hungry individuals wanting to eat delicious crumpets, the higher the price Warburtons can charge because existing production runs out. Up the price and you can still sell out and make more profit. Hence more money created equals higher inflation. Better to borrow off a current holder and pay as little interest as possible. Hence premium bonds were born, long on promises but short on delivery. The largest amount of government borrowing however is in the form of fixed term gilts.

Now it’s OK to borrow as long as you can afford to cover the interest, and there are savers out there to lend you the money in the first place. Collectively lenders calculate the interest rate on the risk they feel they are taking. The higher the risk, the higher the interest rate they charge. The borrower has no choice but to pay. Long term inflation helps borrowers. £1 million borrowed years ago still needs repayment of £1 million today but as all prices and earnings have gone up by inflation, the debt has remained the same. Over the long-term, gradual inflation erodes the burden of Government debt. Or it would do if they didn’t stop returning to the begging bowl.

Selecting the correct level of inflation is similar to the story of Goldilocks. You remember her, the young wild bear botherer. There is a sweet spot for inflation of around 2% per annum. Too hot or hard and savings are eroded. Too cool and economies grind to a standstill and there is no tax income to cover those government debt payments.

Great Britain, was once a great empire, its s now an inconsequential island just off continental Europe. Like every other sovereign state, it has a domestic economy and trades internationally. We are in constant competition with other nations. I believe we are still number 5 in the largest economies of the world table. We import energy, overseas goods and services and we sell our goods and services overseas. The difference between what we sell and what we buy would be a surplus if we were born German or Chinese. But we weren’t, so we endure a trade deficit. We buy more than we sell. Remember at the start of this blog I said I would explain why we call money currency? Well it’s because there is an ongoing calculation of what Sterling is worth versus competitors like the Euro and the Dollar. It equates to what our pound is currently worth internationally. Our ongoing trade deficit means currency created by the UK, leaves the UK and is held by Johnnie Foreigner countries and businesses. As this money gradually seeps away we become increasingly more dependent, as Mark Carney put it “on the charity of strangers”. Because more money endlessly needs creating which needs to find overseas borrowers. We are not alone. The USA finds itself in the same position we are in, as does France and many other nations. There is an ever greater imbalance.

Hopefully if you have read this far you can maybe now see why The Donald wants change. With so many wealthy consumers he has the power to charge other countries for access to all those voracious US punters. He needs change because the future of the reserve status of the dollar depends upon America’s ability to service and eventually make inroads into that colossal $36 trillion debt. The once dominant SWIFT system is already under threat, with commodities no longer exclusively traded and settled in Dollars. China would kill to become the supplier of the next reserve currency to the world. It is currently working away behind the scenes to knock the US off the number one spot. I don’t use the word kill lightly. I have said for at least a decade that China declared war on the west but simply never told us.

Relatively both the UK and the French are in a similar debt position but without the consumer firepower that is needed to threaten tariffs on our trading partners. I’m afraid higher domestic taxation is on its way here in the UK. We will be increasingly forced to spend our savings to generate higher tax revenue. The irony of the situation is “The Laffer Curve”. The economic theory seems to have been proven right once again – once the percentage of tax increases above a certain level, the tax-payers start to revolt and less tax revenue is received. So far this year although UK tax rates are up, the amount of tax collected is down.

I think that covers most of it for today. Any questions?

Very interesting, in fact brilliant. Your blogs are always informative, and light enough to understand.

A very interesting read, yet again learnt something new

Very interesting Howard

I like particularly your funny party political bits !

Keep up the good work,and keep a good eye on our portfolio’s

Brilliant Blog!

Great blog Howard. Do I detect a bit of Sir Terry in there?