Early Sunday morning saw the first signs of a light frost. It’s a harsh reminder that summer is officially over. I believe that there is a further warm spell on it’s way so Autumn could still yield a surprise or two yet.

When the leaves start to fall, it signals to me that it’s the time of the year where some serious investment decisions need to be made. October generally holds a few surprises, but then global markets usually start to rise from here.

Before I talk about our future direction, its worthwhile to describe what has happened so far this year.

Weather-wise this has been a record summer.

Investment-wise it hasn’t been as memorable.

In Brexit pre-occupied Great Britain, we believe much of the UK’s investment performance is driven by the negotiations held with the EU. “It’s all about us”. It isn’t. We are not the centre of the world’s investing public.

For global markets it has been an interesting nine months, with a fair slice of performance – good and bad – down to what has been happening in the USA. The USA has experienced three hikes in interest rates (with another still earmarked for December), and it is home to the largest companies on the planet. Many US companies have had an uplift following Donald Trump’s recent company tax hand outs, which unsurprisingly have driven up the price of their shares. This uplift won’t happen again so I believe the benefit has more or less played out. I sold all of our global holdings earlier in the year, we would have had a larger return if I had kept them as they were US heavy. However the valuations already seemed too good to be true back then.

On this side of the Atlantic, the Brexit process has rumbled on with no clear end yet in sight, while the Eurozone ended September with a renewed round of jitters about the financial profligacy of Italy’s populist government.

Emerging markets have had a stinker, down due to the increasing burden of debt held in a strengthening dollar. Evidenced by Venezuela and Turkey. Nobody knows what the true level of Chinese debt is.

We remain very cash heavy in our portfolios. I took the decision that there was a greater chance of losing money over the summer months than we had the chance of making money. This scenario has indeed played out. Holding excess cash has saved us from higher losses.

Most stock markets are now down across the first nine months of 2018, a fact illustrated below by the graph of the Footsie for the year to date.

It’s also worth looking at the last 9 months in perspective. Here is the FTSE 100 since it began at just 1000 points all the way back in 1984. 2018 is shown at the extreme right of the chart.

How have I done?

As always you can log in to your product providers, Nucleus and Investcentre to get an update 24/7. In the new post MiFiD II world these product providers will be providing you with an update directly on a quarterly basis.

