Here’s some generations old investment advice that is still valid today.

A penny saved is a penny earned.

Reducing the cost of investment is really the only area over which we have complete choice and control. I’m basically tight. I like value for money. By controlling costs and not surrendering a couple of percent a year to Insurance Companies, Star Fund Managers and Crazy Complex Schemes I know our long term savings will grow faster.

Don’t count your chickens before they are hatched.

There are literally hundreds of investment “opportunities” that find their way into my inbox every year. They “guarantee” future returns of 18% a year. I’m not interested. Don’t just promise me chickens, I need to see them and count them before I invest.

Don’t put all of your eggs in one basket.

This year in particular, many who put the majority of their savings solely into large dividend paying shares have seen huge losses. I likened it to being all on the same side of the boat. Diversification is the only free lunch in investment.

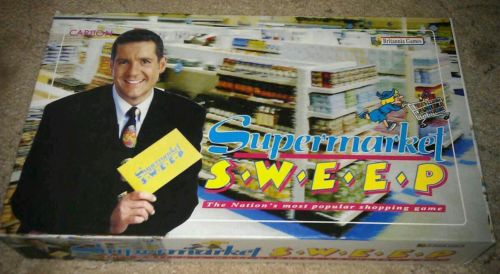

Never go shopping on an empty stomach.

Go into a supermarket when you are hungry and your trolley will end up overflowing. You not only buy what you need, you buy much, much more.

So when should we assess our attitude to investment risk? Does it change over time? Could it be higher when we feel the markets are just rising and rising and we have the appetite to invest. Does it drop lower when our investments have suffered a recent setback?

I’m considering taking a part-time MSc in Financial Planning & Business Management at Manchester. If I can collect enough data to make it possible. So I need all of your help now. Below is a link to our latest on-line risk profiler. You have all done something like it with me in the past. You have all completed it at different times over several years when the investment markets were at various levels. I would now like to take a benchmark of all of my clients this week. Because the start of this year has been poor for investors and there is so much doom and gloom in the media.

It should only take 20 minutes to complete. We have 180 clients and I’m looking for at least 150 assessments. There are just 12 questions. Please help.

I’ve written my latest blog for you to read before you take the assessment. It explains why I use the old speedometer graphic to try to explain risk to clients. The link to it is on the same page as the assessment. Click Here