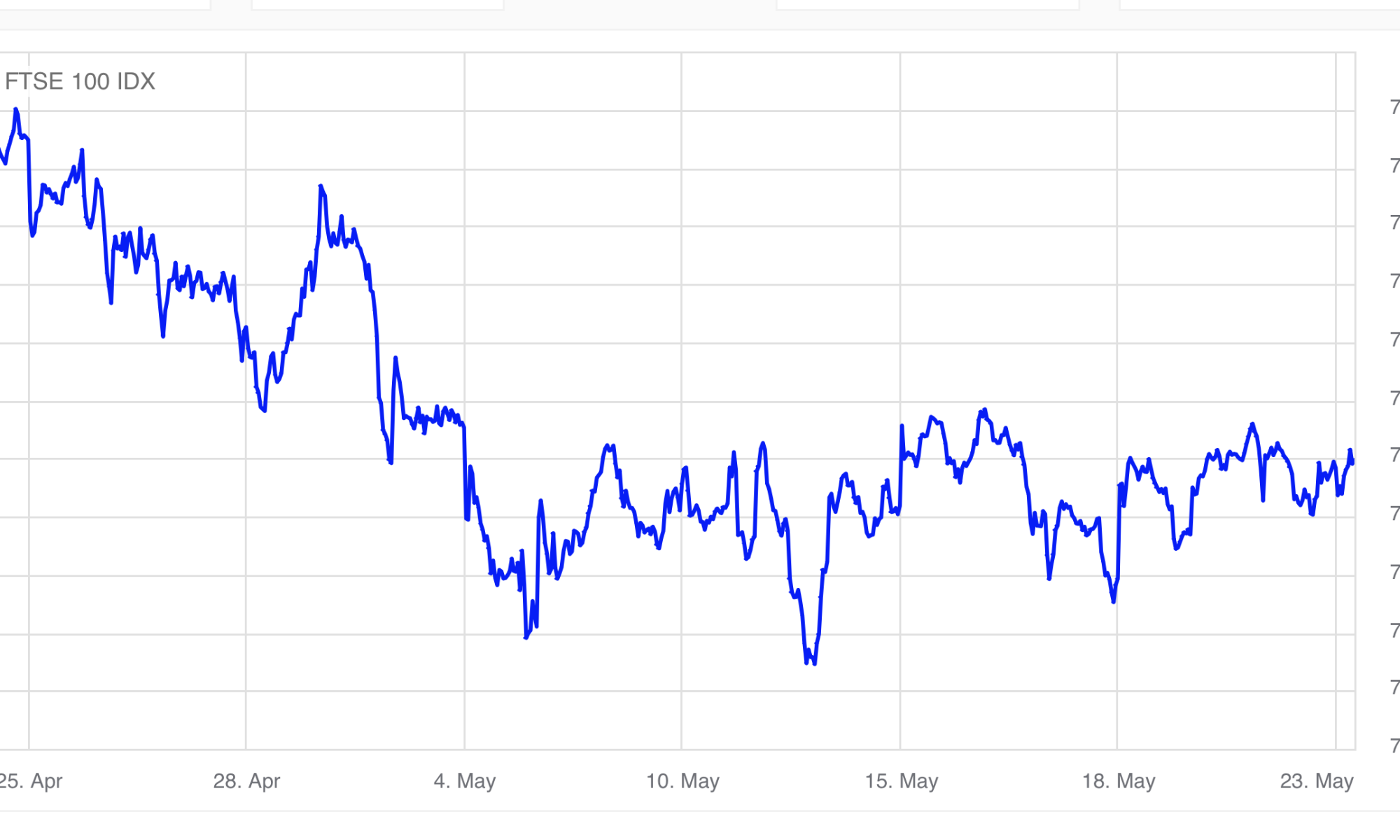

Since the most recent stock market correction in mid March and the quick recovery by mid April, the period since has seen little change in market levels. Here’s some observations.

- Most companies that have reported their first quarter earnings have hit their targets. Although these were admittedly modest.

- The corporate sector isn’t too stressed financially after many with debt took the opportunity to refinance when interest rates were low.

