2020 ended up being the most difficult investment period I can remember in my 33 year career. I could be wrong, as you do tend to remember only the good times and conveniently forget the bad. Both 2011/12 and 2018/19 were years where we lost some of our profits, so the difficult conditions encountered last year were eased by the fact “this wasn’t our first rodeo”.

That said 3 of our portfolios actually ended the year in profit whilst the other two ended broadly level. It seemed like a huge amount of work for very little return.

The scores on the doors.

| Portfolio | 1 Year % | Max Drop in March % |

| Cautious | -0.01% | 38.24% |

| Moderate | 3.81% | 28.45% |

| Adventurous | -0.30% | 40.41% |

| AIM | 2.57% | 46.28% |

| Go For Growth | 20.86% | 55.31% |

| FTSE 100 | -14.34%* | 33.99% |

| FTSE 250 | -6.38%* | 41.37% |

Are our results good or bad?

Only our clients can be the judge of that and of course we can only thrive as a company if our clients feel they are receiving value for money in return for the overall service we offer.

Since we invest in the main in UK shares it’s important to acknowledge that over the same period, both the FTSE 100 and the FTSE 250 both lost money. Thankfully we don’t opt for the easy life and simply track the indices.

Did we miss a trick?

Although we may only hold shares traded on the London Stock Exchange, let’s not forget these companies are global in their reach. Indeed, over 70% of the income generated by the FTSE 100 companies comes from outside the UK.

Whist we did far better than the UK stock markets suggest, other global stock markets did somewhat better. The US in particular powered ahead. This was due to 25% of the S&P index being formed of shares that contain world beating companies that develop, manufacture and distribute computer technology and software. These companies have been the lockdown winners so far. In the UK there is less than 2% of the FTSE All Share index that could be called a tech share. We already own most of them.

In many ways we are fighting with one arm tied behind our back. It’s an ongoing issue as I continue to lobby Nucleus to allow directly held overseas, predominantly US shares, on the platform. My efforts last year were thwarted due to Covid – 19 and the lack of appetite from other advisory firms who solely track indices. Hopefully Nucleus is now closer to committing resources to the platform changes needed and fellow advisers can now see the issues involved with index tracking. If not, I have to weigh up the convenience of the Nucleus award winning software, with an alternative platform with a wider investment choice but perhaps much poorer customer usability.

Of course I could just buy a US fund, but as in the UK, I have no wish to hold a bunch of losers along with a handful of winners.

What’s another year?

Of course all of the investment decisions we take are with the long term in mind. We have a plan and we stick with it. One year is meaningless because we manage life savings over decades. Last years winners become this years losers with astonishing regularity.

A change from Republican to Democrat controlled government in the US signals issues ahead. Look out for countless anti-trust legal cases springing up in the US, targeting the non-payment of US taxes amongst the tech giants. To explain further, for Republican think Conservative, for Democrat think Labour, for anti-trust think monopolies and tax-evasion. Joe Biden thankfully is no Jeremy Corbyn as Bernie Saunders undoubtedly was, but the power has shifted in the US and the advisers behind the elderly forgetful soon to be president are far more left leaning than Kier Starmer appears to be. Not great for the US market.

