There have been 27 market corrections since 1974. There’s no universally accepted definition of a correction, but most people consider a correction to have occurred when a major stock index, such as the S&P 500® Index or Dow Jones Industrial Average, declines by more than 10% but less than 20% from its most recent peak. It’s called a correction because historically the drop often “corrects” and returns prices to their longer-term trend.

Even understanding that corrections do occur regularly, often doesn’t help investors with a propensity to worry to handle these setbacks. Every significant reversal from an upward trend feels like a punch to the stomach.

Regular market setbacks are a function of the system, not a glitch. Without smaller setbacks along the way, you can be sure a much larger crash will follow at some point. Usually all the factors that lead to a change in investment sentiment were already in place and accepted, until one day those same factors are perceived as unacceptable. Still we need to learn from these episodes and endeavour to understand why market confidence suddenly evaporates. I continue to read extensively and believe that one of my go to sources of information succinctly describes why the markets have been so upset, so quickly.

Trump

On an obvious level the upset market is all down to Trump’s actions, but probably not for the reason the mainstream media has suggested. In most of the “quality” US financial press channels, Donald Trump, Elon Musk & Co are deplorables. Stirring hatred through clickbait grabs attention, accumulates viewers and readers, which brings in advertising revenue. So don’t expect a balanced view anytime soon from presenters and journalists schooled in never wasting an opportunity to present regular occurrences as complete crises. However don’t forget a large minority of the population of the US didn’t vote Republican and want to see him fail, many traders on Wall Street included.

What comes next?

Nobody can predict with any degree of certainty whether a correction will reverse or turn into a bear market, which results in more than a 20% fall from the peak. However of the 27 market corrections since November 1974—including the current one—only six of them became bear markets (which began in 1980, 1987, 2000, 2007, and 2020). Whist we have no control over the direction of markets in the short term, an almost 80% chance that this turmoil will pass seems like a reasonable analysis currently.

This blog isn’t going to be short, so if you just want to save time and find out when investment values are likely to improve, I will give you the answer now. Investment values will improve once the US Federal Reserve Bank reduces interest rates and Trump can pass his tax cuts. Trump is working towards that outcome, and he needs a strong stock market back to massage his ego, and grow his investments. The US stock market not performing on his watch is a non-negotiable. The Tech-Bros he proudly displayed at his inauguration ceremony have collectively lost £210 billion in just a week!

Our whole assessment of the Trump induced market turbulence

I don’t believe Trump is dumb. I believe his team are exceptionally smart. Trump does not take action to hurt himself. So why does he seem to be breaking things? What is he planning? How can we benefit as investors? Is there further pain to come?

Debt

Where to start? Debt. Governments borrow money to fund the shortfall left when annual government expenditure exceeds tax receipts. Most debt is never repaid, like car finance, it revolves. The old car goes back the new car is delivered and the payments continue. The payment rate is fixed, and based on the then in-force interest rate. If interest rates have gone up since the previous car deal, the interest payments will rise. As a responsible household we cannot continue to run up debt like a sovereign government with its own currency can. Something has to give. A longer borrowing term may be considered to keep the monthly cost the same or an inferior car could be chosen to keep payments the same.