- We are not seeing wholesale business failures, other than those start-ups who never reached profitability and now cannot secure further cash investment.

- Technically the UK is still not in recession. The US also looks to avoided recession although they “technically” could have entered a mild one in 2022.

- The global banking sector has not fallen into systemic crisis, despite a string of banks being brought to book for reckless concentrated lending.

- Many “safe” government gilts held by banks, insurance companies and corporate pensions remain in a heavy loss position, but that problem will abate as interest rates normalise and there still remains the guarantee if the gilts are held to their maturity dates.

- At long last many businesses are forcing employees back to their offices. It looks like reality has set in now with many dedicated WFH employees. They are faced with little choice but return as company after company confirm job losses. This return will hopefully increase productivity in the services sector. The same can’t be said for government departments and public services!

- The office lease sector is still firmly in the doldrums, but the return of workers back to rented offices has begun.

- In the US, the government is reaching the debt ceiling for the 79th time. A last minute compromise will undoubtedly be reached between the Democrats and the Republicans, but US markets will adapt a wait and see pose and then the crisis will become yesterday’s news again.

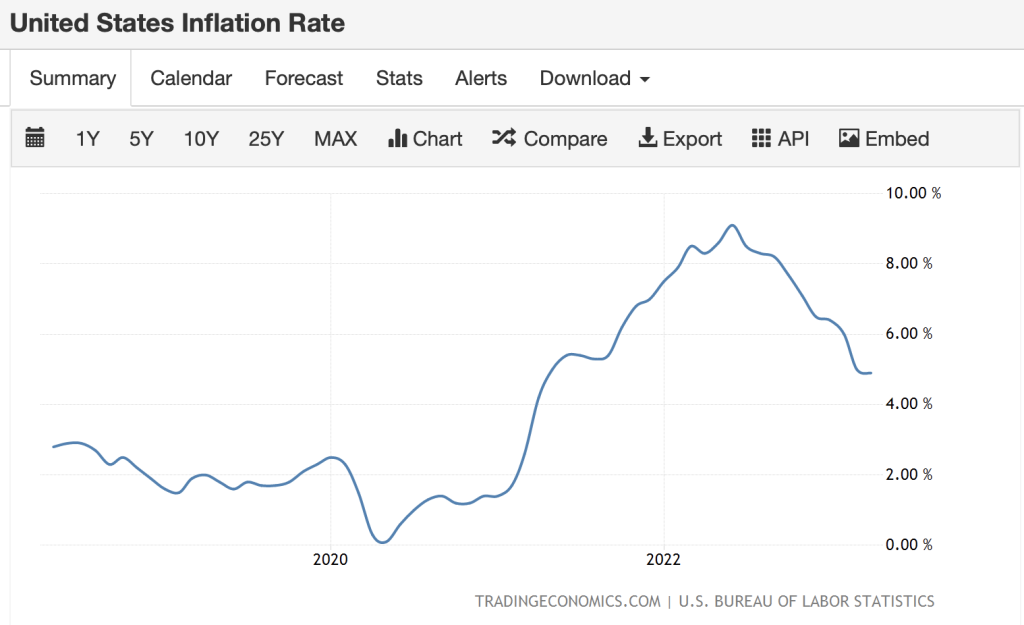

- The FED has gently signalled that the last interest rate rise was the final rate rise, with the debt market now factoring in a reduction in US interest rates starting prior to Christmas.

- In the UK the Bank of England will follow the US lead, however we are some months behind the US curve as the UK suffers from the sticky cost of importing energy. Perhaps two further rises to come but maybe only one more.

- The energy crunch over the winter was not as bad as many projected. On average, both consumers and industry reduced consumption by around 20% and Europe experienced a relatively mind winter. As the war in Ukraine continues it is not expected to cause the same panic next winter as alternative supplies have been sourced.

- Rishi Sunak has hinted that the UK plc is performing better than expected and our tax burden could be eased sooner than was expected.

- The IMF has revised its January projection that stated the UK will suffer a deep recession and have the weakest economy within the G7. It must hurt them to now to declare our economy will outpace Italy, France and Germany. No apologies, simply praise for their team for having the strength to change their opinion.

