According to Urban Dictionary, something that “goes viral’ is an image, video, or link that spreads rapidly through a population by being frequently shared with a number of individuals. It sounds like a good thing to experience

For several weeks now though, we have all watched in horror as a real deadly virus has spread rapidly through a population by being frequently shared with a number of individuals. The true meaning of going viral has reared its ugly head in mainland China, across the world and even on to our shores.

Ever accelerating growth

Nature compounds. We can witness it everywhere in nature. From deadly viruses to cute bunny rabbits.

Credit is given to Leonardo Fibonacci for first documenting the compounding rate of nature in 1202. He was a monk with time on his hands.

How many pairs of rabbits placed in an enclosed area can be produced in a single year from one pair of rabbits if each pair gives birth to a new pair each month starting with the second month?

Breeding like rabbits is still a popular phrase today. So here’s what he came up with. Just two rabbits and you turn your back for a year results in an astonishing 288 rabbits.

the golden ratio

This compound growth rate can be seen everywhere. It’s natural. In nature only the time frame changes. From multiple times a second for bacteria to multiple times per hundred years in trees and indeed forests. I’ve used the ever increasing growth spiral in our company logo for many years to depict the compounding growth rate of our savings too.

natural balance

If you collect 288 rabbits in one place, in no time at all birds of prey arrive for lunch. Nature will always address excesses of supply and demand. Otherwise the planet would be plagued with rabbits. Predator numbers rise and fall depending upon the quantity of prey. From mammals to amoeba, nature balances excesses out. Except with man, we no longer have any natural predators. When I was born in 1961 mankind numbered 3 billion. We are about to reach 8 billion. We should expect more deadly viruses in the future and we should expect them in the densest areas of population. Mother Nature has taught us what to expect with MERS, SARS and avian flu.

Covid – 19

I admit it’s a first world problem worrying how a deadly virus is going to affect our life savings. Families across Asia are losing loved ones I know, but I’m paid to look after our investments so we can look after our loved ones. COVID – 19 seems a world away, but manufacturing supply chains are increasingly global. Many businesses including U.K. ones will run at a less than an optimal level for one or two business quarters. That should be bad news for share prices.

We plan we don’t panic

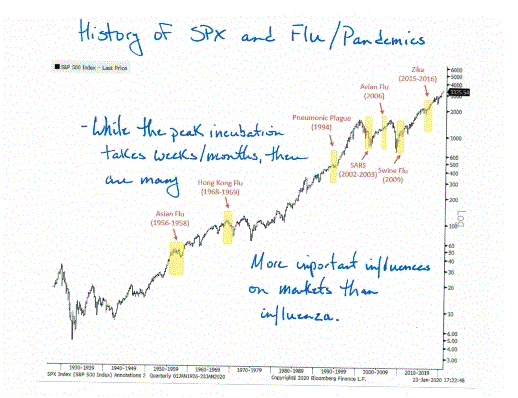

As always we will continue to monitor the situation. Sometimes we need to sit on our hands and not react to every potential issue as it unfolds. Even though an increasingly alarmist media often tempts us to. Better to spend the time looking for the parallels from history. Here’s the data I found on previous epidemics versus the S&P 500. I’m sorry the quality of the image is poor, but the chart shows clearly that investment growth continues.

We continue to work on the assumption that the current containment measures will get on top of the virus. Many more will die in China, but the number of new cases will start to fall and the survival rate will rise once medical supplies and effective treatments arrive. All previous epidemics caused the markets to falter initially, but the rebound was swift. We will continue to monitor the changing situation and take action if and when it is required.

market stimulus to the rescue

So far stock markets have been humbled but have not crumbled. China will be forced to spend enough money to rebalance the situation and other nations will prolong their “lower interest rates for longer” policy to provide further stimulus. The expectation is that goods will finally be delivered and the demand will return and probably increase for a while by way of a catch up. Recession, particularly in the US will be averted once more.

I have often repeated, “never bet against the FED”. When interest rates rise, stock markets fall. The expectation is that COVID – 19 has kicked the inevitable decision to raise rates into the long grass for now. And perversely that’s a good thing for markets.

viral disruption

Ideas go viral too. Over the last month, the idea that a start up car company could survive, perhaps thrive and maybe even dominate a 100 year old business by killing off its competitors in less than a decade, has been brought home to US investors. Granted, many of the legacy car manufacturers are also currently trying to recover from self-inflicted diesel wounds and the lack of investment, but Tesla has begun to transform our expectation of the future of personal transport. Tesla’s share price has grown virally too. I wish we could have all owned that one. But the point is that change is inevitable and we can all prosper by investing in companies that disrupt today’s status quo. It’s the reason behind many of our share-holdings currently. The objective of prospering when a crazy idea today becomes mainstream tomorrow. I do believe that Tesla perhaps is undergoing its “tulip hype moment”, we can expect more imitators and predators and perhaps see that share price fall. But innovative companies like Dyson and even Apple have postponed their attempt to emulate Tesla’s innovations.

Recent Share movements of note

Nucleus released its results recently which has brought it to the attention of many of the UK smaller shares fund managers who promptly started to buy, driving the recently depressed share price up from £1.30 to £1.80 to our collective delight. I expect more in the future as they continue to put their customers at the heart of the business and concentrate on the long term. 0 to £16 billion on the platform in its first 10 years. That’s almost Tesla fast!

In January we sold Carnival for £33.00 a share. It’s the owner of 50% of all cruise ships in the world, including Princess Cruises. It’s nice not to worry about owning that one any more. The share currently trades below £30.00.

Also in January we sold Royal Dutch Shell for almost £23.00 a share, currently they trade at just below £19.00. Perhaps the Greta Thunberg factor encouraged me to ditch the oil and gas company.

We have also sold our Direct Line shares. I’m pretty sure the fall out from COVID – 19 will result in less profit for all insurance companies that provide travel insurance. Coupled with the extreme wet UK weather, future profits have to suffer. It’s share price is still hovering around the £3.40 we sold at.

let’s talk

Tell me what you think about the virus, electric v hydrogen cells, the planet, the growing population…. anything you feel we should be talking about as investors.

Hi Howard here’s one for you….

Is there a company making hydrogen trains? As HS2 is the biggest infrastructure project this country as ever known, its cost could be greatly reduced if the overhead electrification wasn’t required.

Hi Ken

Thanks for the question. I believe there is a lot of work to create hydrogen cell buses so trains would make sense too.

As a slight aside, trucks are heading towards either CNG or LNG as a replacement for diesel and having good results. Not that I would have liked taking a load of explosives on top of a big tank of gas!