I’ve never written two blogs in consecutive days before, but yesterday will go down in history as special. In the end I bought nothing and sold nothing for a couple of reasons

- I had decided that I would wait until the US opened at 2:30, knowing I rarely commit to a purchase or a sale on a Friday afternoon anyway.

- It would have been impossible to act like a pirate on the day as systems crashed up and down the UK under the sheer volume of trades. Nucleus remained operational, but Investcentre broke down in the morning. They weren’t alone, Hargreaves Lansdown crashed, leaving 100,000’s of investors panicking.

In the end Brexit was more a political event rather than an investment event. Although the FTSE 100 still ended the day down, it recovered much of it’s lost ground and unbelievably it still ended the week up! Our currency took a battering initially but recovered a little later. Against the Euro it is virtually at the point it was all the way back as long ago as……… April 9th this year. Not significant I would suggest.

England 1 – European All Stars 0

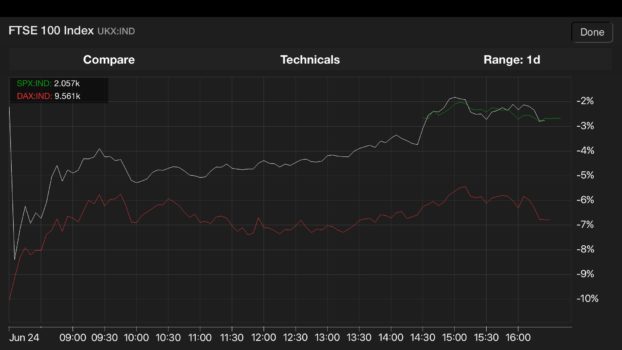

The stock markets are telling us that it’s not the UK that’s broken, it’s closer European Union that looks very broken. Take a look at the chart above. It’s hard to see but the main UK FTSE 100 market ended the day 3.5% down whilst the main German Dax market ended the day 6.82% down. The Germans weren’t alone. The French lost 8%, the Irish 8%, the Italians 12%, the Dutch 6%, the Spanish 12%, the Portuguese 7% & unsurprisingly I guess, the Greeks lost 14%.

The Fat Lady hasn’t sung yet

Friday’s rally after the initial dramatic fall isn’t the end of this story. Cameron announced his resignation and did not deploy the “nuclear weapon” of Article 50. Brexit has won the day, but Brexit hasn’t happened. The markets at the end of the day reflected that. We can expect more wild swings over the Summer.

Thanks Howard. Some steadying words amidst the political mayhem! Just keeping my fingers crossed that we don’t get twin blond-haired nutters in charge of countries either side of the Atlantic later this year!

Brexit may not even happen, parliament has not spoken and delaying chapter 50. Cameron jumped to put the boot into Johnson, but he should have stayed and taken the flack for challanging the result in the commons. Referendum was not legaly binding and Johnson is already backing out, wanting free trade without free movement, think again.

Voters are now beginning to understand, Wales and Cornwall loosing the EU money, farmers not getting their CAP, no NHS money.

Lagarde at aspen ideas festival was interesting.

I normaly think Osborne is useless but he has played a blinder by helping to keep things steady,

I understand that there is no clear way to go yet for investments. pound dropping is the main worry with the moody assessment.

We trust your judgement Howard.

Thanks Captain for taking time to write a second blog. No matter what we are still happy The Leave voters came through in the end. Its been a fasinating few days listening to all the politicians, what drama!!! We remain optimistic and you Howard are our very own Mark Carney.

By the way Ruth folk with dodgy hairstyles, who spend time playing cricket whilst the UK’s administration is in turmoil, could never be taken seriously enough to represent our great nation!!!!