Haters gotta hate

By now you probably all understand I am not a fan of the economic and social policies of this UK Government. To be fair I didn’t like most of the last shower’s either. Two sides of the same global agenda coin, putting global ideology before the people. I am unapologetically a Capitalist. I believe that capitalism works. It may be flawed, more rewards tend to end up going up the ladder than down, but it has proven to be the system that has lifted over 2 billion people around the world and counting, out of poverty. Socialism, Marxism, Command Capitalism all impoverish the masses, if not, then the price an individual pays is the loss of freedom.

So from a political point of view I do hate any ideology which impoverishes and removes personal freedoms. Which brings me to the position UK citizens currently find themselves in with this iteration of democratic government.

The UK economy is in a bit of a pickle.

As someone who is deeply interested in the future prospects of governments, economies and companies (we have the wealth of 200 families sat on our shoulders) I do read extensively and try to keep that reading balanced. I’m a capitalist and yet I will read articles in The Guardian to maintain that balance. Ultimately I source material from individuals with “skin in the game”, money on the line, rather than graduate journalists or editors with chips on their shoulders.

To cut to the chase, UK governments have already borrowed too much, and investors who hold that debt are worried. There was a time when investors in UK Government debt were domestic in nature. Large UK investment funds and UK pension funds especially. But over time that domestic loyalty has waned. A typical UK pension fund only holds the minimum mandatory level of UK gilts to remain within the law. Those funds have also reduced their holding of UK listed shares from around 40% to, wait for it, now just 4%! The Chancellor is currently trying to force UK pension funds to invest more. Watch this space.

Who holds the hot potato?

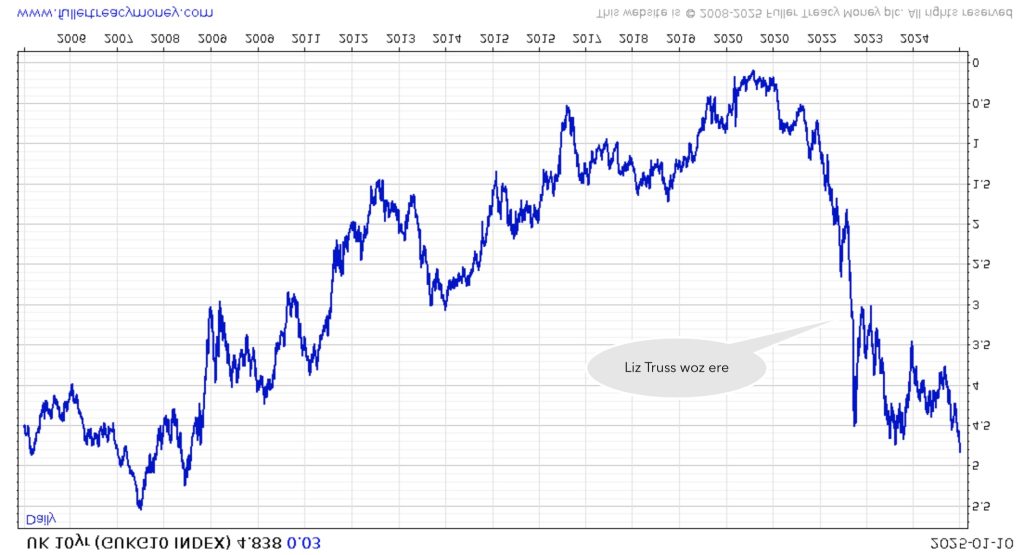

So who invests in our debt? Johnnie Foreigner is the answer. It is all too true that our current predicament relies on “The kindness of strangers”. Unfortunately “Rachel from Accounts” is in a hole and refuses to throw away the shovel. This political party has ambitious plans to spend even more on vanity projects. The problem is, they don’t have any money. The rise in government debt yields reflects the plummeting credit rating the UK has on the international market. “You want to borrow more? It’s going to cost you”. Here’s the chart showing yields accelerating higher.

Now normally we look at a chart rising left to right and we see that as a good thing. But as yields rise, the value of the underlying investment falls. (Hard to get your head around I know). I believe you get a better picture of how investors are losing faith and losing money by inverting the above chart.

