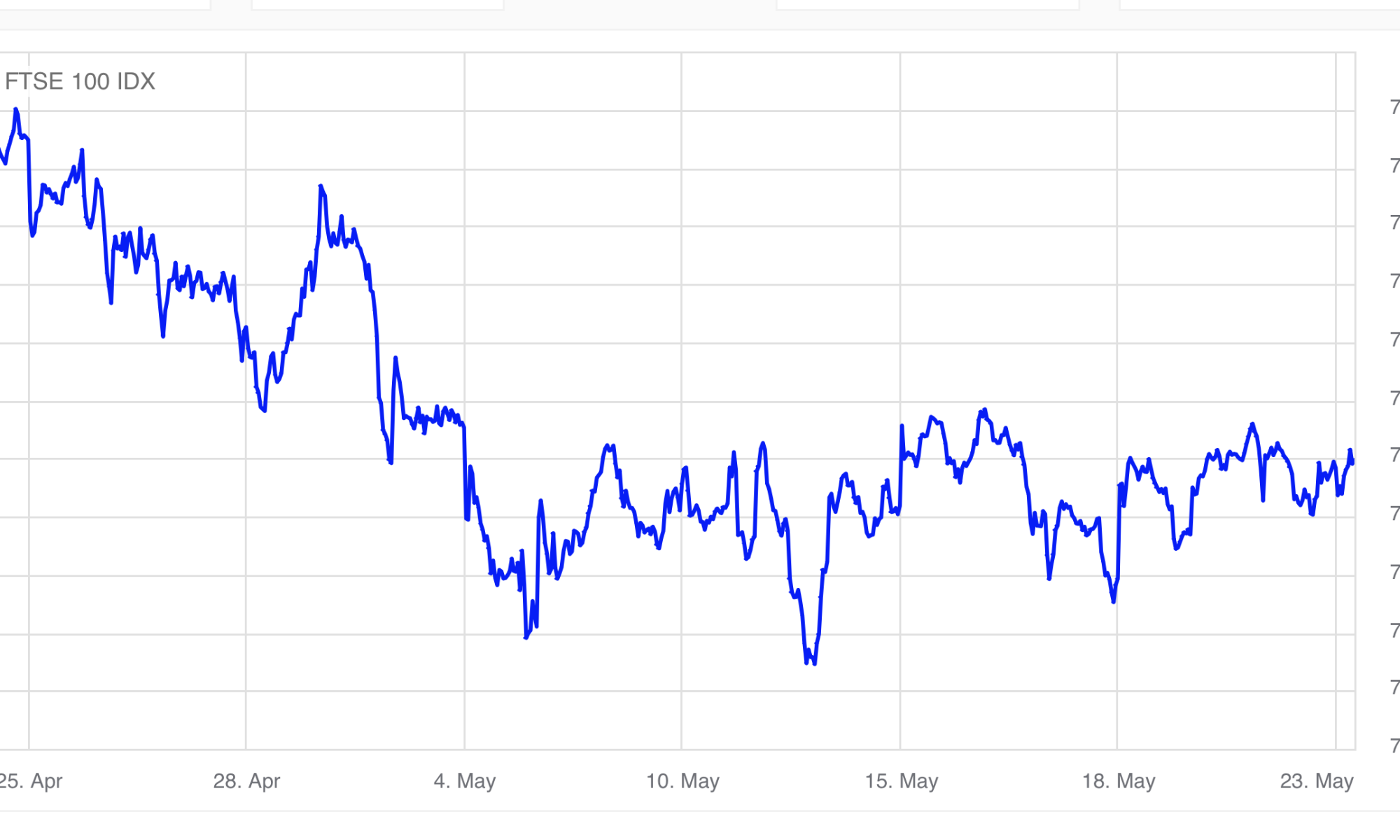

Since the most recent stock market correction in mid March and the quick recovery by mid April, the period since has seen little change in market levels. Here’s some observations.

- Most companies that have reported their first quarter earnings have hit their targets. Although these were admittedly modest.

- The corporate sector isn’t too stressed financially after many with debt took the opportunity to refinance when interest rates were low.

- We are not seeing wholesale business failures, other than those start-ups who never reached profitability and now cannot secure further cash investment.

- Technically the UK is still not in recession. The US also looks to avoided recession although they “technically” could have entered a mild one in 2022.

- The global banking sector has not fallen into systemic crisis, despite a string of banks being brought to book for reckless concentrated lending.

- Many “safe” government gilts held by banks, insurance companies and corporate pensions remain in a heavy loss position, but that problem will abate as interest rates normalise and there still remains the guarantee if the gilts are held to their maturity dates.

- At long last many businesses are forcing employees back to their offices. It looks like reality has set in now with many dedicated WFH employees. They are faced with little choice but return as company after company confirm job losses. This return will hopefully increase productivity in the services sector. The same can’t be said for government departments and public services!

- The office lease sector is still firmly in the doldrums, but the return of workers back to rented offices has begun.

- In the US, the government is reaching the debt ceiling for the 79th time. A last minute compromise will undoubtedly be reached between the Democrats and the Republicans, but US markets will adapt a wait and see pose and then the crisis will become yesterday’s news again.

- The FED has gently signalled that the last interest rate rise was the final rate rise, with the debt market now factoring in a reduction in US interest rates starting prior to Christmas.

- In the UK the Bank of England will follow the US lead, however we are some months behind the US curve as the UK suffers from the sticky cost of importing energy. Perhaps two further rises to come but maybe only one more.

- The energy crunch over the winter was not as bad as many projected. On average, both consumers and industry reduced consumption by around 20% and Europe experienced a relatively mind winter. As the war in Ukraine continues it is not expected to cause the same panic next winter as alternative supplies have been sourced.

- Rishi Sunak has hinted that the UK plc is performing better than expected and our tax burden could be eased sooner than was expected.

- The IMF has revised its January projection that stated the UK will suffer a deep recession and have the weakest economy within the G7. It must hurt them to now to declare our economy will outpace Italy, France and Germany. No apologies, simply praise for their team for having the strength to change their opinion.

- And finally Artificial Intelligence is improving the valuations of the tech sector. I will touch on this later in the blog.