Policyholders

If I knew you 25 to 30 years ago, then I sold you life assurance companies policies. That made you a “policyholder”. After a decade I moved on to become Independent, proudly being able to offer all companies policies. But you would still have been a policyholder, just now you held many different companies policies. I moved on…

Unit-holders

We had already started to recommend the funds of Investment fund providers like New Star and Invesco. That made our clients unit-holders too. As the firm continued to grow, we decided to drop all external influences. That influence was commission so we began to charge fees only in 2005. No longer would we recommend life assurance companies policies that only paid commission. Instead we recommended that clients buy a cheap product wrapper, like an ISA or SIPP, and then we filled it with directly owned unit-linked funds. That now made our clients purely unit-holders. We tried to find the best fund managers. We pitched one fund manager against another. We carefully assessed each fund managers charges, along with their recent performance record. Obviously recognising our Regulators eternal phrase;

“Past performance isn’t necessarily a guide to the future”.

In the long term no individual fund manager wins. Why? Because it is only the shares that give the returns and all investment managers buy mostly the same shares. Time to move on again.

Now I recognise how difficult it is to hold internationally listed companies like Apple. Those shares are denominated in Dollars and we invest in Sterling. So to some extent we will always be investment fund unit-holders where overseas investment is wise. Hence we still hold our Technology & Health and Pharma funds.

Shareholders

But we moved on once again and dropped most of our current investment managers. To be truthful we had dropped the vast majority of all investment managers back in 2007. We have had almost a decade of client returns powered purely by index-tracking funds. Today there has to be a compelling reason to pay any UK fund manager to buy shares on our behalf. Even though our chosen index-tracking funds were very cheap to hold. Because with £70 million between us, we are free to collectively buy our own shares now. We have become shareholders. Since November 4th the majority of our savings within our Pensions, ISAs and General Accounts have been invested directly into shares. We will no longer pay any annual fees to hold these shares. 🙂

But will our returns be any good?

I believe our returns will continue to be good. Our long term cost for holding our UK shares is now zero. That will yield a saving of about 0.5% a year. The main reason active (star) fund managers usually can’t beat the market is because they charge an arm and a leg. Index-tracking fund managers have to under-perform the index too, because although their charge is low in comparison, there still is one. The index and the shares within it have no annual charge.

And who says we need to out-perform the share market anyway? We simply need to achieve our lifetime investment goals and continue to be able to pay our bills. Neither of those are correlated to what the FTSE All Share Index is doing.

Highlights so far

Well, since we have owned the shares on 4th November 2016, which is less than 3 months.

- Thankfully none of them have gone bust

- One of them has been bought out giving us a 45% profit – Fyffes. Yes it’s bananas.

- 12 of them have returned more than 10% – Ashtead, BooHoo, Carnival, CVS Group, Dart, Fevertree, Fyffes, London Stock Exchange Group, Nichols, Scapa & D.S. Smith

- 3 have lost more than 10% – National Grid, Shaftesbury & Vodaphone

- Overall the Moderate Portfolio has returned over 4.5%

- Already we have all received some dividends too.

Here’s some frequently asked questions

Will we be keeping all these shares forever?

Forever is a long time. We constantly review our shorter term tactics, so who can say what will come next. However it is our intention to hold these shares for the long-term, removing the odd one and adding others from time to time.

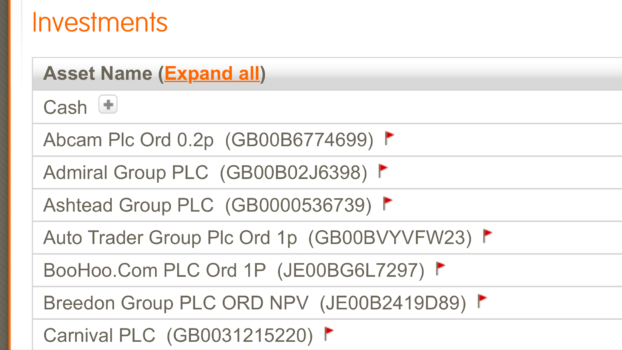

What do the red flags mean that I see when I log into my Nucleus accounts?

Those red flags denote caution. They are applied to anything that isn’t a UCITS compliant fund. (I’m not going to explain what that is here). In the case of a share it means that a minimum of £500 a time must be traded. Since we bunch together when we buy or sell, our trades always exceed that amount. The red flag certainly doesn’t mean we have lost money and a green one would indicate that we have made some money. However it would be a quick way to assess performance though. I will asked Nucleus to look at colour on our print-outs.

Will we receive 50 or 60 share certificates?

Thankfully no. The shares are held between us on the one certificate. Plus its all electronic these days.

Will we receive the dividends we are due?

Absolutely!

Can you still call yourself an Independent Financial Adviser?

I believe so. An IFA must be able to offer a client any product from any company. I still can and probably will do in the future. It’s just that right now I don’t feel many of them offer us value for money.

Can I recommend shares to you?

Please do. You can use the form below. We will investigate any UK share you feel we should look at. If it passes our selection process we will then buy it for all of us.