Get the picture?

Last time things looked this bad was over 15 years go. Remember the great financial crisis and Northern Rock Bank going under? It was the time of “Jingle Mail” with mortgage borrowers sending their keys back to the lenders, unable to cope with their homes now in negative equity.

Obviously the chart flipped with all the borrowing the world took onboard to fight Covid-19, as you know a further, I’ll spell it, half a trillion pounds, was added to the amount the UK owed, but the recent acceleration down is particularly unnerving. It is time Rachel came out with a “Whatever it Takes” big speech moment, like Mario Draghi did to save Greece. Twice. Indecently the Greek economy is now doing better than the UK economy.

Can we earn our way out of this hole?

This is a real hole we find ourselves in, not like the £22 billion black hole which the Chancellor decided to fix by trying to change the UK’s credit card limit parameters to the tune of over £40 billion. The UK economy has tanked since the budget, inward investment has ceased. Companies are delisting out of London and heading to New York. Productivity has stagnated, expect “the hard working British public” to be losing 100,000’s jobs due to the impending National Insurance increases.

And finally our currency is tanking too, causing those kind strangers to question whether they wish to hold increasingly ugly debt denominated in an increasingly ugly currency. The more kind strangers that head for the exit, the lower Sterling falls. It’s a doom spiral.

There is an economic term for an economy falling into recession, with lower GDP coupled with higher inflation. It is Stagflation. Fortunately we have not heard that word since the 1970’s. Remember the 1970’s a time of 3 day weeks, not enough electricity to go around and unions ensuring British manufacturing went out of business. However that term will once again describe the UK’s position unless there are serious public sector spending cuts (I’m not talking about just 5%), a dramatic cut in red tape and a reversal of the April employer National Insurance hikes to get the private sector incentivised and working again. After all, it is the private sector that creates the wealth that the public sector spends. Will there be a U Turn. I doubt it. Rachel, the one with the dubious CV because she never worked in Accounts it was Complaints, is more likely to quote Margaret Thatcher (It would be amusing if she did) and pick up her shovel to resume digging.

“You turn if you want to – this lady is not for turning”

Margaret Thatcher – 1980

Can we do anything?

Yes the UK economy is stuck between a rock and a hard place. Already suspecting that this would be likely following the results of the UK general election and the US presidential election, our actions have already enriched us. We made the decision to turn our backs on the liability of owning UK Gilts and most UK shares. Holding US shares protects our buying power as they are denominated in Dollars not Sterling. Gold is priced in Dollars too.

To give a balanced view of how we got to this nadir, some of the pain the UK is currently experiencing is also being experienced across the whole of Europe and across most other nations who are heavy exporters to the US. Only some of the pain, the UK’s, seems to be much worse. By 20th January we will see what Donald Trump has up his sleeve.

With a slim majority The Donald knows he has to work fast and deliver immediately. Expect a raft of legislation on day one. The Omnibus Bill.

Will the UK be spared high export tariffs due to our “Special Relationship”? I believe Lammy & Co have already cooked that goose. Will Peter Mandelson be able to salvage the UK’s position? I doubt that too.

Sometimes the odds are good of knowing the likely outcome. At other times we can only play the hand we get after the event. I’m happy to say our investments are positioned on the right side of the Atlantic currently, and I cannot see that changing during this Presidency. All eyes on the 20th.

Amazingly opportunities can be found in the most unexpected places. Could Johnnie Foreigner’s loss be our gain? Getting out of UK Sterling denominated debt makes sense if you fear the currency is tanking against your own countries currency. But what if your savings are already in that currency? When does the interest available on UK debt become an offer too good to refuse? Tie up some savings for 15 years at an approaching 5% “risk free” return? That a question for another time. It all depends on what the eroding power of inflation looks like in the future, remember it was 11%!

We have your backs.

Fabulous balanced update Howard and thanks for the diligent securing of our funds 👍💪

Thanks for explaining the mess these clowns are sending us in. Keep up the good work young man and your staff obviously.

Come on the 10 men

Peter and Janet.

As always, thanks Howard!

Morning Howard & co, it’s good to hear we are are in safe hands.

Thankyou