We do tend to make greater returns on our investments over the winter months than we do over the summer months. However last year that didn’t happen. October to December was an appalling period to be an investor, but it did pick up early in the new year. Crucially, we are investors, not speculators. We are never all in the market or all out of the market, trying to time the ups and downs. We maintain a long term strategic asset allocation, tactically adjusting that balance up and down in line with market conditions and sentiment. We have learned to remain patient and understand that when the results have been coming along in spades, those times just don’t last. But also when things look bad, those times don’t last either.

So here we are in October already, by halloween we could be “crashing out”, “on the cliff edge”, “surrendered” or “defeated”. Whatever evocative language the press and the politicians choose to use, that’s where we will be within the month. The “October effect.”is starting to look like a bit of investment legend which could be proved true once again. October tends to be a bad month for the markets.

According to Wikipedia; The “October effect”, as exemplified by the 1929, 1987 and 2008 stock market crashes which all roughly occurred in October.

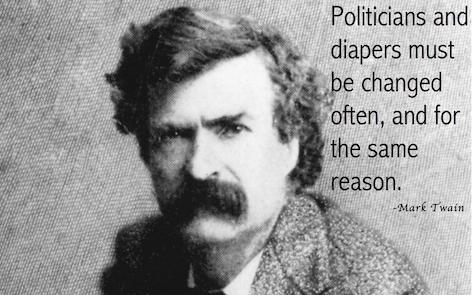

The reason there is an “October Effect” where stock market crashes are deemed more likely to happen is because Mark Twain once wrote.

October. This is one of the peculiarly dangerous months to speculate in stocks.

The fact that Twain died in 1910, so witnessed none of those posthumous stock market crashes is an in-convenient truth for the theory. His second sentence is also forgotten rather conveniently.

The others are July, January, September, April, November, May, March, June, December, August, and February.

You see Twain was a speculator not an investor. He lost two fortunes in his lifetime. He also knew he couldn’t help himself. “I must speculate in something, such being my nature.” He had no head for details and lost patience easily. Two traits which are guaranteed to lose anyone money over the long term. His quote above is not a prophesy that bad things can happen to investors in October. There is no “October effect”. Instead he understood all too well that he was a gambler with no control over that personality failing.

So for many rational investors, October is just like any other month of the year.

- Yes, it’s the latest “cliff edge” but it looks like there will be several more within a few month’s to come.

- Yes, Donald Trump may be indicted, but that threat has been with us since his election victory in November 2016.

- Yes, further dirt is being thrown around by opposition politicians but that’s been happening since the Greeks and the Romans.

The month of October isn’t a worry for me any more than any other month. I have never been superstitious. It’s true, we live and invest in interesting times, but that has been true so far over my 32 year career. We continue to invest for the long term.

A decade after the above quote, a much wiser and poorer Mark Twain did create the following maxim which I do follow:

There are two times in a man’s life when he should not speculate: when he can’t afford it and when he can.

A dead cert this october

Charlie has decided to run her first half marathon for charity. She is taking on the Manchester Half Marathon on 13th October. To run 13.1 miles takes training and dedication, you can’t just rock up and hope to complete the course. So far she has run a couple of hundred training miles. She is a dead cert to complete this challenge.

If you would like to support her by giving a little bit in sponsorship, she has chosen a charity very close to our hearts, where we know every penny raised helps a struggling ex-serviceman or his family. The link to her giving page is here. Thank you.

Nice one Howard.