Now we have safely got our feet under the table of the new decade, it’s time to look back to see how we fared in the last decade. We are in the “twenties” now. We have a name for this decade. I think the last real named decade was the “nineties”, the “noughties” and the “tens” just didn’t cut it. Let’s hope we are entering the “Roaring Twenties” once again. Thankfully the “tens” weren’t terrible, in fact for investors I would go as far as saying they were the “Terrific Tens”. There that sounds better already.

our central investment philosophy remains intact

I have believed for 6 years now that the Global economy is within a secular growth trend. Secular simply means long-term in investment speak. The more usual trend is cyclical, the one all financial commentators comment about. Cycles are much shorter term, typically expressed over a “seven year business cycle”. Cyclical trends still exist, but they are never boom and bust during a secular growth trend. They remain compressed, up a bit – down a bit. Here’s what I wrote in my January 2014 Investment Review. It’s well worth a re-read for my older clients and a first read for anyone who became a client since 2014. In short I believe the markets are set to expand gradually over a 20 or 25 year period. I believe it began in 2013.

so how have clients fared over the last decade?

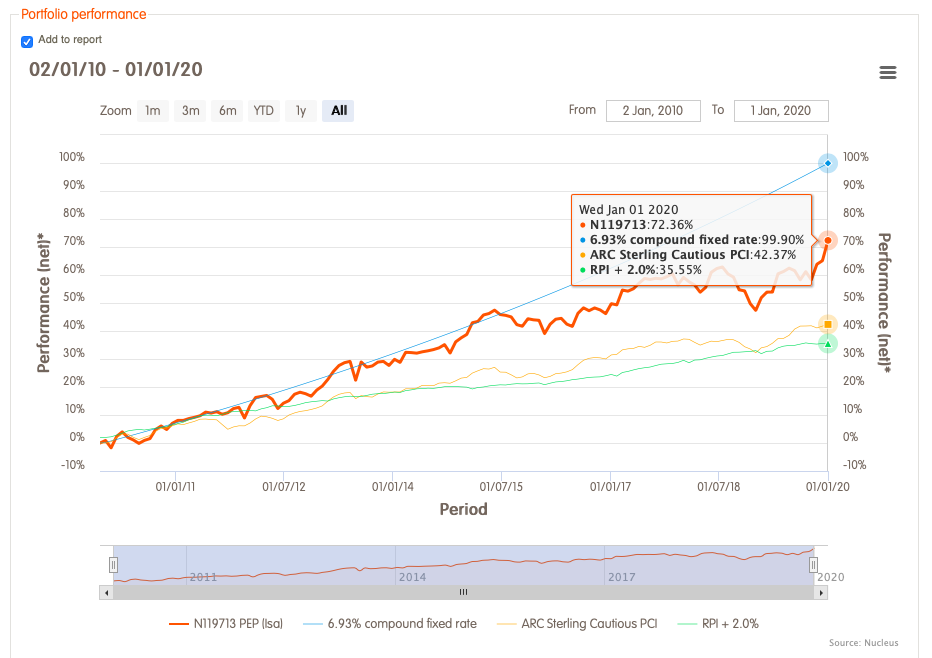

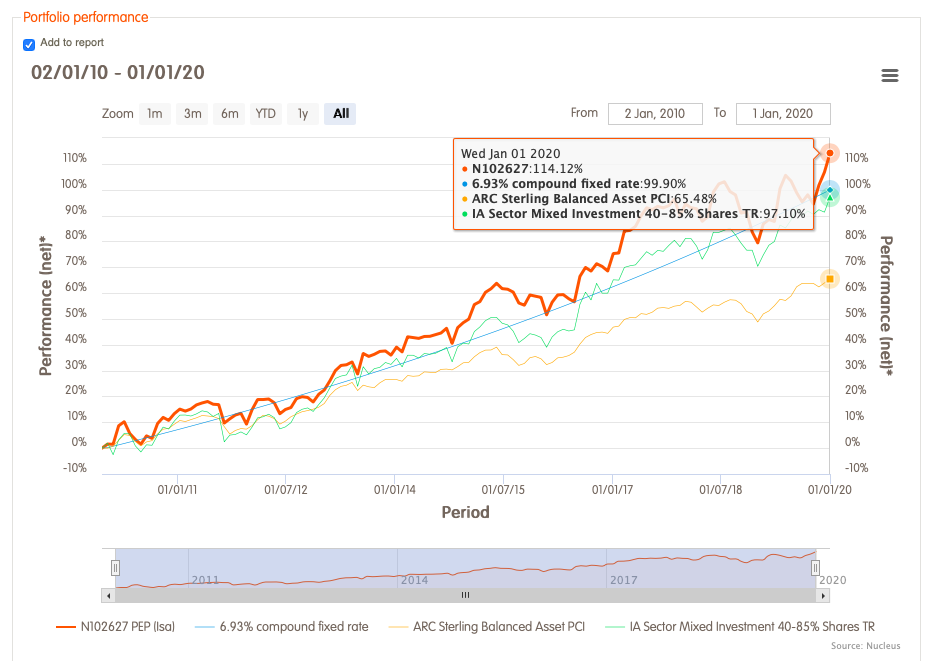

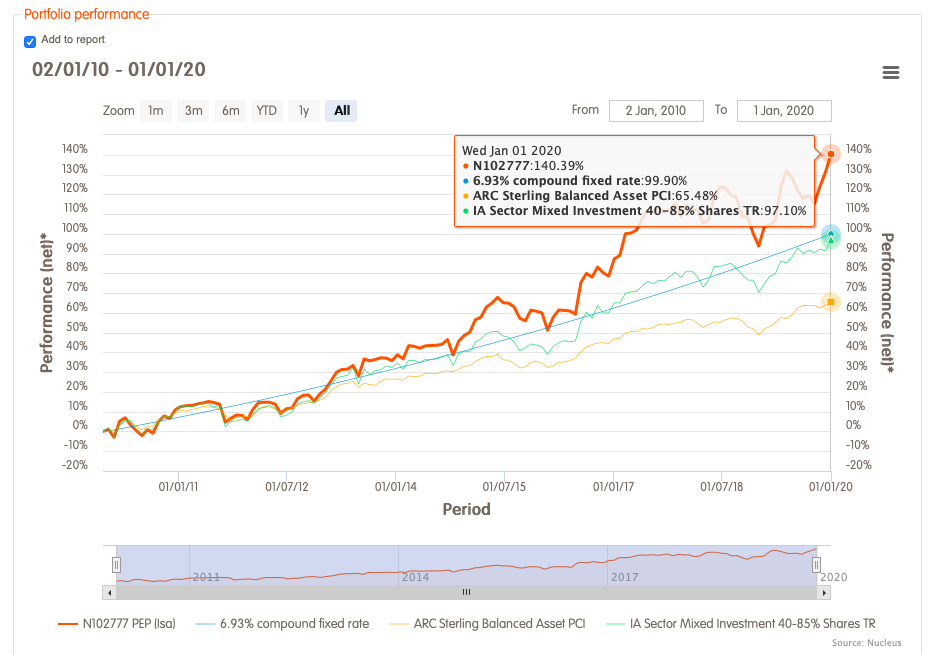

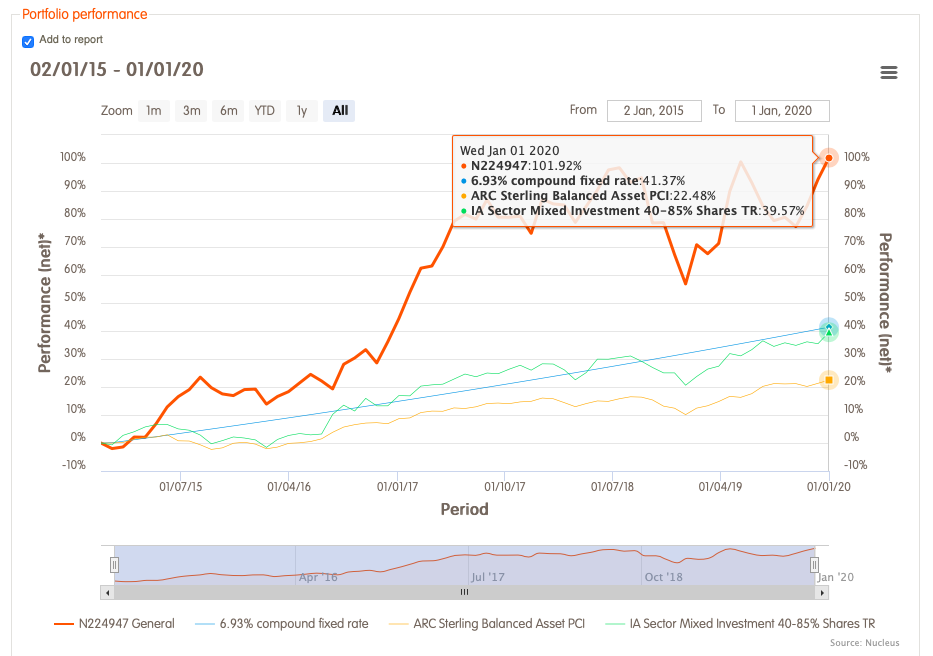