- And finally Artificial Intelligence is improving the valuations of the tech sector. I will touch on this later in the blog.

Sell in May?

Many clients are familiar with the old adage – “Sell in May and go away, come back St. Leger’s Day”. The markets tend to perform better in the winter months than they do in the summer months. On average that is true 7 years out of 10.

| Portfolio | Return Since October 16th |

| Cautious | 10.55% |

| Moderate | 12.90% |

| Adventurous | 15.37% |

| Go For Growth | 0.00% |

| AIM | 5.05% |

The main portfolios have all grown as expected, the more specialist portfolios are showing signs of life but are very sensitive to interest rates and currency exchange. The US favoured portfolio, Go for Growth, has shown no growth when the appreciation of Sterling against the Dollar has been taken into account. The AIM portfolio which is invested in a narrow range of smaller companies listed on the junior market in the UK has grown only slightly, which is a welcome sight after the previous level of losses incurred as interest rates rose and credit for growth companies dried up. The expectation is smaller shares will start to lead again, once there is evidence that UK interest rates are about to fall.

Even though we do not make much over the Summer months in general, we seldom lose much. The chances of missing a long awaited recovery is high if we lighten up our percentage of equities we hold across the portfolios. There will be no starting flag waved when the recovery is about to start, so for now, whilst the volatility index is acceptably low we will not be lightening up our portfolio weightings.

Obviously this decision is reviewed continually as events develop.

Artificial Intelligence

AI is the current investment buzz word, with every technology giant believing that arriving at a workable solution first, will result in huge profits. AI was formerly known as machine learning, where a computer effectively writes its own future software self, without the further input of humans. In reality, a better phrase would be Artificial Dumbness or at best Artificial Trial & Error. It works by running millions of guesses to arrive at the correct answer to a question. Once the output is correct, the software (originally programmed by humans) narrows down the number of guesses required to arrive at the correct solution next time. And so on.

Google are pioneers of taking huge amounts of data and narrowing the answer down into something acceptable. But they seem to be a little late in releasing a workable, profitable solution. There is no such thing as a free lunch. Ever wondered how Google gets paid? They benefit from well over 90% of search traffic on the internet and yet their service is free to users. Their income comes from advertisers who pay them. Pay them for what? Your data of course. Individuals freely give away their personal details, their dreams, their goals and aspirations in pursuit of interesting pictures of domestic animals and fools falling over. Smart speakers collect conversations all of the time. All of this data has been used to initially program the AI. Hopefully the AI will take it from here and be able to trawl through a couple of decades of data it holds on each and every one of us. Then Google will be able to sell the short answer for an awful lot of money. Purchasers of the data will know what we want to do, what we want to buy and where we will probably want to visit next. This will allow them to specifically market “opportunities” to us before we even know we wanted them in the first place.

Only Apple promises not to sell your data to third parties as do a few alternative search engines such as Duck-Duck-Go. I have been deeply sceptical of the business model for some time, I have refused to use Google for over a decade now. I’m not on Instagram or Facebook either. I’m sure the large data collectors will still have built a comprehensive file on me over time. Always take the time to refuse cookies, because by accepting any Google still can collect the data.

The development of AI has been given a giant leap forward with the latest release of ChatGPT, another contender for King of AI, which under test conditions recently passed every professional examination thrown at it with an average 95% pass mark. Every professional exam – Law, Accountancy, Medicine – you name it. The consequences could be huge, with widespread job losses in the future. No job would be safe if someone currently does that job through a computer. Mine included.

Already many on-line articles are written by machine. Before you believe anything in the future, you will need to check who or what is responsible for writing it. Malicious players could make up the future, re-write the past – it is straight out of George Orwell’s 1984.

I’m not too paranoid, I’m observing the progress of each data thief to try to pick the winners to invest in.

The Consumer Duty

Finally there are changes afoot in our profession once again. The Consumer Duty (CD) is the latest directive from the FCA. The planning and implementation of CD has taken up most of my waking hours outside of client meetings and investment management for over a month now. The CD is why I have had no time to write a blog recently. When the FCA suggest I jump, my only response is “How high?” Like the lull in the markets, normal service here has been paused too. I’m happy that the markets have been reasonably benign of late, because I could not have returned all the information requested by the FCA on time, if I needed to spend even more of my time monitoring the markets and making decisions. Failure to respond to the FCA on time really is something I never want to do.

