Another Quarterly Review

I have been writing these reviews since January 2011, so I decided to read my very first one again. It seems things have changed very little in the last 7.5 years. The FTSE 100 is still the roller-coaster it was back then.

These updates over the last few years were designed to be read alongside your valuation emails, which gave a personalised snapshot of how your investment portfolio has performed. However this now needs to be changed. Here’s why.

MiFid II Compliance

The new European Directive which came into force in January ushered in a new reporting regime. Previously, platforms sent bi-annual statements, now that frequency must become quarterly. So each quarter you will each be receiving much more than just a snapshot valuation. You will be receiving complete valuations and transaction summaries. These will be in much more detail than the snapshots that we previously sent. There seems to be little point in duplication.

Platform Usage

Many more clients regularly logon to Nucleus and Investcentre than they did 7.5 years ago. Who needs a quarterly snapshot when we all have access to our investment balances 24/7?

GDPR Compliance

The General Data Protection Regulations that came into force at the end of May have dealt a death blow to us sending any personal financial information to you via email unless we password protect that email or any document that contains personal financial information. We are still trying to find a system secure enough yet simple enough for us all to use with ease. I struggle to remember passwords like the rest of us.

Financial Crime Prevention

Locking our houses and locking our cars are second nature to us all. Just like putting on a seatbelt. It’s now time to lock up our personal data. We are all targets of organised crime. In my next blog I will share with you a cautionary tale of our brush with criminals recently. It was a very professionally executed scam that could have easily resulted in a £30,000 loss to any company with less stringent controls in place.

So in response to taking data security seriously, you will each receive an email shortly asking you to give us a password so we will know immediately if any requests we receive from you are genuine and any documents that we send to you cannot be opened by third parties.

If you have difficulties logging on to the platforms or would like to see our usual quarterly chart, just speak to Melissa and give her your preferred password over the phone.

So now on with the investment review…

Half Time Score

“Both sides have scored a couple of goals, and both sides have conceded a couple of goals.” – PETER WITHE – 11 England Appearances

Where did the first half of 2018 go? We are half way through the calendar year now, let’s hope 2018 will be an investment game of two halves, because the first half was end to end excitement, but sadly finished only in a draw.

“I never make predictions, and I never will.” – PAUL GASCOIGNE – 57 England Appearances

Now we are fully into the lazy summer months, we can expect a boring, cagey, niggling start to the second half, with the excitement not building until much later on in the game. I hope our investment goals this year are reached well within regular time and don’t become reliant on a last minute penalty shootout to generate our results. If we have to wait for a Santa Rally to bring the returns it could fray some nerves.

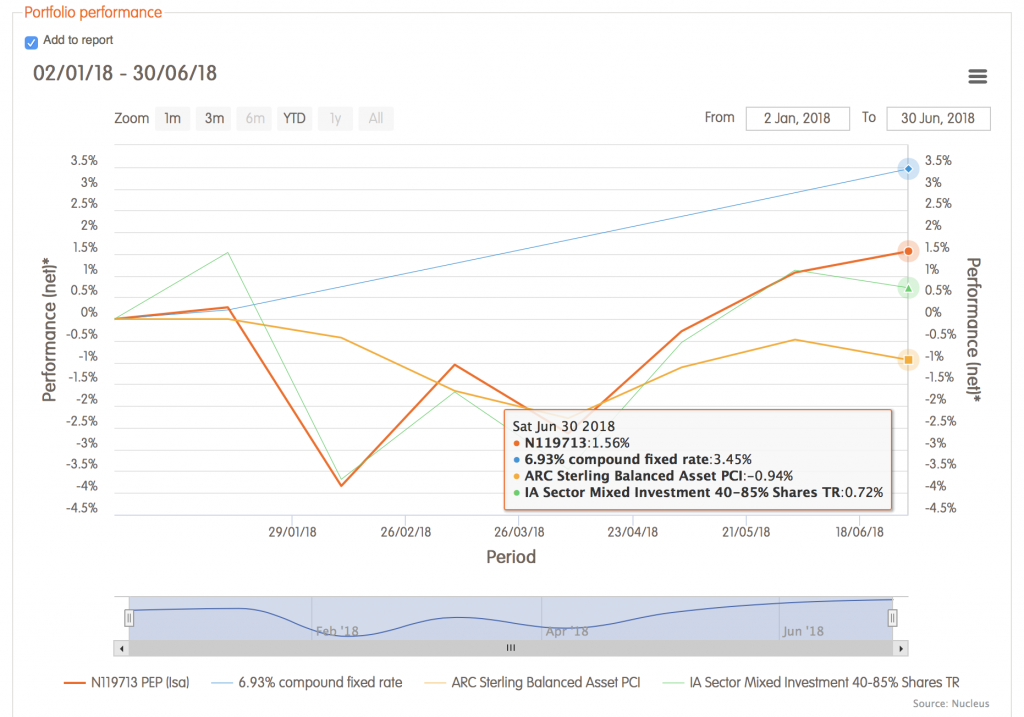

Cautious Portfolio Results

“If history repeats itself, I should think we can expect the same thing again.” – TERRY VENABLES – 2 England Appearances

Our Cautious Portfolio continues to do what it says on the tin. Whilst the FTSE 100 dropped by a huge 11.5% earlier this year, losses in our Cautious Portfolio were contained to just a 4% drop over the same period. Our portfolio has since gone on to give a return higher than the FTSE 100 over 6 months pushing back into positive territory.