As a rule of thumb, life savings can double over a decade if a growth rate of 7.2% is achieved. It’s known as “The rule of 72”. Since our portfolios compound on a daily basis 6.9% is a more accurate measure, but more difficult to calculate in our heads. On our charts the blue line is the doubling over a decade comparison, whilst the orange line is our Managed Portfolio.

For those of you who prefer numbers to charts

| Portfolio | 5 Year % | 5 Year £ | 10 Year% | 10 Year £ |

|---|---|---|---|---|

| Cautious | 24.23% | £1242.30 | 72.36% | £1723.60 |

| Moderate | 42.92% | £1429.20 | 114.12% | £2141.20 |

| Adventurous | 60.66% | £1606.66 | 140.39% | £2403.90 |

| AIM | 101.92% | £2019.20 | – | – |

The AIM or Alternative Investment Market Portfolio commenced 1st October 2014, hence only 5 years performance figures are available.

in conclusion

As always we remain vigilant. Our central investment philosophy will remain the same until it becomes clear that facts have changed. We will try to continue to drawdown profits when we feel the markets have got ahead of themselves and re-invest when we believe that markets have fallen to good value. We will buy the dips and sell the crests. All the portfolios performance quoted above relate to our Growth Portfolios. Income Portfolios by their very nature need more cash to fulfil individual drawdown and surrender requirements.

Here’s to the “Roaring Twenties”

The usual

This blog does not offer financial advice.

The value of your investments can fall as well as rise.

Past performance isn’t necessarily a guide to the future.