I have regularly spoken to individual clients in review meetings about how we decide what shares we buy, at what price we buy and at what price we sell. However I have never explained it to everyone in a blog. Having sold out of BooHoo.com last week, we have just committed to buying back more of their shares. Describing our recent actions will show how we work.

Christmas bonus

If you work on something everyday, occasionally you get lucky. Fyffes, Worldpay, The London Stock Exchange and Dart to name just a few lucky results in recent years. Now we can add Boohoo.com either to that lucky list, or we can take credit for an investment process that highlights value and helps us to make more good decisions than bad ones.

Collectively we have just safeguarded a swift £370,000 in extra shares. Normally that takes patience and time. The BooHoo.com story has unfolded in just 1 week.

targets

Our target to sell BooHoo.com was 316.59 pence. We came very close last Thursday so decided to sell. We keyed the trades switching out of BooHoo.com into Cash Deposit. We had decided to take the profit of 110% built up over just 3 years, then hopefully buy the share back at its next regular setback. We had calculated the price would drop to 285.80 pence. We like the share and we believe it’s a long term keeper. It has featured in our share portfolios since we first bought £5000 of it for just two clients in our very first AIM portfolio in October 2014.

Then we were less lucky. Within just 2 months the share had halved in value to just 50p. We bought £5000 more shares.

buyers and sellers

So how do you sell shares? It’s pretty obviously when you think about it. You can’t just sell a share and hope a stock-broker will hold onto it until a buyer arrives. A used share can’t be just parked up on a used share lot like a second hand car. To sell a share you need to find a willing buyer. To buy, you need to find a willing seller. One party will be wrong in the short term. The number of willing buyers and sellers for any particular share is described as liquidity. How free flowing are those shares?

With smaller amounts or with larger FTSE 100 shares like Diageo or United Utilities all it takes is the confident press of a button on a keyboard. The rest is automatic and the cash is in our accounts 4 days later. This administration is the part the platform does for us. That’s why we choose to pay 0.35% a year.

So how about BooHoo.com? Well that involves an element of horse-trading. We were trying to sell £2,600,000 of shares in a company valued at £3.6 billion. It shouldn’t be difficult, but the shares don’t change hands regularly. So the trades are keyed, the phone calls commence and a deal is finally struck. The broker, or man-in-the-middle, wants to earn something, its our job to adopt a take it or leave it attitude and minimise his “spread”. We agreed to sell at 314p, giving him a margin of 0.5p a share, not bad.

the plot thickens

Mahmud Kamani and Carol Kane, the founders of BooHoo.com have also just decided to sell some of their shares. £150,000,000 in total! Who would buy something like that? Deals are struck in advance, where institutional investors are offered the shares. They want to buy that amount at a discount so they can make a profit in the future. The deal was struck at 285 pence. That large sale immediately brings down the price of the shares, which triggered our buy back target of 285.80 pence

coincedence or voodoo?

There are two ways of calculating the value of a business. Fundamental analysis and technical analysis.

Fundamental analysis considers profits, cashflow P/E ratios etc. Basically you look to see how a business is performing based on its accounts. We take these fundamentals into account for every share we consider. We don’t want to see too much debt on the balance sheet otherwise the businesses lenders will make more than us the shareholders.

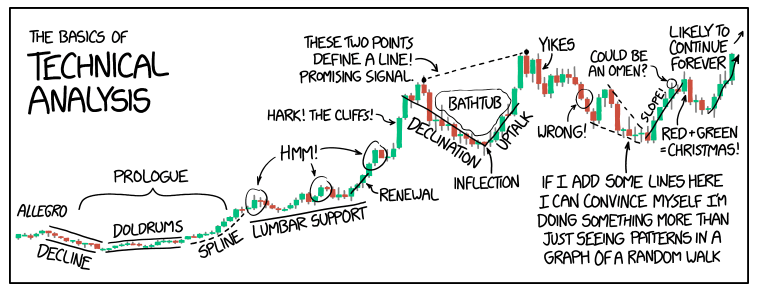

Technical analysis is like looking at the tea leaves left behind in a teacup. By looking at charts you can see the history of a share’s price. By looking at the past you can help to see what should happen in the future. History doesn’t repeat, but it often chimes. The lines we overlay on the charts aren’t real, but there are enough technical analysts out there looking at the same points on the same charts that shares often move predictively as expected. Of course it doesn’t work in every case, but more often than not is all that we need to try to achieve incrementally better investment results.

After this set-back we set our next heady target price and so forth until something material changes at the company and we reconsider. Most share purchases require a huge amount of patience over many years to reap our rewards.