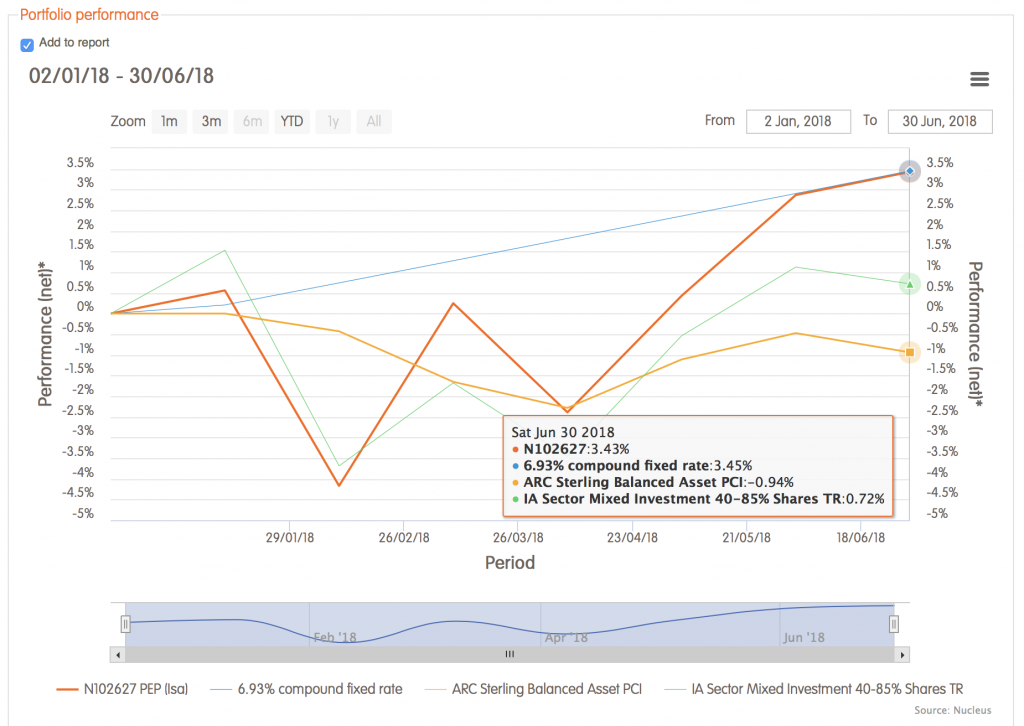

Moderate Portfolio Results

“That was in the past – we are in the future now” – DAVID BECKHAM – 115 England Appearances.