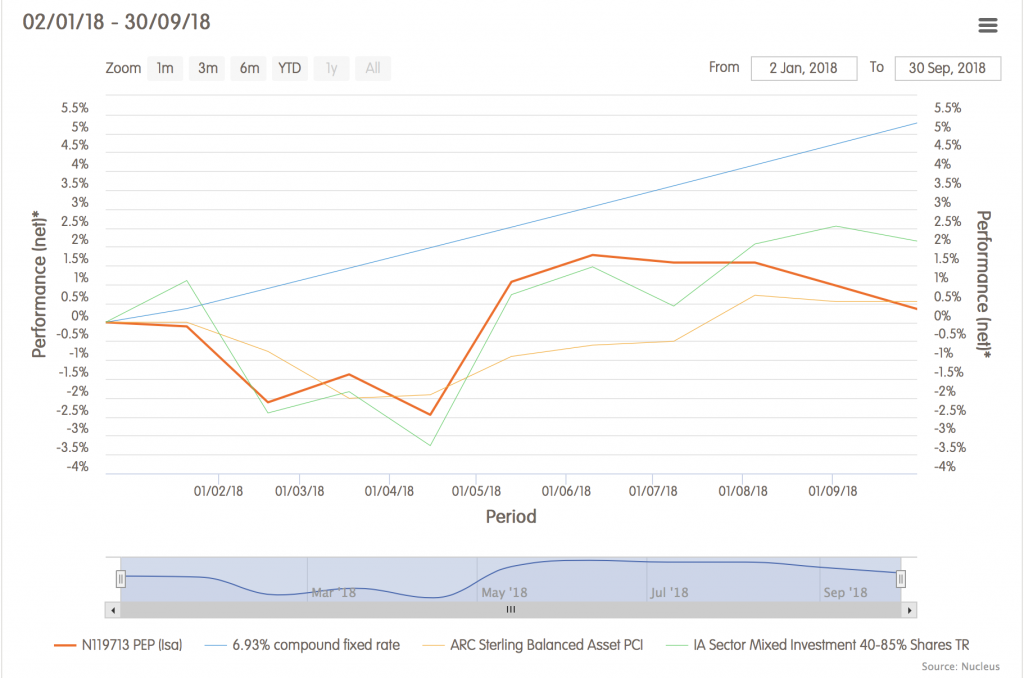

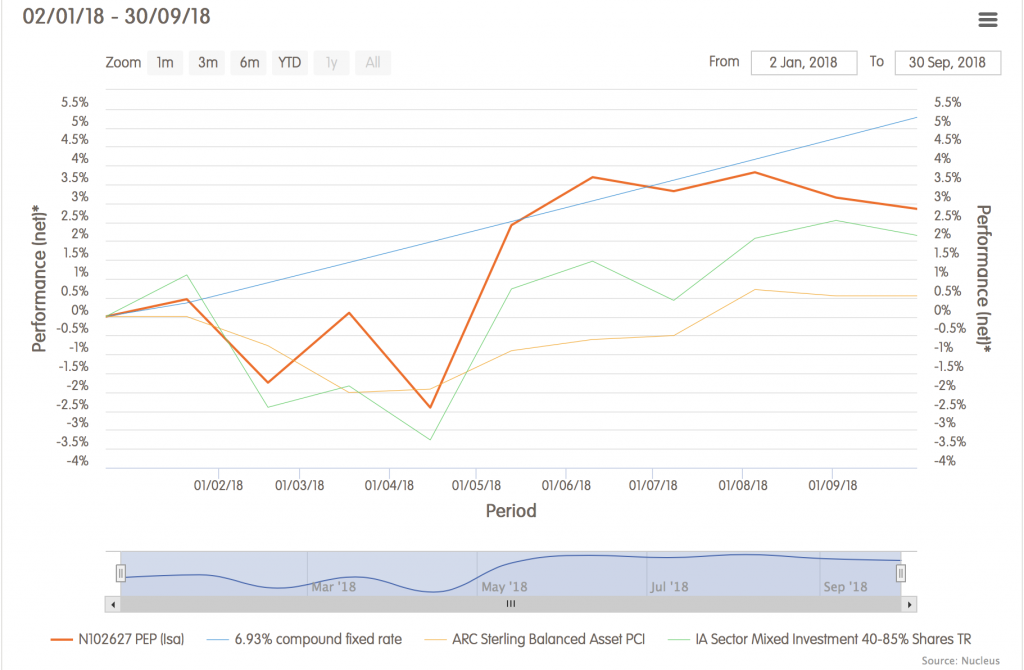

In each of the charts below our Portfolios are shown as the Orange line and our benchmarks are the faint coloured lines.

Cautious Portfolio Results

Our Cautious Portfolio has made no return over the year. It’s difficult to make money when very little risk can be taken. It has achieved its goal. In years like this one, just try to not lose much of any clients life savings. It’s the correct portfolio for those clients who already have enough savings in life and don’t want to jeopardise them.

Moderate Portfolio Results

Our Moderate Portfolio has ended the first nine months of the year in positive territory. This has been helped by the amount of cash we have held, but hindered by my decision to sell our Technology and Pharmaceutical funds too early. The US markets have recovered to once again post all time highs. I remain convinced this will be hard act to follow for some time from this high point.

Aggressive Portfolio Results

Our Aggressive Portfolio has not done much better than our Moderate Portfolio over the period, but recorded a positive return. Although it holds more cash than usual, those clients who are invested in this portfolio expect a bumpier ride along the way. This allows me to remain more or less fully invested throughout the year if I feel it is prudent. When we experience a period like this where most of the stock markets in the world decline, then our Aggressive Portfolio falls too.

AIM Portfolio Results

Our AIM Portfolio is not for everyone. An investor needs to be able to take big knocks along the way. It’s unsuitable for those clients who need an investment return to be able to pay their bills. It’s unsuitable for those who worry about money. It invests simply in the Junior UK stock market. That implies more risk, but also suggests more opportunity for those prepared to take those risks. For the right client it gives the long term opportunity to create wealth. This years return so far is well into positive territory and it caps a quite astonishing 4 year period where the portfolio has doubled in value.

The Future Direction

We have retained most of our growth over the summer as the Footsie currently continues to be sold off. At around 7200 it is now approaching the bottom of it’s 2 year range. October 2016 saw the FTSE 100 at 7000 points. My expectation is that buying equities again at this level offers much better value than when we part sold down on 25th April at 7421 points and then again on 22 June at 7683 points. We will continue to monitor the market and are prepared to re-invest some of our cash.

Did I sell exactly at the top? No. Will I buy exactly at the bottom? Probably no again. We don’t have a crystal ball, but each time we capture some of the upside and avoid some of the downside we continue to win over the medium to long term.

We are approaching a difficult time politically. The US Mid Term Elections will be held on November 6th, it will be interesting to see if the protest vote that brought in Donald Trump as President will have strengthened or lost much of its forward momentum. And in Europe we are entering the final critical weeks of coming to some sort of agreement. One that can then be discussed and voted on (down) here and across all of the EU block. Both events have the potential to shock and give to us a value for money opportunity to re-enter the market with our cash.

The Small Print

This blog does not offer financial advice.

The value of your investments can fall as well as rise.

Past performance isn’t necessarily a guide to the future.

I don’t understand the ironic Lance Armstrong picture. Your not pretentious, your not on drugs and you don’t attempt to fool people.

As you explain its tough but I wouldn’t trust any one else with my money.

There has been a lot of getting back into gold lately but your policy of keeping cash is good for me.

Hi Peter

Thank you for your comments. The US did indeed have a minor meltdown yesterday and the expectation is we will open lower here today also.

I continue to research gold as a “holder of value”. It does best when the dollar weakens and the FED doesn’t increase interest rates when it should do. Neither of those conditions are true just yet. I also watch silver, platinum and palladium as they tend to jump before gold does.

In my small print I say “past performance isn’t necessarily a guide to the future. Last quarter I demonstrated it with a picture of our favourite, George Best. This time I thought Lance Armstrong was a good example. 🙂