What has happened this quarter?

This quarter the FTSE100 has shot up! It has risen by 6.5%. As you will no doubt remember I use the progress of the FTSE 100 index purely as a benchmark. “No man is an island” and no island is an island in investing terms. The UK FTSE 100 cannot do well unless much of the Western world does well also.

Our Moderate portfolio ended the quarter an astonishing 9.13% higher!

Last month I was half apologising for our Moderate portfolios returning around 5.9% over the year. Three months later our Moderate portfolios returned 14.05% over a year.

How has a typical Moderate client faired over the year?

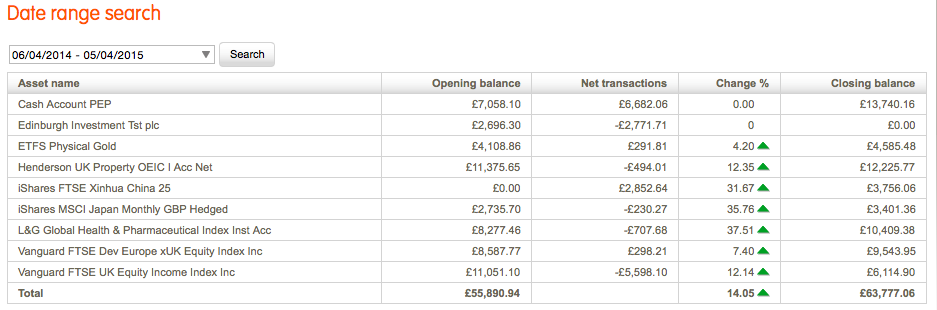

The screen shot below is an actual, but anonymous client account.

The above calculation includes our fees, Nucleus charges, the cost of the funds and all dealing costs over the period. The 14.05% is the actual return in the clients pocket after all costs have been settled.

The table below shows all portfolio returns over the periods we have acted as investment manager.

Portfolio |

1 year | 3 years | 5 years | 7 years |

|---|---|---|---|---|

| Cautious Moderate Aggressive |

11.84% 14.05% 16.38% |

25.41% 36.37% 45.57% |

38.84% 47.03% 52.87% |

45.79% 92.80% 114.51% |

Anything to mention?

I think my quarterly valuation commentary from January 2014 pretty much said it all and still confirms my current thinking. Rather than re-writing it, you can read it again here.

So what next for markets?

It’s almost Summer in the Northern Hemisphere and once again we expect to make less profit over these months than we do from September to April. Having seen huge gains this quarter we cannot expect the same again. Some of our gains should be considered “froth” and probably won’t last. I last talked about investment froth here. We have already started to reduce our equity holdings to try to keep our profits, expect more sales to come. I mentioned reducing our UK holdings in my last blog as we get closer to the UK General Election (yawn). We are invested globally. The outcome of the UK General Election will not directly change much of our portfolio’s prospects.

When is the next update?

These updates are quarterly so we will write again in early July 2015.