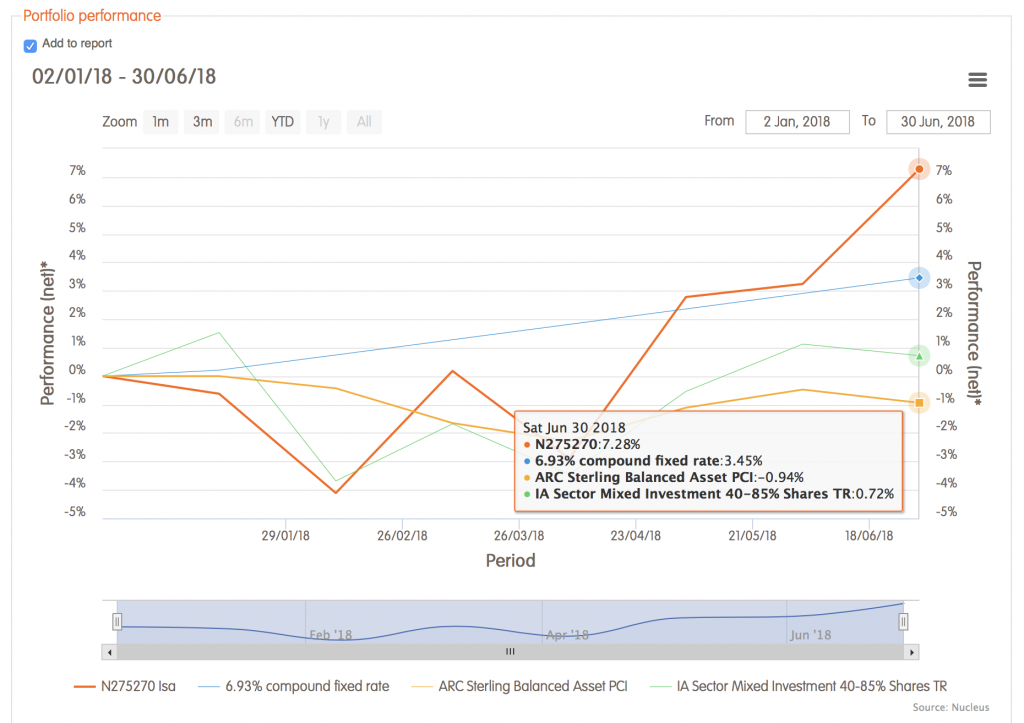

Our Moderate Portfolio comprehensively beat the returns of it’s peer group once again over the last six months. It isn’t just a flash in the pan. Our Moderate Portfolio has been bringing in better returns than it’s peer group over more than a decade now. Don’t forget that the chart above shows your return after we have been paid and all dealing and platform fees have been settled. By comparison the chart benchmarks do not take account of advice fees or platform costs which together amount up to around 0.7% over the period. It means our peer group, like the FTSE 100 index struggled to generate a positive return over 6 months. We will work to carry on that performance into the future.

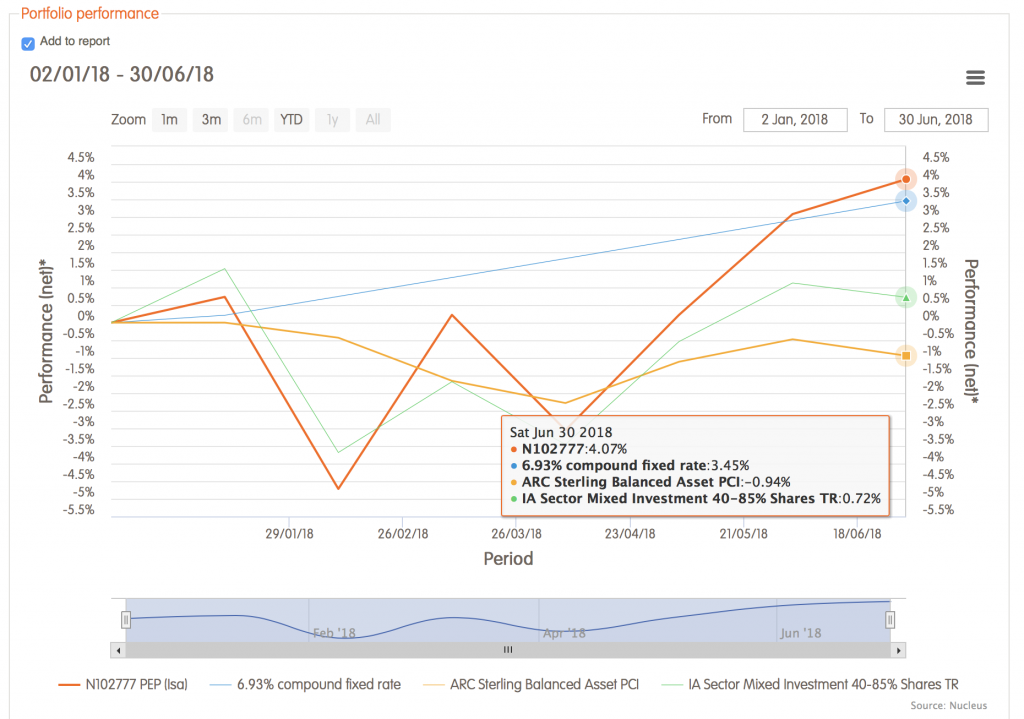

Aggressive Portfolio Results

“The thing about goalscorers is that they score goals” – TONY COTTEE – 7 England Appearances

Our Aggressive Portfolio is for those amongst us who can live with larger daily ups and downs than those experienced within the average moderate portfolio. If our Cautious Portfolio is set up to defend, this portfolio is set up to get results. With a 4% return over a very flat six months we have converted our chances into results so far.

AIM Portfolio Results

“Well Clive, it’s about the two M’s, Movement and Positioning” – RON ATKINSON – 0 England Appearances

Our newest portfolio has not quite been around for 4 years yet, but has doubled in value and beaten the best. The team has no goalkeeper or defenders or mid-fielders. It consists of only out and out goalscorers and has frequently been caught offside as it is always fully invested. Our management is very focused with a team of just twenty FTSE Alternative Investment Market shares, with some substitutes and some team rotation. All of the shares also appear on loan in our Aggressive Portfolio and half regularly appear in our Moderate Portfolio.

Interestingly, because the Portfolio has very limited global exposure, the chart shows it wasn’t caught offside during the recent US initiated volatility, falling only as much as our Cautious Portfolio.

The Small Print

This blog does not offer financial advice.

The value of your investments can fall as well as rise.

Past performance isn’t necessarily a guide to the future.