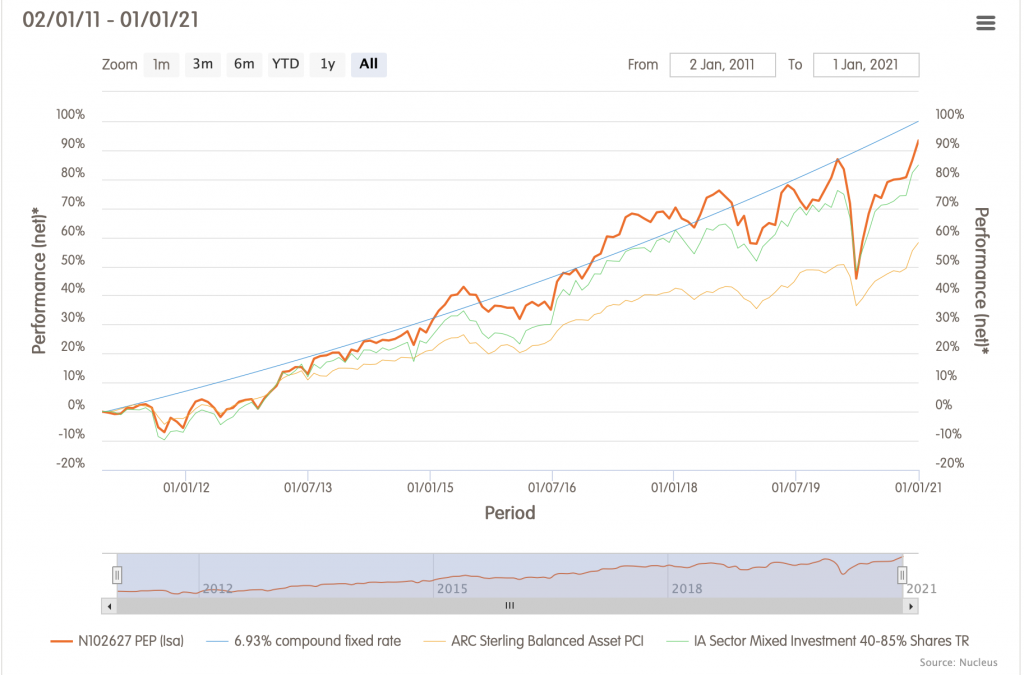

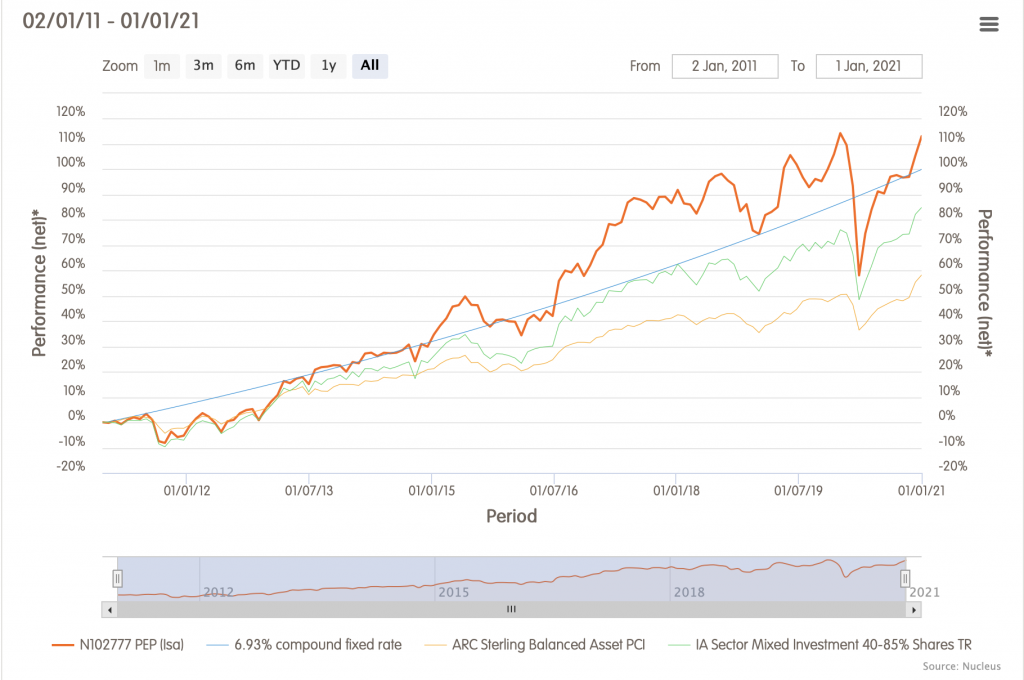

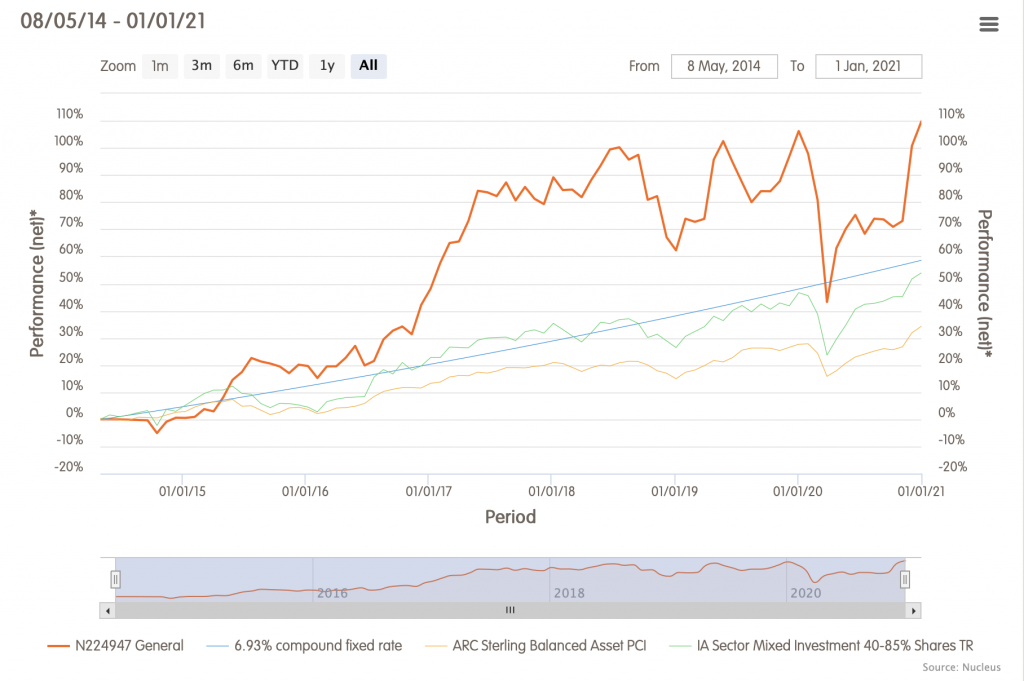

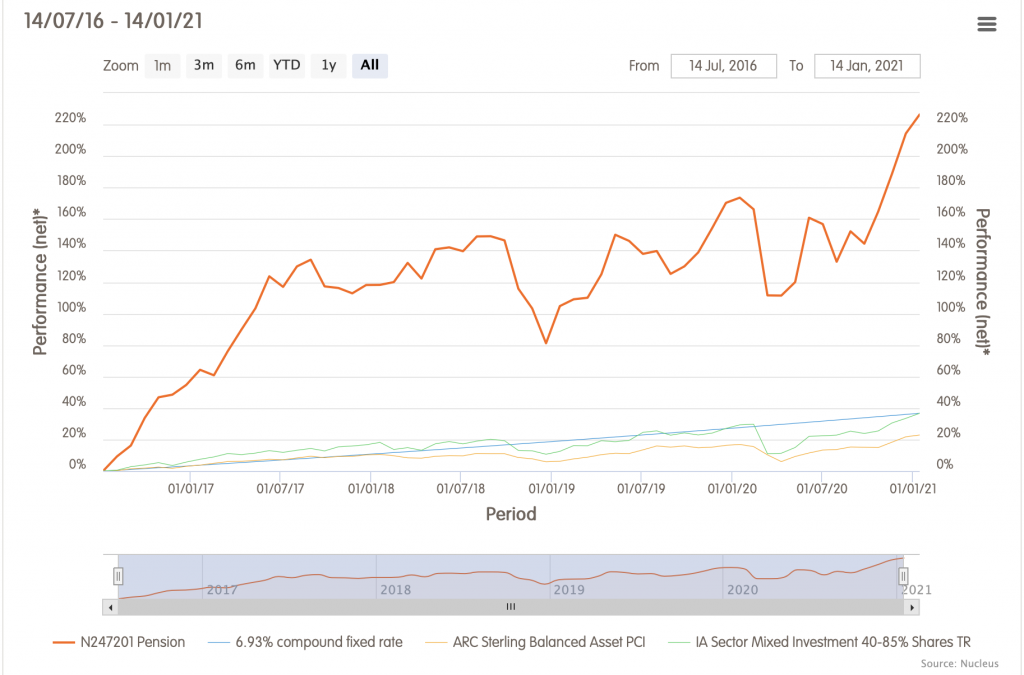

As a rule of thumb, life savings can double over a decade if a growth rate of 7.2% is achieved. It’s known as “The rule of 72”. Since our portfolios compound on a daily basis 6.93% is a more accurate measure, but more difficult to calculate in our heads. On our charts the blue line is the doubling over a decade comparison, whilst the orange line is our Managed Portfolio.

Cautious

Moderate

Adventurous

AIM

Go For Growth

Please Get In Touch

2020 was a rollercoaster year. We can look back with a sigh of relief that when the global population and market participants panicked, eventually level heads returned. It’s hard to remember how bad we all felt at the time, but if the memories are still raw and you never want to experience that again, perhaps adopting a lower risk now would be prudent. You are free to switch between our portfolios at any time.

If however you took it all in your stride, then you are currently invested in the correct portfolio.

I’m looking forward to the recovery potential that will undoubtedly come once the world returns to some kind of medical and political normality.

The Usual

This blog does not offer financial advice.

The value of your investments can fall as well as rise.

Past performance isn’t necessarily a guide to the future.