As a business we have had some impossible deadlines to adhere to as the CD comes on top of a full thematic review of the discretionary investment sector. We have had just 3 weeks to detail our progress so far towards the CD roll out date of July and to answer a huge amount of questions relating to the communication procedures between clients, advisors and discretionary managers.

Communication

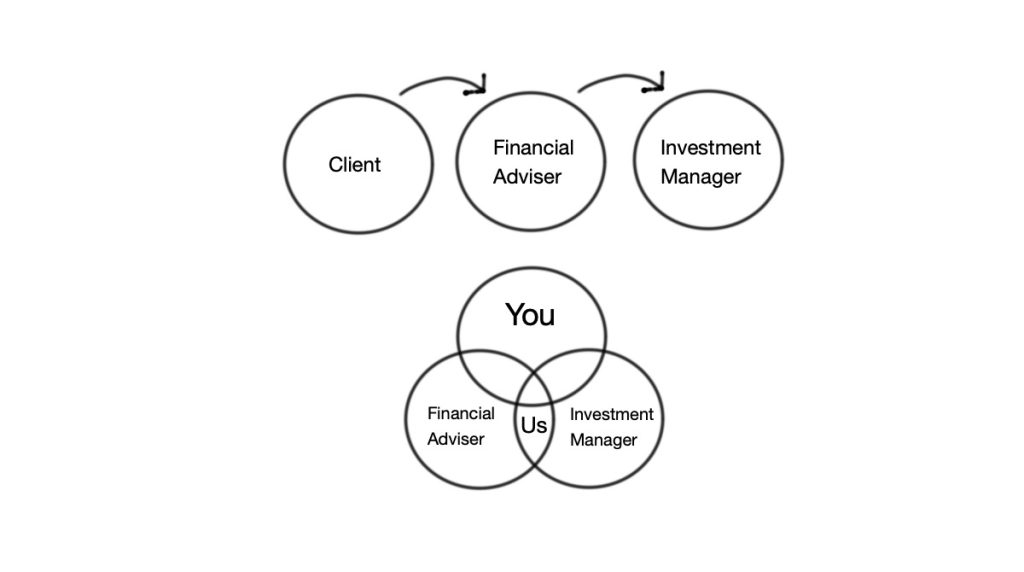

The FCA are worried that the discretionary investment manager doesn’t know their client sufficiently. I believe they are correct because it is the financial advisers job to know the client and the financial advisers job to pass all of this information on up the chain. But as you can see from the top line of my rather hastily drawn model above, many details are probably not passed up the chain and information is also probably not passed down the chain. The investment manager cannot “know” their client, they only know what they have been told. Is the investment manager investing the client’s savings correctly?

Our model is different and best depicted with the Venn diagram above. Here we are the financial adviser and the discretionary investment manager. No information is lost up or down the chain as there is simply no chain. You can speak directly to the investment manager when you are speaking to the financial adviser. I have forgotten how rare this model is in the marketplace. Less than 3% of the profession works this way.

There is no multiplication of costs with our model, just one fee. With the typical model the financial adviser charges a fee, the discretionary investment manager charges a fee and the fund managers chosen by the discretionary manager all charge a fee too.

No wonder the FCA’s thematic review is asking some serious questions.

Constant Review

As always we continue to monitor the news flow and be ready to change direction as prospects improve or deteriorate.

Only four times in history has a negative year followed a previous negative year. 2023 would enter the history books if that happened.

This market pause will end, probably when the US debt ceiling is extended. The direction after the pause is usually in the same direction of travel as before the pause. The markets have finally commenced their climb back from last Octobers lows, the next period should be a continuation of that climb up.

Smart speakers most definitely do home in on your conversations. Check it out for yourself. Talk about some random topic et voila!,…….up pops a Google reference to the same subject matter.

Thank you for the blog Howard. The information is most useful and gives us confidence the financial world is getting a little brighter.