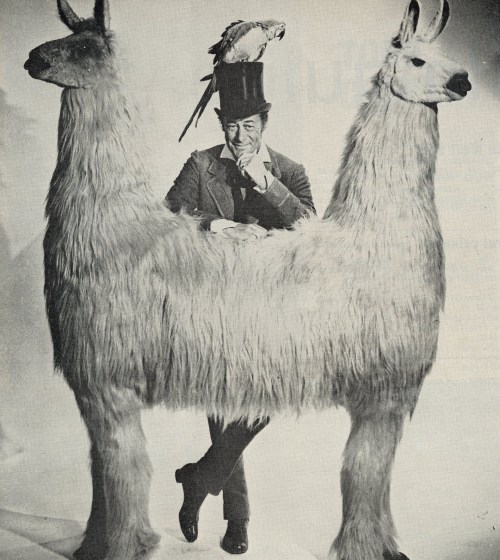

Risk is universal. If it’s not one type of risk it’s another. Fear of investing in case you lose out – versus – Fear of missing out by not investing. It’s very much like the Push-you-pull-me from Dr. Dolittle.

Our investors leave this “should they or shouldn’t they” to us. It’s up to me to go and have a quiet word with myself. So what am I looking for?

Indicators

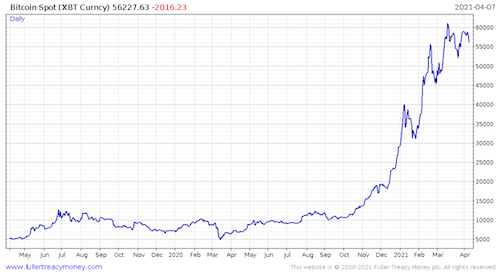

I’m a constant observer of what other investors are doing. It has become more difficult recently as the long-term balance has been upset by the number of short term speculators distorting the markets. The get-rich quick gang. So at times like this, it makes sense to watch what those speculators are watching. Bitcoin.

I’m not interested in buying Bitcoin as an investment for our clients, although shortly we may be able to get exposure through the mobile app many purchasers use, called Coinbase, as it floats on the Nasdaq on April 14th. I’m more interested in the guaranteed income streams the app will provide, rather than the wild fluctuation in the underlying prices of the crypto-currencies. Investing in Coinbase would be like owning the store that sold the picks and the shovels to the gold rush speculators.

So when Bitcoin is in the news, do one thing only. Avoid it. When it’s not making the headlines because of new highs, it’s in the news because the price has plummeted, taking with it another load of suckers that have handed their savings to the markets manipulative professionals. When it makes new highs it becomes newsworthy and when it drops dramatically it becomes newsworthy too. But it isn’t in the news currently. The price shot up and has stayed put for a few months. That’s unusual. Bitcoin can be seen as the lightening rod of excessive speculator risk, therefore it remains a good indicator of risk taking at the extremes. Currently it says nobody is taking more risk, but nobody it taking less risk. That is quite a change. Unusual as I said.

It is therefore unsurprising that the last three months for our portfolios have likewise remained broadly flat.

Flat is good

After a dramatic period of growth, a flattening off is a good thing relative to the alternative. When values shoot up they tend to defy gravity for a while and then suddenly drop back. Values tend to rise too far too fast. Currently values have shot up, but then have levelled off for a good period. We often see this as the markets “catching their breath”.

What is the trigger then, that send values climbing once again? Well it’s usually a short drop, bringing values back to a buying opportunity and from there we are off at the races again. The alternative is that a flat market just drags on and on until finally investors believe assets are cheap because they haven’t risen in price for a long time.

My hunch this time is a quick re-rating of no more than 10%, bouncing back quickly and then rising upwards again. Probably triggered by speculative assets like crypto-currencies losing at least a third of their “value”in the short term. That is why I’ve mentioned Bitcoin.

What do I know?

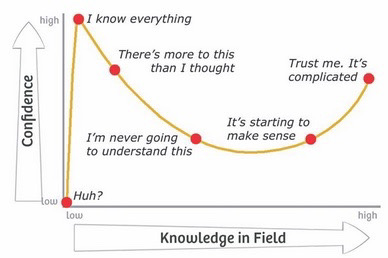

I was reminded recently of the journey we all take as investors. I think the chart below nails our journey perfectly.

So after 34 years I’m at the point of understanding that no person can understand everything, but by understanding you can’t know everything, it gives you the edge over those who think they already know it all. Stronger hands taking from weaker hands.

Enough of short-term crystal ball gazing.

Let’s look at how our portfolios have done.

- I’m not going to focus on what has happened since the start of the year – broadly positive but not by much.

- I’m not going to look at how we have performed over the last 12 months – tremendous but very misleading as the period commenced after the fall.

Instead I’m going to save both you and me some time and re-focus on a much longer period because after all, we are all lifers. We are investors forever. 12 months on from the investment crash following the global outbreak of a novel Coronavirus, have our collective life ambitions and goals, backed up by our life savings been well and truly flushed down the toilet? Thankfully not, otherwise I wouldn’t be bringing it to your attention.

Rather than repeat January’s blog here, I’m going to save some time by referring you back to that last quarterly update . Add the table below and you can see not much has changed.

| Portfolio | 3 month return |

| Cautious | 0.5% |

| Moderate | 1.5% |

| Adventurous | 2% |

| AIM | 1% |

| Go for Growth | 5.5% |

Next Move?

Everyday since mid February I have been the double headed beast that can talk to Dr. Dolittle. An unhealthy mix or Fear and FOMO. Sitting on my hands is very uncomfortable, but occasionally it is the best option until the odds tip one way or the other.

This year currently feels less and less as a “sell in May and go away” year. Last year we pushed the go button rather than the stop button. But from those depressed levels common sense dictated markets would recover over time. This summer could be another blockbuster as so much bad news has already been factored in. The FTSE 100 remains 15% lower than it was 3 years ago.

I just wanted to say thanks for the updates and the general reassurance in these troubled times. I’m sure that you sometimes feel as though you’re dropping your words of wisdom into a black hole. I just thought I’d raise my head above the parapet for once and assure you that they are appreciated.