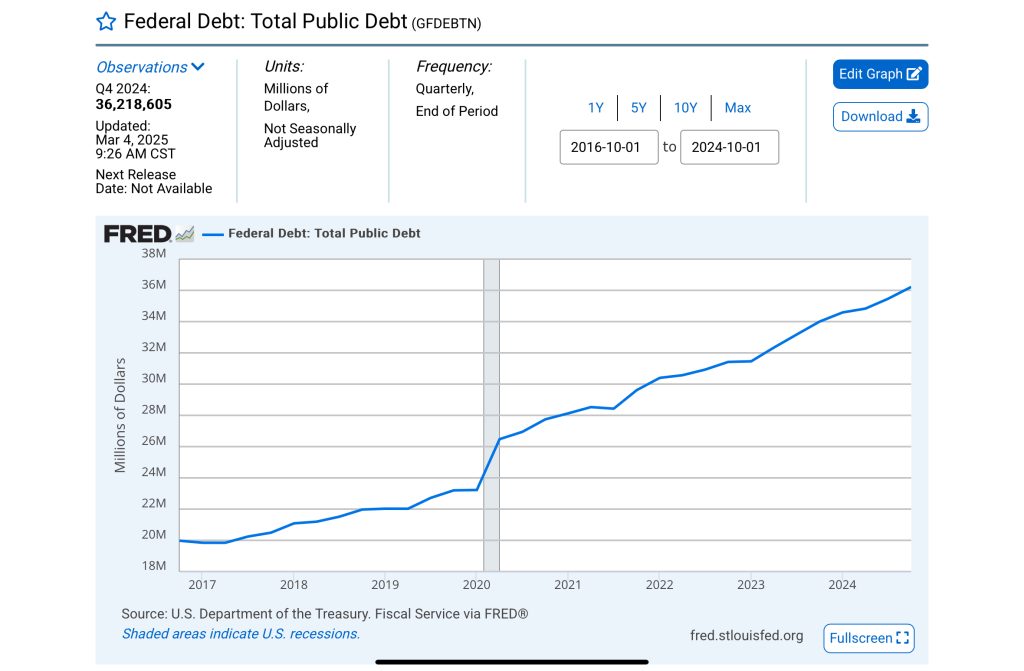

The level of US federal debt at the end of 2024 stood at over $36 trillion. During the Biden years debt climbed $8 trillion from $28 trillion. Interestingly during the previous Trump presidential years, debt also climbed $8 trillion from $20 trillion. The cost of US debt interest currently exceeds every other line of expenditure including benefits, healthcare and the military. At some point the dominance of the US currency as the planets reserve currency, must come under attack if debt levels continue to rise.

Now obviously the US government doesn’t just have one loan at one interest rate, there are many individual treasuries all with different maturity dates and differing interest rates. Some were taken out in the decades after The Great Financial Crisis, in 2008 when Lehmans Bank collapsed. Interest rates fell to next to zero, a very good time to borrow. The repayment terms on the current US debt vary from 3 months to 30 plus years. What is important in any one year is the balance that needs to be re-borrowed in that year. Here lies the problem during this Trump administration of 4 years. There is an awful lot of debt that is due to revolve, with interest rates far higher than the maturing debt. Janet Yellen effectively kicked the can down the road. From 2022, any debt that needed refinancing was done over shorter terms, instead of on a term for term basis, hoping to eventually extend terms once again as interest rates normalise. It was a gamble that hasn’t paid off. Hence there is a tsunami of debt that is about to hit. The US is not broke, but its debt costs are considerable and need taming.

Jerome Powell at the FED has clashed with Trump in the past, Trump would dearly love to sack him but he can’t. Powell isn’t playing on the same team and neither is he likely to acquiesce to Trumps kind requests. Perhaps if the economy shows signs of weakness, bringing down inflation the FED will be forced to reduce interest rates?

Cut costs to stop the debt expanding

Enter Elon and the Department of Government Efficiency. Huge spending cuts are being sought. Less spending means a lower annual deficit, means lower future borrowing. It’s what we do when times are tight. It’s the equivalent of an individual needing to trim surplus expenditure by cancelling Sky, Netflix and the gym membership.

Cutting 100’s thousands of government jobs saves expenditure on their salaries, but with no salaries, reduced personal spending follows and thus a weaker economy. Much has been made on the one hand of the reckless cuts to social spending, jeapordising the safety of the most vulnerable in society. Whilst on the other hand some of the expenditure discovered has been completely wasted on vanity projects and dubious backhand deals. There is no point as investors believing one position or the other, the partisan press will definitely both be exaggerating the position

