This week I have been with Nucleus in Edinburgh. We meet for one day every quarter and have been doing so for years now. Together with a few other IFA’s, we help guide the future direction of the Nucleus platform. I guess that is why I’m so passionate about the Nucleus platform. H.J.Scott & Co. along with all of the daily feedback we receive from our clients, has helped shape what the platform is today and what it will be in the future.

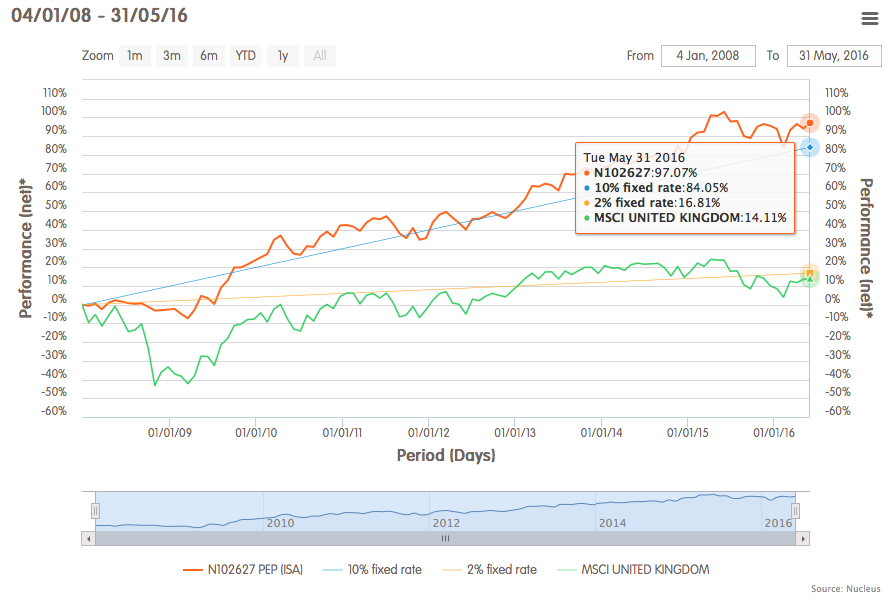

The chart below shows an example of some of the recent reporting work that we have been involved in which will go live to clients next year. We are hoping it will answer the eternal questions.

How are my investments performing? and Will I run out of money in the future?

In the twenty years or so before we used Nucleus, never once did any Insurance Company or Investment Company ask how they could do things better, for the benefit of their customers. To this day, they continue to be far too fixed on benefitting themselves and their shareholders first.

What is Nucleus

Even after 9 years using Nucleus, its sometimes difficult to explain to a new investor exactly what Nucleus is. It’s certainly easier to describe what it isn’t.

- It’s not an insurance company like Standard Life or Scottish Widows.

- It’s not an investment company like Invesco Perpetual or Fidelity.

- It doesn’t make your savings grow, it just costs money.

- Nucleus never recommends where we invest our savings

- Nucleus doesn’t actually hold our savings, our money is safely ring-fenced away from their money

Nucleus is simply a financial administration company. We as clients subscribe to their service, which is basically software that lives in secure data centres. Nucleus hold authorisation with the UK financial regulator and so are licensed to operate amongst other investment wrappers, a pension scheme and an ISA scheme. We could never do that ourselves. The product regulation runs to thousands of pages, £millions of regulatory capital is required to back up their promises and the cost of each product licence alone runs to six figures. To do that job requires scale.

Constantly developing but maintaining the same at heart

Since the platform began it has stayed true to it’s word. To offer clients a transparent, cost effective, safe, unbiased placed to house their savings. The Nucleus fee of just 0.35% pa of a client’s savings held on the platform remains competitive, however the offering continues to just get better and better. It has to do. Other platforms are available and it is completely free for us all to leave Nucleus. Collectively as clients, we now pay Nucleus around £160,000 per year for their service.

It’s your Birthday

I’m back up to Edinburgh with Lesley on the 27th June to celebrate the 10th Birthday of Nucleus. With my surname I should probably attend their party dressed in a kilt.

Back on the 15th November 2007 we became the 28th firm to use their services. Our first client isa was set up shortly after, with an initial investment of just £7000. Back then the total held on the Nucleus platform was just £300 million.

It could be a fitting birthday present if after 10 years in business the platform closes in on administering £10 billion of clients savings. It will be a close call; assets at the end of May stood at £9.5 billion.