Nostalgia ain’t what it used to be

Benny Hill bagged the Christmas number one with “Ernie” who drove the fastest milk cart in the West. The song was a personal favourite of mine at the time and it still makes me smile to this day. My excuse for liking it so much then? I was only 10, but now I’m approaching 54.

If any of you hanker to see the video again, then I have added a link to the youtube video below. WARNING: For those of you who are very politically correct, please look away now.

Anyway, Benny Hill has nothing to do with investment, but when I hear Ernie……

E.R.N.I.E

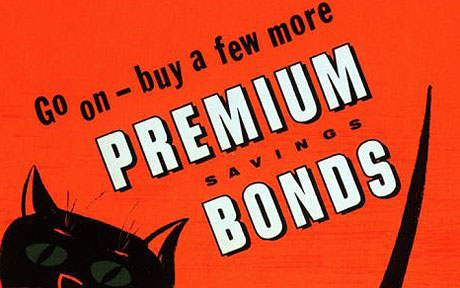

Yesterday I attended a meeting presented by the Director of National Sales, the NS&I. The old National Savings. Promoters of Premium Bonds and such. Long sold by the Post Office, but no longer. NS&I are reaching out to Financial Planners to recommend more of their products as part of a well balanced investment portfolio. They have got all trendy and digital now. Ernie, short for Electronic Random Number Indicator Equipment is currently at iteration 4, no longer does it look like Joe 90’s lab, it’s a state of the art computer. The link above will take you to the new website and a fabulous old film about Ernie. I feel I have now played my part in directing you to the products available from NS&I. Please don’t consider this a recommendation to buy their products, as you know my blogs are never to be seen as sound Financial Advice.

On Budget day, 17 April 1956, Harold Macmillan announced the launch of Premium Bonds. His intention was to reduce inflation and offer an alternative way to save.

What’s in it for them?

Interestingly the primary role was to reduce inflation. So, created by Government you have to ask, what’s in it for them? NS&I products currently hold £120 billion, their target is to increase that total by £2 billion a year. In reality £10 billion a year leaves NS&I products, which means they have to find £12 billion annually. They are prevented from gathering more, as they would literally close down the banks. Try to find me a bank that doesn’t have an outrageously poor offering currently. It seems NS&I are forced to let them get away with it.

820,000 individuals own £30,000+ of NS&I products. 4,000 individuals have £1 million+ It’s not hard to see why. All money is backed by the Treasury. Safe as houses. After all as a country we only owe £1.3 trillion in total. Good old Blighty would never default on it’s debt mountain 🙂

The bit that caught my eye

The annual budget to run NS&I is £150 million. That just about covers the usual business stuff; marketing, admin, salaries etc. A slide in the presentation boasted that last year National Savings created a saving to the UK tax-payer of £330 million. At the end of the presentation I had to ask the question “How did you work out that £330 million figure?”

The answer was simple. Money raised by NS&I goes towards servicing the National Debt. £120 billion borrowed has been given to the Treasury. It costs the Treasury £150 million each year in expenses to maintain. If the Treasury was forced to borrow the £120 billion from other sources, e.g. Government issued Gilts, they would be forced to pay additional interest to the tune of £480 million. So net £480m-£150m means they had saved UK tax payers £330 million by borrowing the public’s money. I was delighted by the tax saving. If I personally held any National Savings products myself, I would feel diddled…

Has anybody ever met a Premium Bond millionaire?