The US as global policeman becomes unaffordable

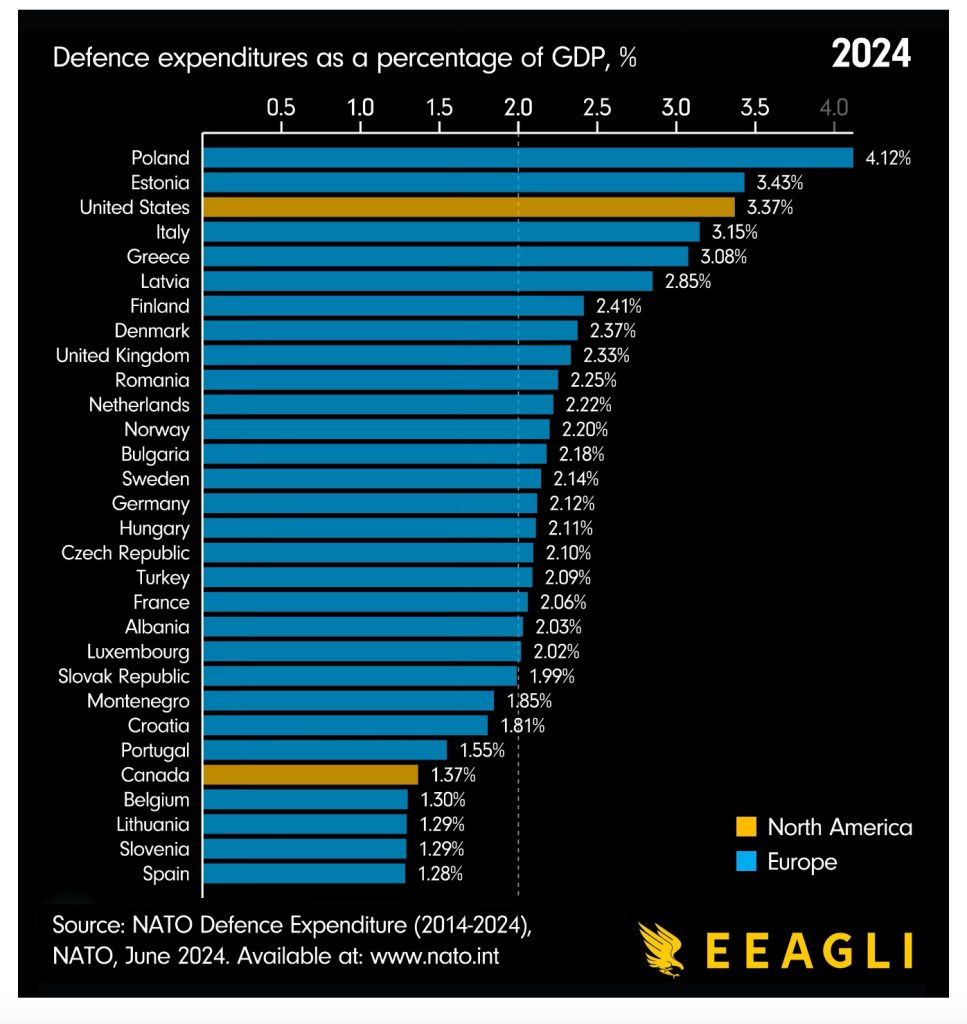

The biggest Federal cost after interest charges in the US is defence. For many years Trump has berated Europe for not contributing enough to NATO. Germany under Merkel never came close to the 2% of GDP required for full membership. However Trump has used the hostilities in Ukraine to move more of the US funded NATO defence costs to Europe. Ursula von der Leyen has recently created an €800 billion facility to strengthen EU defence suddenly from thin air and each European sovereign state is in the process of finding further funding, including Germany with a further €500 – €1000 billion to rearm. When Starmer and Lammy recently went to see Trump, they didn’t arrive with flowers and a bottle of Scotch, it was with a grovelling apology for their previous defamatory tweets and the promise of increased defence spending up to 2.5% of UK GDP. Meeting this ambitious target should be a cinch, because the soon to be replaced “Rachel from Accounts” seems intent on driving UK GDP to zero. And 2.5% of zero is…. I’m sure Trump was far from impressed, as of the (current) 50 US states, the UK economy ranked the equivalent of only number 46 in 2019!

Let’s hope Trump’s team pays no credence to Russian state TV anchor Dmitry Kiselev’s comment of, ‘But what troops? You could fit the whole British army into Wembley stadium and you’d still have room for some of the French.’ It has proved to be an exaggeration, but with a 90,000 concert capacity, Dmitry is not that far from the truth. Expect tariff threats to extend to the UK soon.

Obviously the stakes have increased since the Russian invasion of Ukraine in 2022. The latest figures I can find for current promised military expenditure are shown below, with already the majority of European nations paying up to fall favourably within NATO’s umbrella.

In just a couple of weeks Trump and his team have shifted the cost of defending Europe from Putin the Aggressor, off the shoulders of the USA to Europe themselves where it belongs, saving well over $1Trillion a year in the process. Bullying and a position of strength works where diplomacy previously failed.

Generate more income

Here’s where tariffs come into play – charge other countries a fee to sell their goods in the US. Conventional wisdom (as written by the economist Adam Smith) suggests nobody wins if there isn’t free trade. Charge a tariff and a retaliatory counter tariff is put in place. Some countries like Canada have tried this with Trump so far and he’s simply doubled his original tariff as a counter measure. It’s a global game of poker which the US will eventually win, because it imports an awful lot and exports not much at all. But the threat of tariffs are actually a smokescreen to cover his real objectives, one of which is to renegotiate existing trade deals which are more beneficial to the US. They are also useful in driving foreign governments to take action, where prior to the threat of tariffs, they were reluctant to do so. The US has lost over 100,000 fighting age adults annually to Fentanyl overdoses over the last 4 years, well above the number of soldiers it had lost in WWII. The majority of these illegal drugs cross the border from Canada en-route from China. Trudeau was not prepared to stop this as the problem was not manifest in Canada’s cities. The threat of tariffs was enough to suddenly try a little harder to secure their border with 10,000 more Canadian troops on the ground and an undertaking to shut down the supply chain.

Trump the man

I believe Trump would probably be a loathsome individual to deal with. Some of the stories about him if true, suggest he is repulsive. However I have met an American who has a multi-million dollar apartment in Trump Tower and she assures me he is charming. That said, I believe he has put some seriously intelligent advisers around him, who want the best for the USA, even if that means upsetting friend and foe alike.

In his first term he was correct to never trust the Communist Party in China to be a dependable trading partner. He understood that the completion of Nordstream 2, ensuring Germany’s reliance on Putin for cheap gas was shortsighted. Also Merkel’s assertion that defence spending could be substituted with peacetime expenditure concentrating on un-reliable, expensive renewable energy to save the planet from existential risk 100 years from now was folly.

I also believe that Trump and his team have a huge set of objectives and a short period of time to achieve them all. Part of the Federal job cuts are undoubtedly vindictive, after all 98% of the electorate in Washington DC voted for Kamala Harris (remember her?). However he is focusing on the items in his political manifesto pledges, something that doesn’t seem to have happened after many recent UK political parties swept to power – even with large majorities in the House of Commons. No one can be surprised at his actions to “Put America First”, as he pledged to do all of this. Much of what he says is bluster and taken literally by the mainstream media, but this is a deflection tool, whilst the team quietly go about their objectives in the background

Babies & Bathwater

The assumption was always that Trump has the backs of investors. As part of the Global Elite, he would work exclusively for the rich 1%. The 1% who have most to lose if stock markets crash. That has changed now. He has now stated markets will be bumpy and he has a tolerance for short term pain if prosperity follows in the long term. With the Magnificent 7 having excess valuations any hiccup would cause a mighty fall. Many are down over 20% from their peak. Together those 7 shares made up almost 30% of the S&P 500. It was inevitable the index would fall if the largest shares did. Unfortunately automated trading programs sell indiscriminately at times like this. The index is sold so all share constituents suffer to some degree.

Once again patience is required. Trump will be judged on his achievements in his first 100 days. Stalemate and relative stability should follow. The next 3 years of the Presidential cycle are normally better.

If you have any questions don’t hesitate to contact us.

Sources

https://fred.stlouisfed.org/series/GFDEBTN

Wow Howard that certainly is a lot to take in, never mind write about.

Certainly makes an interesting read.

All the best to you and the team.

Michael